- China

- /

- Electronic Equipment and Components

- /

- SHSE:688627

High Growth Tech Stocks Including Digital China Holdings and Two More

Reviewed by Simply Wall St

As global markets continue to react positively to potential trade negotiations and AI advancements, major indices like the S&P 500 have reached record highs, with growth stocks gaining momentum over their value counterparts. In this environment, identifying high-growth tech stocks such as Digital China Holdings can be crucial for investors looking to capitalize on technological innovation and market optimism.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.37% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1228 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Digital China Holdings (SEHK:861)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise clients mainly in Mainland China, with a market capitalization of HK$4.84 billion.

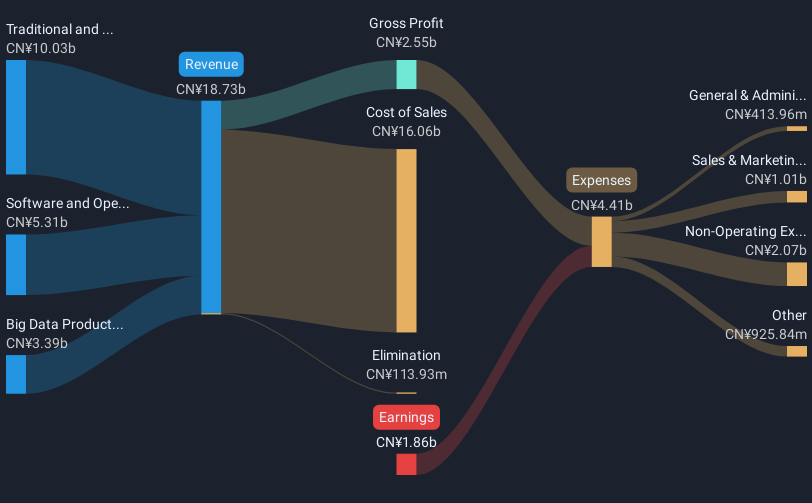

Operations: The company generates revenue primarily from three segments: Big Data Products and Solutions (CN¥3.39 billion), Software and Operating Services (CN¥5.31 billion), and Traditional and Localization Services (CN¥10.03 billion).

Digital China Holdings, navigating the competitive tech landscape, demonstrates promising financial dynamics with a projected annual revenue growth of 8.8%, slightly outpacing the Hong Kong market average of 7.7%. While currently unprofitable, the firm is expected to shift this trajectory significantly, with earnings potentially growing at an impressive rate of 42.12% annually over the next three years. This growth is underpinned by substantial R&D investments that not only reflect commitment to innovation but also align well with industry trends towards digital solutions and services expansion. Despite these positive indicators, its current lack of profitability and lower forecasted return on equity (7.6%) compared to benchmarks suggest cautious optimism about its capacity to leverage these investments into higher market share and financial stability in the near term.

- Unlock comprehensive insights into our analysis of Digital China Holdings stock in this health report.

Evaluate Digital China Holdings' historical performance by accessing our past performance report.

Shenzhen SEICHI Technologies (SHSE:688627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen SEICHI Technologies Co., Ltd. focuses on the research, development, production, and sale of new display device testing equipment in China with a market capitalization of CN¥6.66 billion.

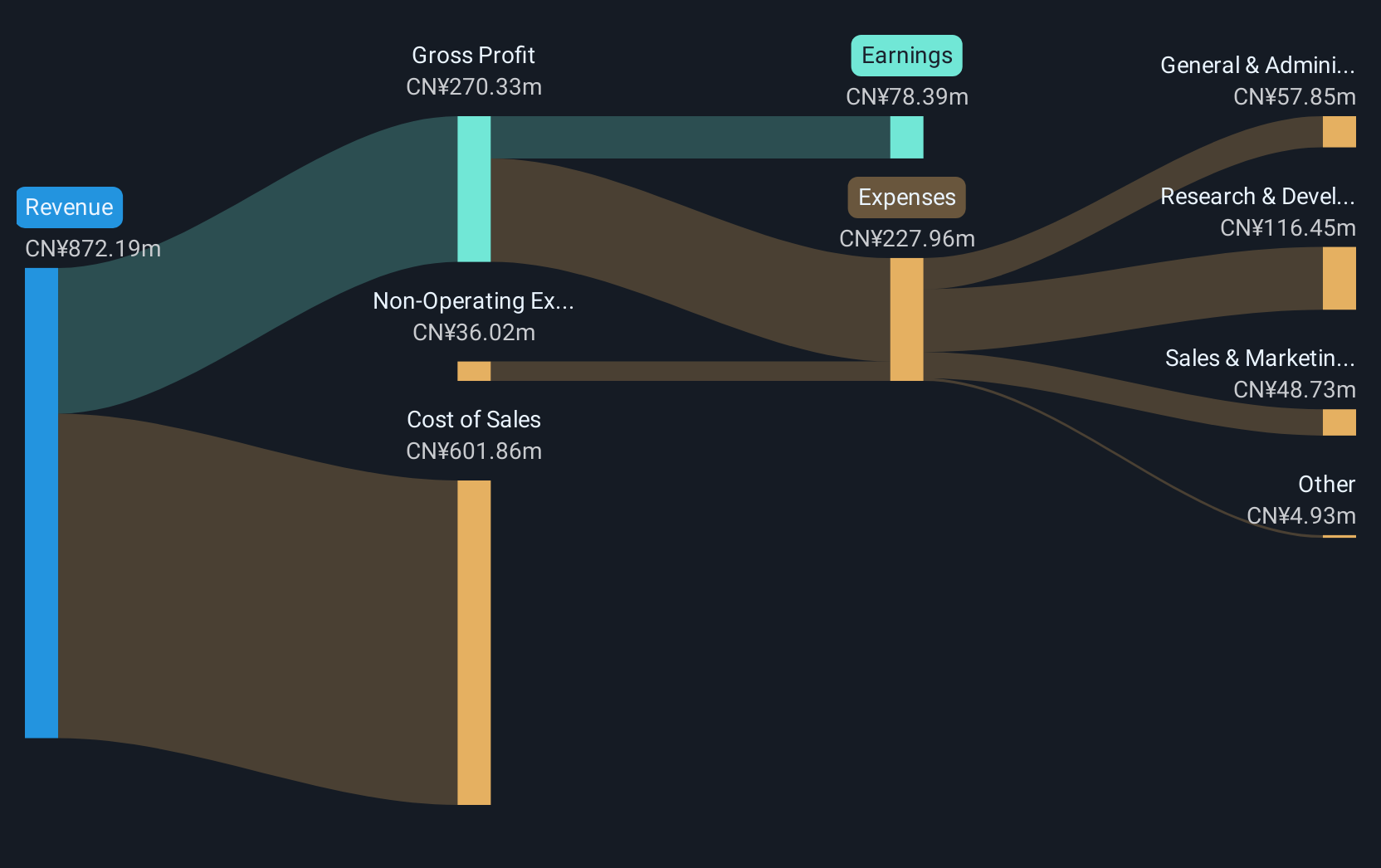

Operations: SEICHI Technologies specializes in developing and selling advanced testing equipment for new display devices in China. The company's operations are centered around R&D, production, and sales within this niche market.

Shenzhen SEICHI Technologies is distinguishing itself in the high-tech industry with a robust annual revenue growth rate of 29.1%, significantly surpassing the Chinese market average of 13.3%. This growth trajectory is bolstered by its aggressive R&D spending, which has been pivotal in driving innovation and maintaining competitive edge in a rapidly evolving tech landscape. Despite recent challenges, including a volatile share price and negative earnings growth last year, the company's forward-looking strategy includes substantial investments in technology development, evidenced by an expected profit surge of 42.6% annually over the next three years. These financial commitments are set against a backdrop of strategic shareholder engagements and zero share repurchases in the latest quarter, reflecting a focused reinvestment approach to fuel future expansions and market penetration.

Zhejiang ZUCH Technology (SZSE:301280)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang ZUCH Technology Co., Ltd. specializes in providing electric connectors in China and has a market cap of CN¥4.23 billion.

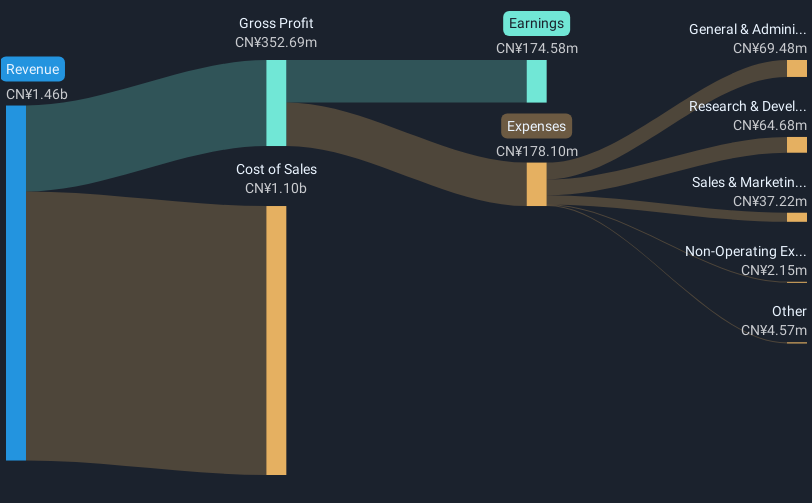

Operations: ZUCH Technology generates revenue primarily through the sale of electric connectors within China. The company focuses on leveraging its expertise in this niche market to cater to various industrial applications, contributing to its overall financial performance.

Zhejiang ZUCH Technology is making significant strides in the tech industry, driven by a robust annual revenue growth of 28.4% and an impressive earnings increase of 31.2% over the past year, outpacing the broader Chinese market's growth rates. This performance is underpinned by substantial R&D investments, amounting to notable figures that underscore its commitment to innovation and market leadership in a competitive landscape. The company recently focused on enhancing shareholder value through strategic financial management discussions at their extraordinary meeting, aiming to optimize cash resources and expand operational capabilities efficiently. These efforts are poised to bolster Zhejiang ZUCH's market position and sustain its growth trajectory amidst evolving industry dynamics.

- Click to explore a detailed breakdown of our findings in Zhejiang ZUCH Technology's health report.

Understand Zhejiang ZUCH Technology's track record by examining our Past report.

Next Steps

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1225 more companies for you to explore.Click here to unveil our expertly curated list of 1228 High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688627

Shenzhen SEICHI Technologies

Engages in the research and development, production, and sale of new display device testing equipment in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives