- China

- /

- Communications

- /

- SHSE:688609

Not Many Are Piling Into Unionman Technology Co.,Ltd. (SHSE:688609) Stock Yet As It Plummets 25%

Unionman Technology Co.,Ltd. (SHSE:688609) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 27% share price drop.

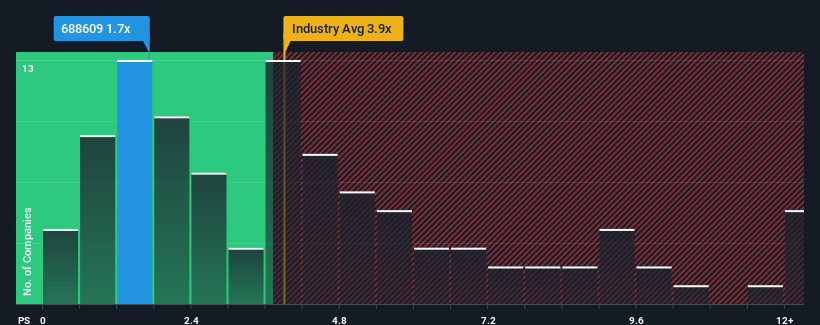

Following the heavy fall in price, Unionman TechnologyLtd may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.7x, considering almost half of all companies in the Communications industry in China have P/S ratios greater than 3.9x and even P/S higher than 6x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Unionman TechnologyLtd

How Has Unionman TechnologyLtd Performed Recently?

Unionman TechnologyLtd could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Unionman TechnologyLtd.Is There Any Revenue Growth Forecasted For Unionman TechnologyLtd?

In order to justify its P/S ratio, Unionman TechnologyLtd would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.4%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.5% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 66% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 48% growth forecast for the broader industry.

In light of this, it's peculiar that Unionman TechnologyLtd's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Unionman TechnologyLtd's P/S Mean For Investors?

Shares in Unionman TechnologyLtd have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Unionman TechnologyLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Unionman TechnologyLtd is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688609

Unionman TechnologyLtd

Engages in the research and development, production, sales, and service of intelligent terminals and communication modules, and industry application solutions in China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026