- China

- /

- Electronic Equipment and Components

- /

- SZSE:000925

High Growth Tech Stocks in Asia for March 2025

Reviewed by Simply Wall St

Amidst global uncertainties, including trade policy tensions and inflation concerns that have weighed on U.S. stocks, Asian markets are navigating their own economic landscapes with a mix of cautious optimism and strategic fiscal policies. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability to shifting market dynamics while capitalizing on regional economic priorities such as technological advancement and increased consumption.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Fositek | 40.38% | 52.94% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| PharmaResearch | 23.41% | 26.41% | ★★★★★★ |

| Bioneer | 26.13% | 104.84% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

UniTTECLtd (SZSE:000925)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: UniTTEC Co., Ltd is a company that offers integrated solutions in rail transit and energy saving and environmental protection sectors in China, with a market capitalization of CN¥6.34 billion.

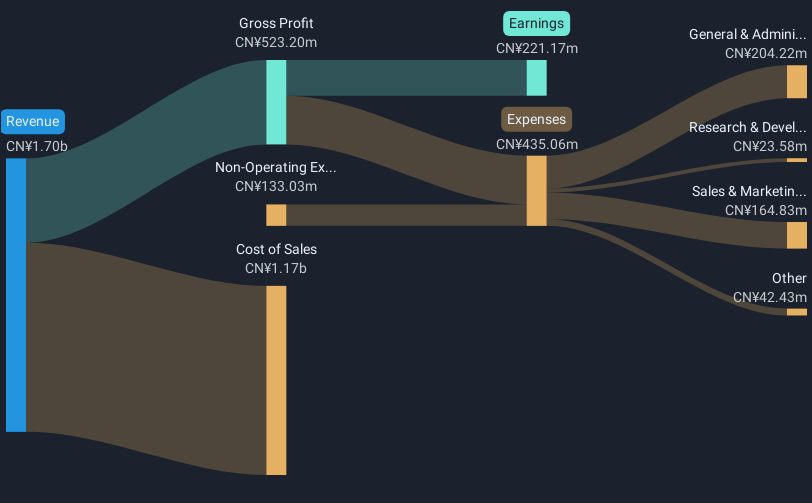

Operations: UniTTEC Co., Ltd focuses on providing comprehensive solutions in rail transit and energy efficiency, particularly within the environmental protection sector in China.

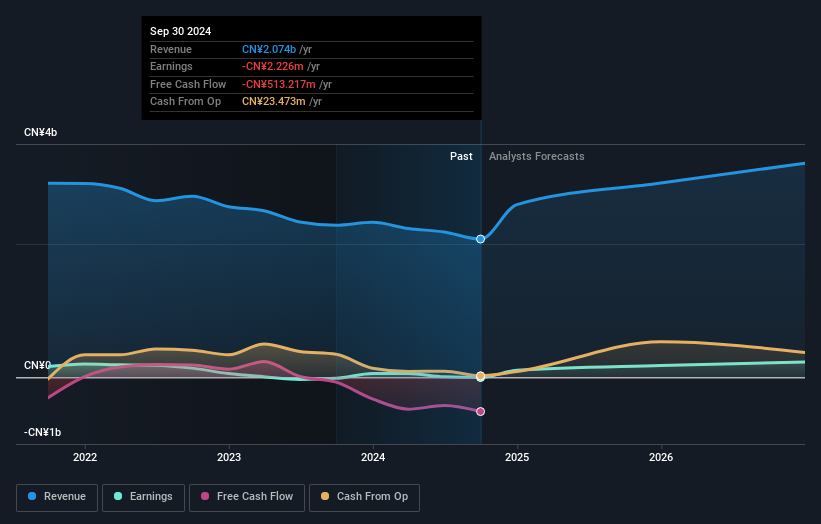

UnitTEC Ltd., despite its current unprofitability, is poised for significant transformation with an expected annual revenue growth of 16.4%, outpacing the Chinese market's average of 13.3%. This growth trajectory is supported by strategic initiatives including a recent share repurchase program, signaling confidence in future profitability. The company's focus on innovation is evident from its R&D investments, crucial for maintaining competitive edge in the fast-evolving tech landscape. Moreover, earnings are projected to surge by approximately 70.4% annually over the next few years, reflecting potential shifts towards profitability and market leadership.

- Take a closer look at UniTTECLtd's potential here in our health report.

Review our historical performance report to gain insights into UniTTECLtd's's past performance.

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Huace Film & TV Co., Ltd. is involved in the production, distribution, and derivative of film and television dramas both in China and internationally, with a market cap of CN¥15.28 billion.

Operations: Huace Film & TV focuses on creating and distributing film and television content domestically and abroad. The company's revenue model is centered around these core activities, contributing to its market presence.

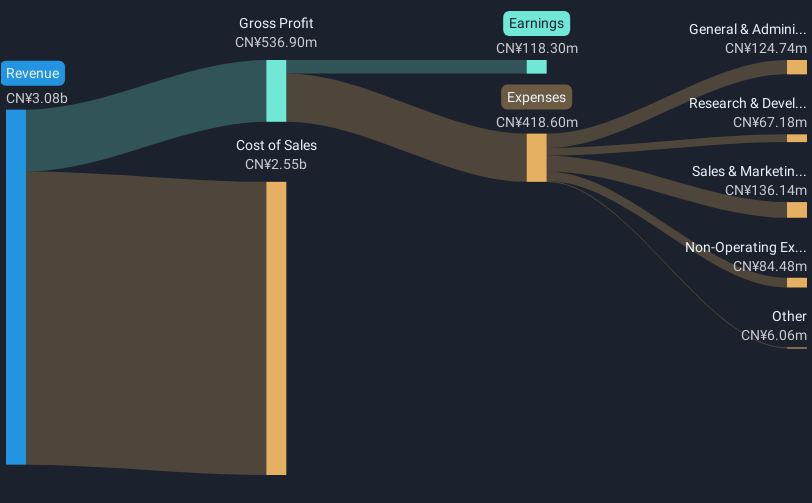

Zhejiang Huace Film & TV, amidst a challenging entertainment landscape, has demonstrated resilience with a robust annual revenue growth of 20.8%, surpassing the Chinese market average of 13.3%. This performance is coupled with an ambitious earnings forecast projecting an increase of 28.6% annually, signaling potential for substantial financial improvement. Despite recent volatility in share price and negative earnings growth last year of -48.4%, the company's commitment to shareholder value is evident through consecutive special dividends and a proactive dividend policy as seen in early 2025 announcements. These strategic financial distributions reflect confidence in its fiscal strategies and future prospects within the high-growth tech sphere in Asia, although challenges remain given its current earnings trajectory compared to industry averages.

- Navigate through the intricacies of Zhejiang Huace Film & TV with our comprehensive health report here.

Assess Zhejiang Huace Film & TV's past performance with our detailed historical performance reports.

Shanghai Yct Electronics GroupLtd (SZSE:301099)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai YCT Electronics Group Co., Ltd specializes in offering electronic products within China and has a market capitalization of CN¥6 billion.

Operations: The company generates revenue primarily from the sale of electronic products in China. It operates with a market capitalization of approximately CN¥6 billion.

Shanghai Yct Electronics Group Co., Ltd, a contender in Asia's tech arena, has demonstrated robust growth with an impressive 36.4% annual increase in revenue, outpacing the Chinese market average of 13.3%. This surge is complemented by a significant earnings growth of 41.5% annually, indicating strong operational efficiency and market demand. The company recently announced a share repurchase program valued at CNY 240 million to boost shareholder value and fund employee incentives, reflecting confidence in its financial health and strategic vision. Despite some concerns over large one-off losses impacting recent financial results, Shanghai Yct's commitment to innovation and expansion in high-tech sectors positions it well for sustained growth amidst competitive pressures.

Next Steps

- Discover the full array of 515 Asian High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade UniTTECLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000925

UniTTECLtd

Provides integrated solutions in the areas of rail transit, and energy saving and environmental protection in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives