- China

- /

- Tech Hardware

- /

- SZSE:002017

Earnings are growing at Eastcompeace TechnologyLtd (SZSE:002017) but shareholders still don't like its prospects

Investors can earn very close to the average market return by buying an index fund. In contrast individual stocks will provide a wide range of possible returns, and may fall short. Unfortunately for investors in Eastcompeace Technology Co.Ltd (SZSE:002017), the share price has slipped 24% in three years, falling short of the marketdecline of 19%. Even worse, it's down 15% in about a month, which isn't fun at all. But this could be related to poor market conditions -- stocks are down 8.8% in the same time.

If the past week is anything to go by, investor sentiment for Eastcompeace TechnologyLtd isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Eastcompeace TechnologyLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Eastcompeace TechnologyLtd actually managed to grow EPS by 70% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

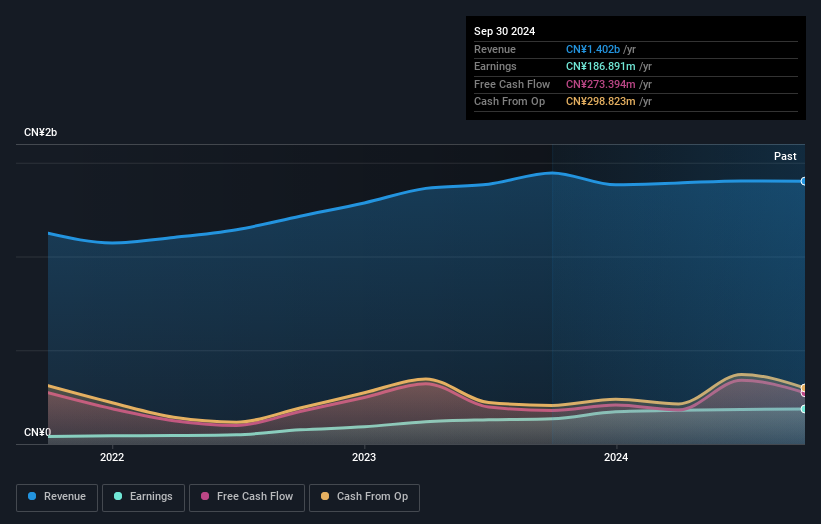

The modest 1.6% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 9.8% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Eastcompeace TechnologyLtd further; while we may be missing something on this analysis, there might also be an opportunity.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Eastcompeace TechnologyLtd's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Eastcompeace TechnologyLtd's TSR for the last 3 years was -22%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Eastcompeace TechnologyLtd shareholders are up 1.1% for the year (even including dividends). But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 3% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Eastcompeace TechnologyLtd better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Eastcompeace TechnologyLtd you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

If you're looking to trade Eastcompeace TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eastcompeace TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002017

Eastcompeace TechnologyLtd

Provides smart card and system solutions in China and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives