As we enter January 2025, global markets have shown mixed signals with the S&P 500 and Nasdaq Composite closing another strong year despite recent profit-taking and economic indicators like the Chicago PMI signaling contraction. In this environment of fluctuating market sentiment, identifying high-growth tech stocks requires a focus on companies that demonstrate robust fundamentals, adaptability to changing economic conditions, and innovative potential to thrive amidst broader market volatility.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 44.32% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

China Greatwall Technology Group (SZSE:000066)

Simply Wall St Growth Rating: ★★★★☆☆

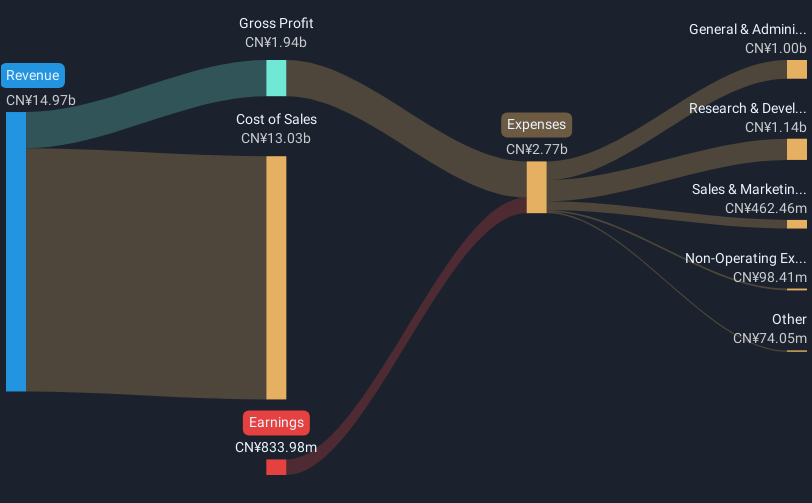

Overview: China Greatwall Technology Group Co., Ltd. (SZSE:000066) is a company with a market cap of CN¥42.39 billion, engaged in the production and development of electronic information products and services.

Operations: Greatwall Technology focuses on the electronic information sector, generating revenue primarily through the sale of its technology products and related services. The company's operations include various segments that contribute to its financial performance.

China Greatwall Technology Group has demonstrated a notable commitment to innovation, particularly in the AI-driven product sector, as evidenced by its recent showcase of advanced technology at a major industry event. The company's focus on developing lighter, smarter devices aligns with global trends towards efficiency and high performance. Despite currently being unprofitable, it has managed an impressive annualized revenue growth of 18.2% and is expected to see earnings surge by 101.82% annually. Additionally, the firm actively engages in share repurchase initiatives as seen with the recent completion of a buyback worth CNY 20 million, signaling confidence in its long-term value proposition and dedication to shareholder interests. These strategic moves could potentially position China Greatwall Technology for future profitability and market leadership within the tech industry.

Cetc Potevio Science&TechnologyLtd (SZSE:002544)

Simply Wall St Growth Rating: ★★★★☆☆

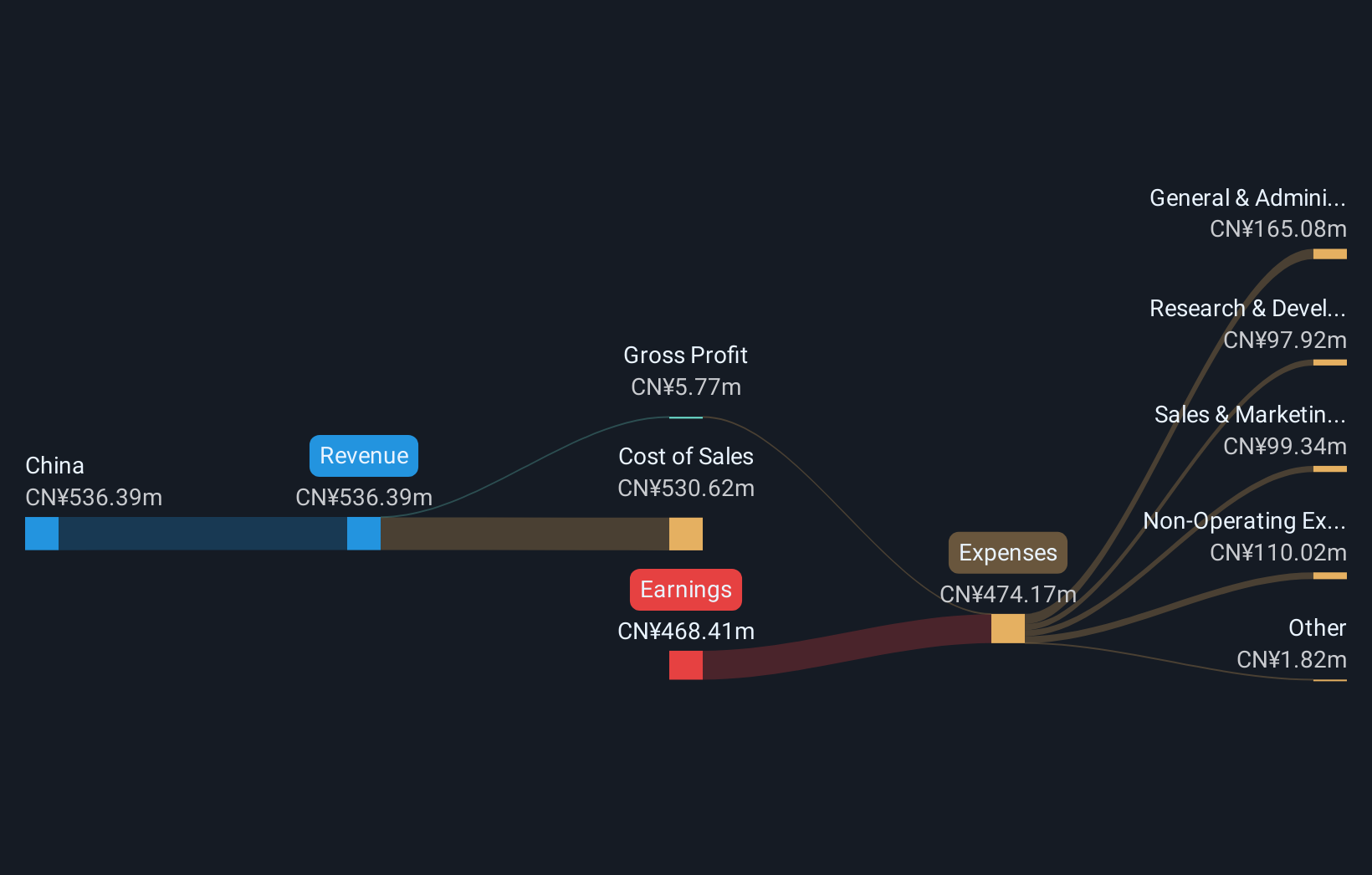

Overview: Cetc Potevio Science&Technology Co.,Ltd. offers network communication solutions in China and has a market capitalization of approximately CN¥12.68 billion.

Operations: The company generates revenue primarily from its Software and IT Services segment, which contributes CN¥4.99 billion. This segment is a key component of its business model, reflecting the company's focus on providing network communication solutions in China.

Cetc Potevio Science&TechnologyLtd, recently added to the Shenzhen Stock Exchange Component Index, is navigating a challenging yet promising path. Despite a dip in revenue to CNY 3.42 billion from last year's CNY 3.89 billion and a decrease in net income from CNY 64.23 million to CNY 18.25 million, the firm is poised for recovery with strategic project extensions discussed at their latest extraordinary shareholders meeting. The company's commitment to R&D is underscored by its significant expenditure in this area, aligning with its ambition to lead in tech innovation and potentially boost future earnings growth projected at an impressive annual rate of 72.55%.

- Click here to discover the nuances of Cetc Potevio Science&TechnologyLtd with our detailed analytical health report.

Learn about Cetc Potevio Science&TechnologyLtd's historical performance.

Beijing eGOVA Co (SZSE:300075)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing eGOVA Co., Ltd is a smart city core application and operation service provider in China with a market cap of CN¥9.07 billion.

Operations: The company focuses on providing smart city core applications and operational services. It generates revenue primarily through its technology-driven solutions for urban management and public service sectors.

Beijing eGOVA Co., amidst a challenging fiscal landscape with a revenue drop to CNY 697.67 million from CNY 1,064.27 million year-over-year, still forecasts robust future growth with expected annual revenue increases of 31%. This projection is significantly above the Chinese market's average of 13.5%, highlighting its potential in a competitive sector. The company's commitment to innovation is evident in its R&D spending, crucial for sustaining long-term growth in the tech industry where rapid evolution is constant. Despite current profitability challenges—net income fell sharply to CNY 20.5 million from CNY 182.37 million—the firm's strategic focus on research and development could catalyze its transition into profitability, expected to surge by an impressive 60% annually over the next three years.

- Get an in-depth perspective on Beijing eGOVA Co's performance by reading our health report here.

Evaluate Beijing eGOVA Co's historical performance by accessing our past performance report.

Key Takeaways

- Navigate through the entire inventory of 1263 High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing eGOVA Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300075

Beijing eGOVA Co

Operates as a smart city core application and operation service provider in China.

High growth potential with excellent balance sheet.