- China

- /

- Tech Hardware

- /

- SZSE:000066

Market Might Still Lack Some Conviction On China Greatwall Technology Group Co., Ltd. (SZSE:000066) Even After 41% Share Price Boost

The China Greatwall Technology Group Co., Ltd. (SZSE:000066) share price has done very well over the last month, posting an excellent gain of 41%. Notwithstanding the latest gain, the annual share price return of 4.8% isn't as impressive.

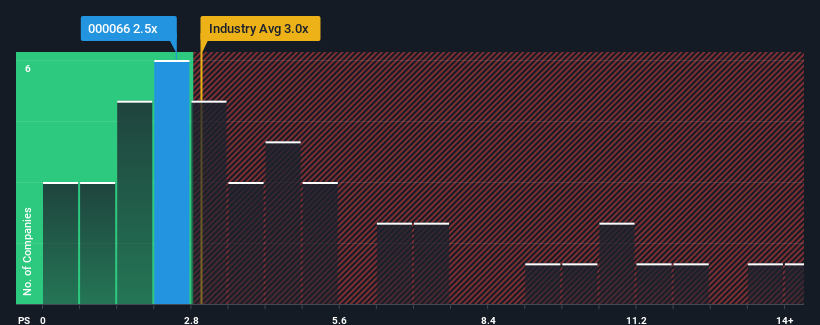

In spite of the firm bounce in price, there still wouldn't be many who think China Greatwall Technology Group's price-to-sales (or "P/S") ratio of 2.5x is worth a mention when the median P/S in China's Tech industry is similar at about 3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for China Greatwall Technology Group

What Does China Greatwall Technology Group's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, China Greatwall Technology Group has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think China Greatwall Technology Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is China Greatwall Technology Group's Revenue Growth Trending?

In order to justify its P/S ratio, China Greatwall Technology Group would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 15%. However, this wasn't enough as the latest three year period has seen an unpleasant 18% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 23% as estimated by the three analysts watching the company. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

In light of this, it's curious that China Greatwall Technology Group's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On China Greatwall Technology Group's P/S

Its shares have lifted substantially and now China Greatwall Technology Group's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, China Greatwall Technology Group's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You should always think about risks. Case in point, we've spotted 1 warning sign for China Greatwall Technology Group you should be aware of.

If these risks are making you reconsider your opinion on China Greatwall Technology Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000066

China Greatwall Technology Group

China Greatwall Technology Group Co., Ltd.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives