As global markets continue to navigate mixed economic signals, with the S&P 500 Index marking notable gains despite recent volatility and the Chicago PMI indicating contraction in manufacturing, investors are increasingly turning their attention to small-cap stocks for potential opportunities. In this dynamic environment, identifying promising stocks involves looking beyond immediate market trends and focusing on companies with strong fundamentals, innovative strategies, and resilience amidst broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Saudi Azm for Communication and Information Technology | 12.21% | 17.40% | 21.14% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Tongda Smart Tech (Xiamen) (SZSE:001368)

Simply Wall St Value Rating: ★★★★★★

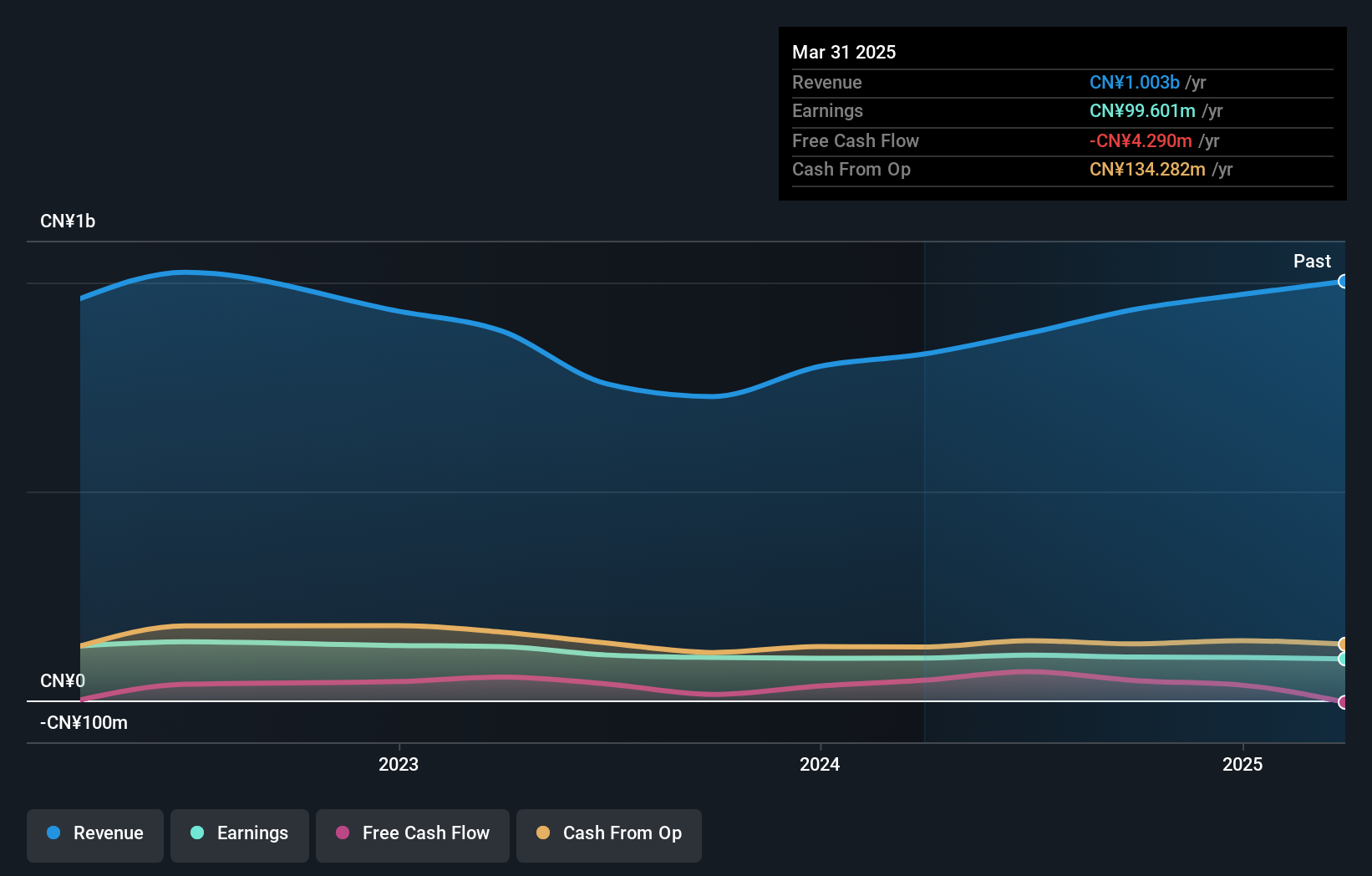

Overview: Tongda Smart Tech (Xiamen) Co., Ltd. specializes in providing consumer products across sports and outdoor, home life, and health care sectors, with a market cap of CN¥2.19 billion.

Operations: Tongda Smart Tech (Xiamen) generates revenue through its diverse consumer product offerings in sports and outdoor, home life, and health care sectors. The company's financial performance is highlighted by a notable trend in its net profit margin.

Tongda Smart Tech (Xiamen) stands out with its debt-free status, a stark contrast to five years ago when the debt-to-equity ratio was 3.4%. The company reported sales of CNY 715.09 million for the first nine months of 2024, up from CNY 578.26 million a year earlier, showcasing steady growth. Despite this progress, net income saw only a slight increase to CNY 83.89 million from CNY 80.97 million in the previous year, reflecting challenges in translating revenue into profit gains. With a price-to-earnings ratio of 21.8x below the CN market's average of 32.7x, it presents an attractive valuation opportunity within its industry context.

Shenzhen King Explorer Science and Technology (SZSE:002917)

Simply Wall St Value Rating: ★★★★★☆

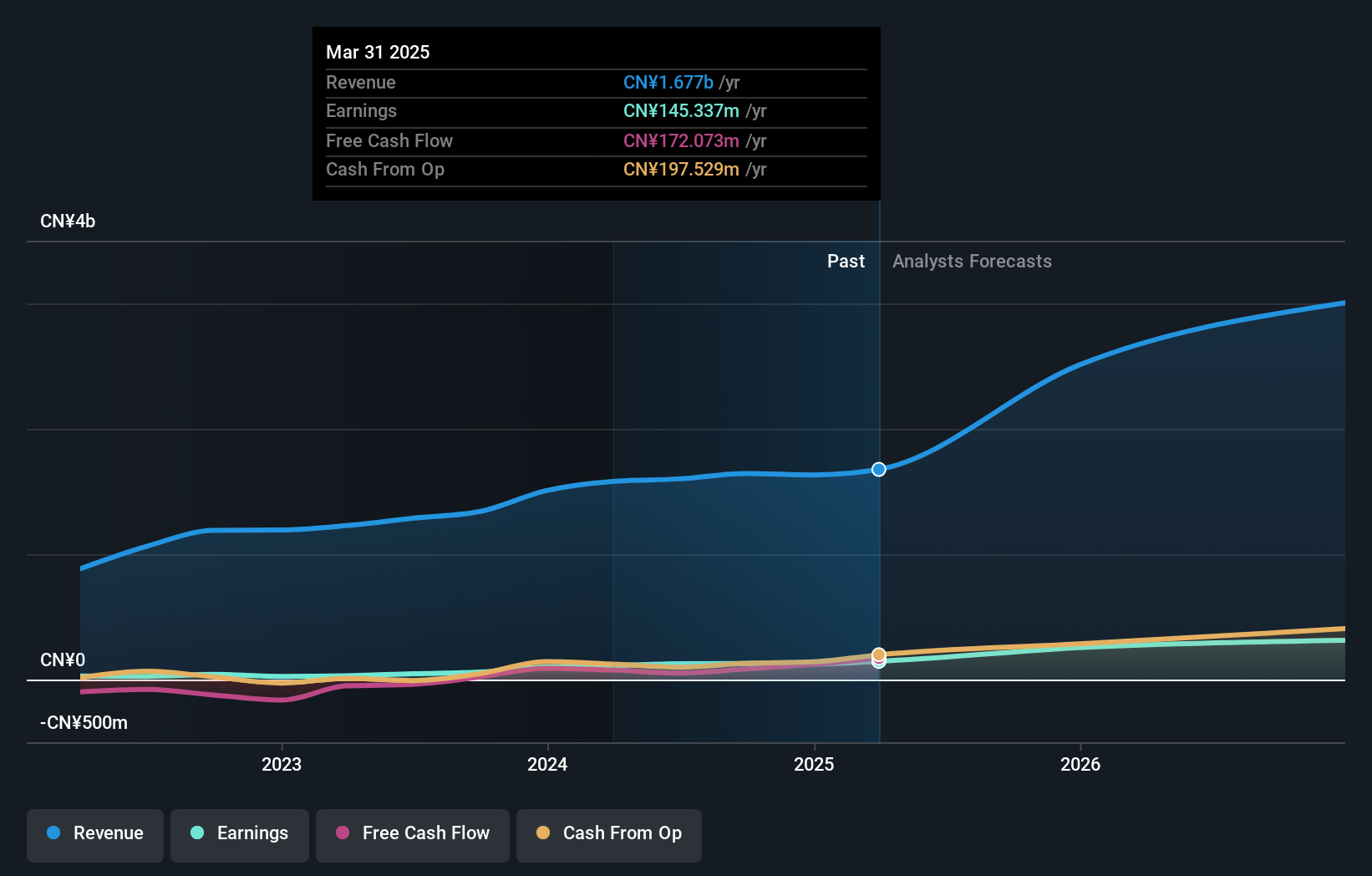

Overview: Shenzhen King Explorer Science and Technology Corporation engages in the research, design, development, manufacturing, and sale of intelligent equipment systems for civil explosive production and blasting service companies both in China and internationally, with a market cap of CN¥3.30 billion.

Operations: The company's revenue is derived from the sale of intelligent equipment systems to civil explosive production and blasting service companies. The financial performance shows a focus on manufacturing efficiency, with significant investments in research and development. Gross profit margin trends indicate variability, reflecting fluctuations in production costs and pricing strategies over time.

Shenzhen King Explorer Science and Technology, a relatively small player in its field, is showing promising signs of growth. Over the past year, earnings surged by 117%, outpacing the broader chemicals industry. The company trades at an attractive valuation, nearly 48% below estimated fair value. Its net debt to equity ratio stands at a satisfactory 16%, suggesting prudent financial management. Recent results highlight sales of CNY 1.18 billion for nine months ending September 2024, up from CNY 1.04 billion previously, with net income rising to CNY 107.67 million from CNY 80.81 million last year—indicative of robust operational performance.

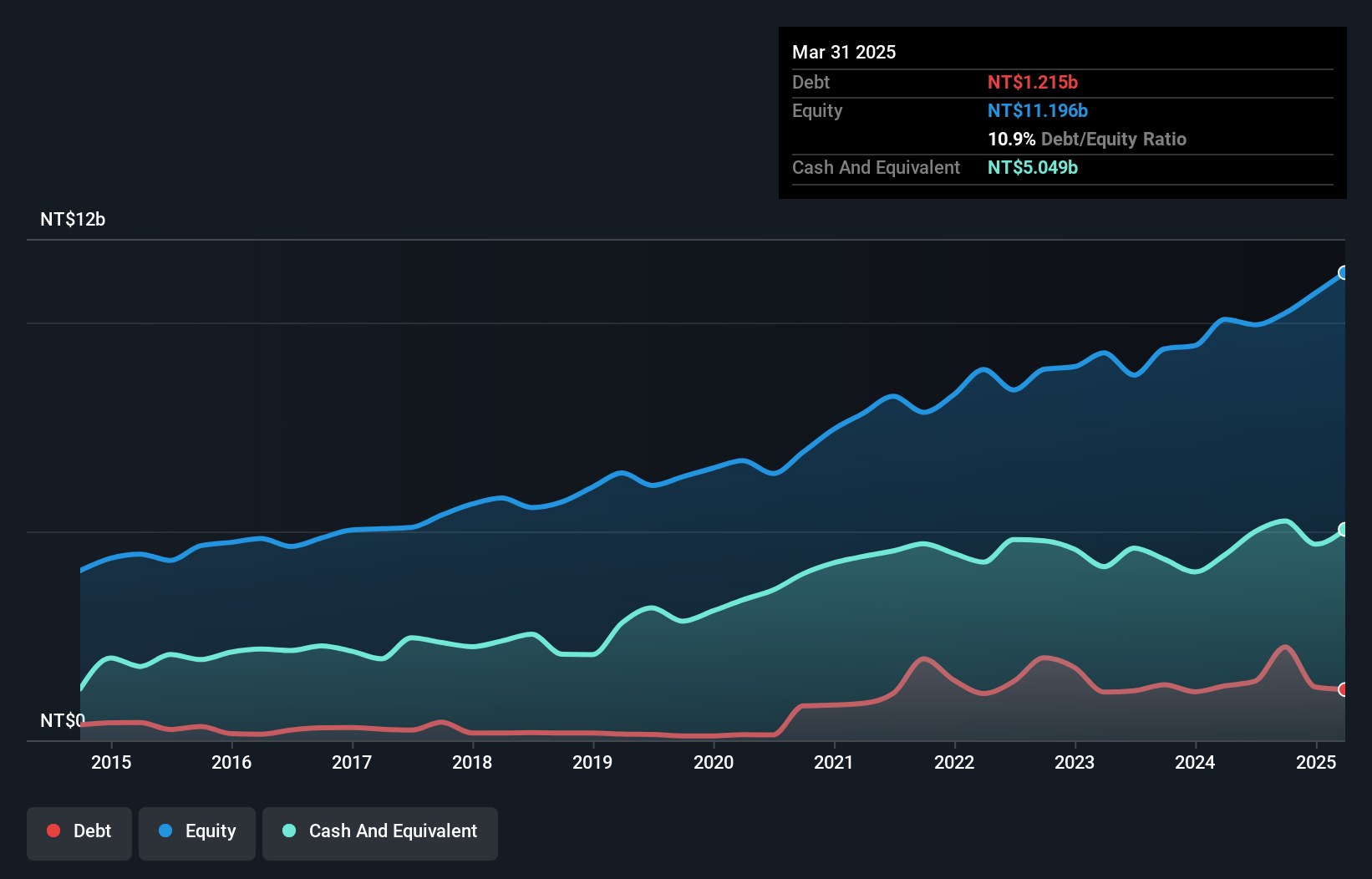

Thinking Electronic Industrial (TWSE:2428)

Simply Wall St Value Rating: ★★★★★☆

Overview: Thinking Electronic Industrial Co., Ltd. is involved in the manufacturing, processing, and selling of electric devices, thermistors, varistors, and wires across Taiwan, China, and international markets with a market cap of NT$19.60 billion.

Operations: The primary revenue streams for Thinking Electronic Industrial Co., Ltd. include Dongguan Welkin Electronic Co. with NT$3.90 billion and Xing Qin contributing NT$3.35 billion, while Thinking (Changzhou) Electronic Co., Ltd. adds NT$2.98 billion to the total revenue mix.

Thinking Electronic Industrial, a nimble player in the electronics sector, has demonstrated robust performance with earnings growth of 35.9% over the past year, outpacing the industry's 6.6% rise. This company seems to be managing its debt effectively despite an increase in its debt-to-equity ratio from 1.7% to 21.9% over five years, likely leveraging this for expansion opportunities like the recent CNY 133 million factory construction deal. With a price-to-earnings ratio of 13x below Taiwan's market average of 21x and more cash than total debt, it appears well-positioned financially while maintaining high-quality earnings and positive free cash flow.

Make It Happen

- Reveal the 4673 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002917

Shenzhen King Explorer Science and Technology

Researches, designs, develops, manufactures, and sells intelligent equipment systems to civil explosive production and blasting service companies in China and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives