- South Korea

- /

- Entertainment

- /

- KOSE:A352820

High Growth Tech Stocks In Asia With Promising Potential

Reviewed by Simply Wall St

As global markets navigate through cautious economic environments, with U.S. indices experiencing declines amid hawkish Federal Reserve commentary and inflationary pressures, Asian tech stocks continue to capture attention due to their potential for high growth in a region marked by innovation and expanding digital economies. In this context, identifying promising tech stocks involves assessing their ability to leverage technological advancements and market demands while navigating the broader economic landscape effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 23.97% | 28.52% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Zhongji Innolight | 28.79% | 30.71% | ★★★★★★ |

| PharmaEssentia | 31.61% | 70.22% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management, with a market cap of ₩11.15 trillion.

Operations: HYBE generates revenue primarily through its platform segment, contributing ₩369.99 million. The company is also involved in music-related activities such as production and artist management, with a market cap of ₩11.15 trillion.

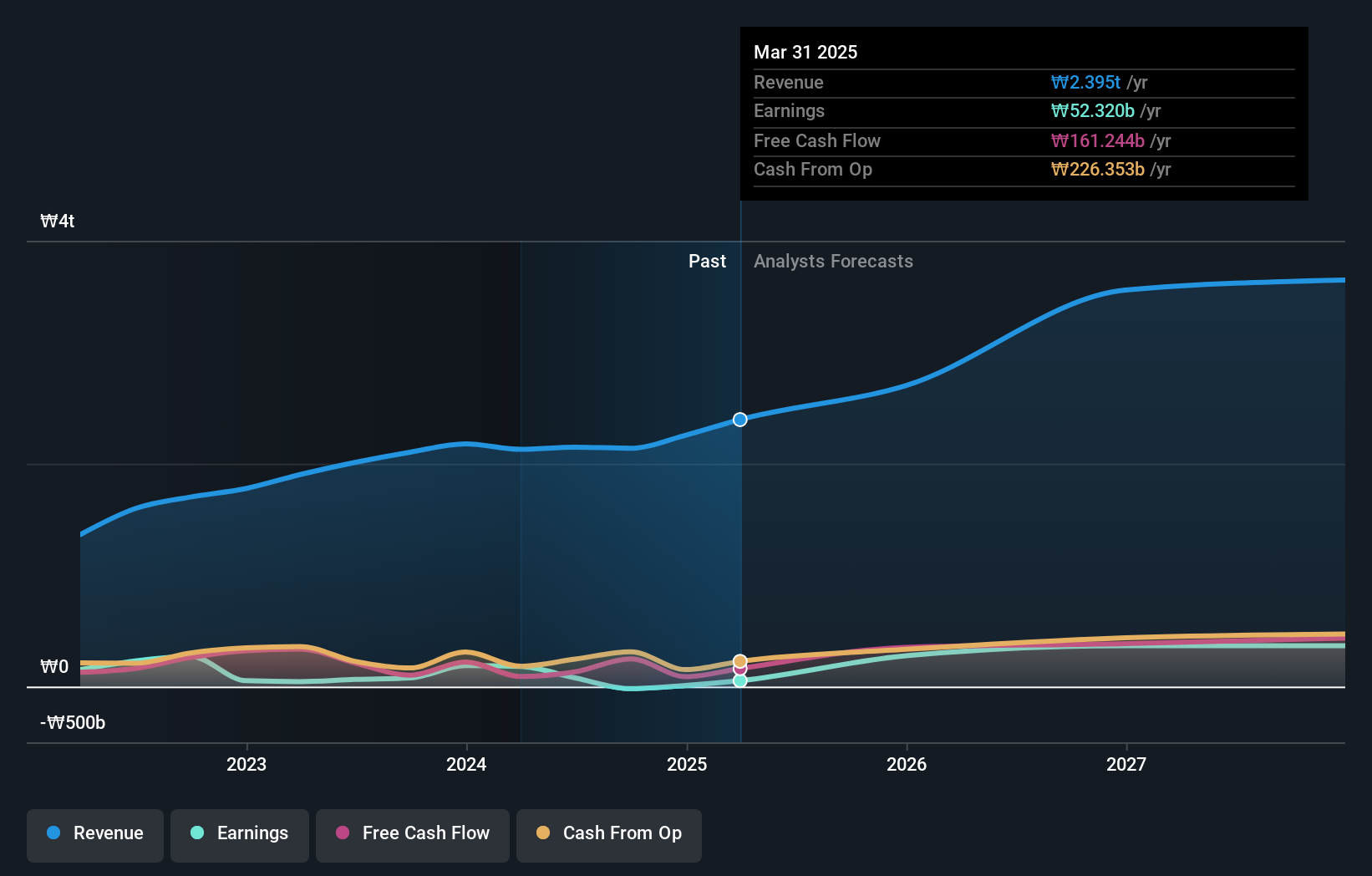

HYBE, a key player in the Asian tech scene, has demonstrated robust financial performance with a notable 46.3% projected annual earnings growth and a 16.8% increase in revenue per year, outpacing the Korean market's average. Despite recent challenges, including a significant one-off loss of ₩45.4 billion affecting its financial results up to June 2025, HYBE's strategic focus on innovation and expansion into new entertainment segments suggests potential for sustained growth. The company's recent earnings report showed an impressive surge in both sales and net income for the first half of 2025, indicating resilience and adaptability in a competitive industry landscape.

Genew TechnologiesLtd (SHSE:688418)

Simply Wall St Growth Rating: ★★★★★☆

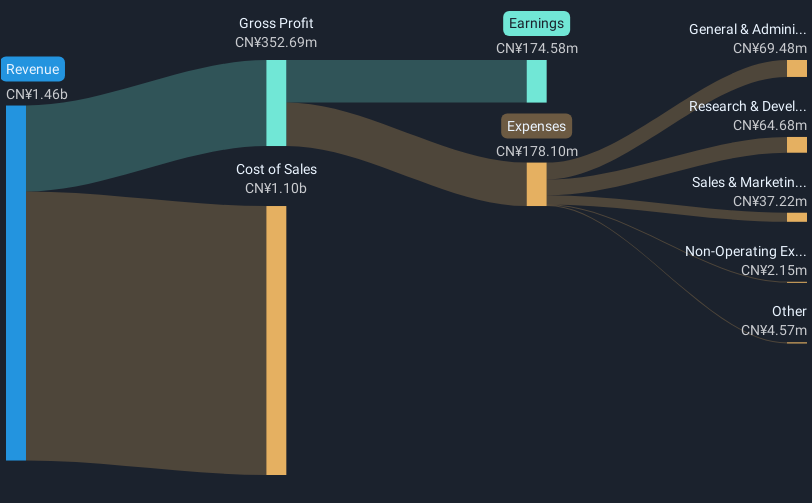

Overview: Genew Technologies Co.,Ltd. focuses on the research, development, production, and sale of communication and network products globally, with a market cap of CN¥5.53 billion.

Operations: Genew Technologies Co.,Ltd. generates revenue through the development and sale of communication and network products on a global scale. The company is involved in various stages from research to production, focusing on innovative solutions in the telecommunications sector.

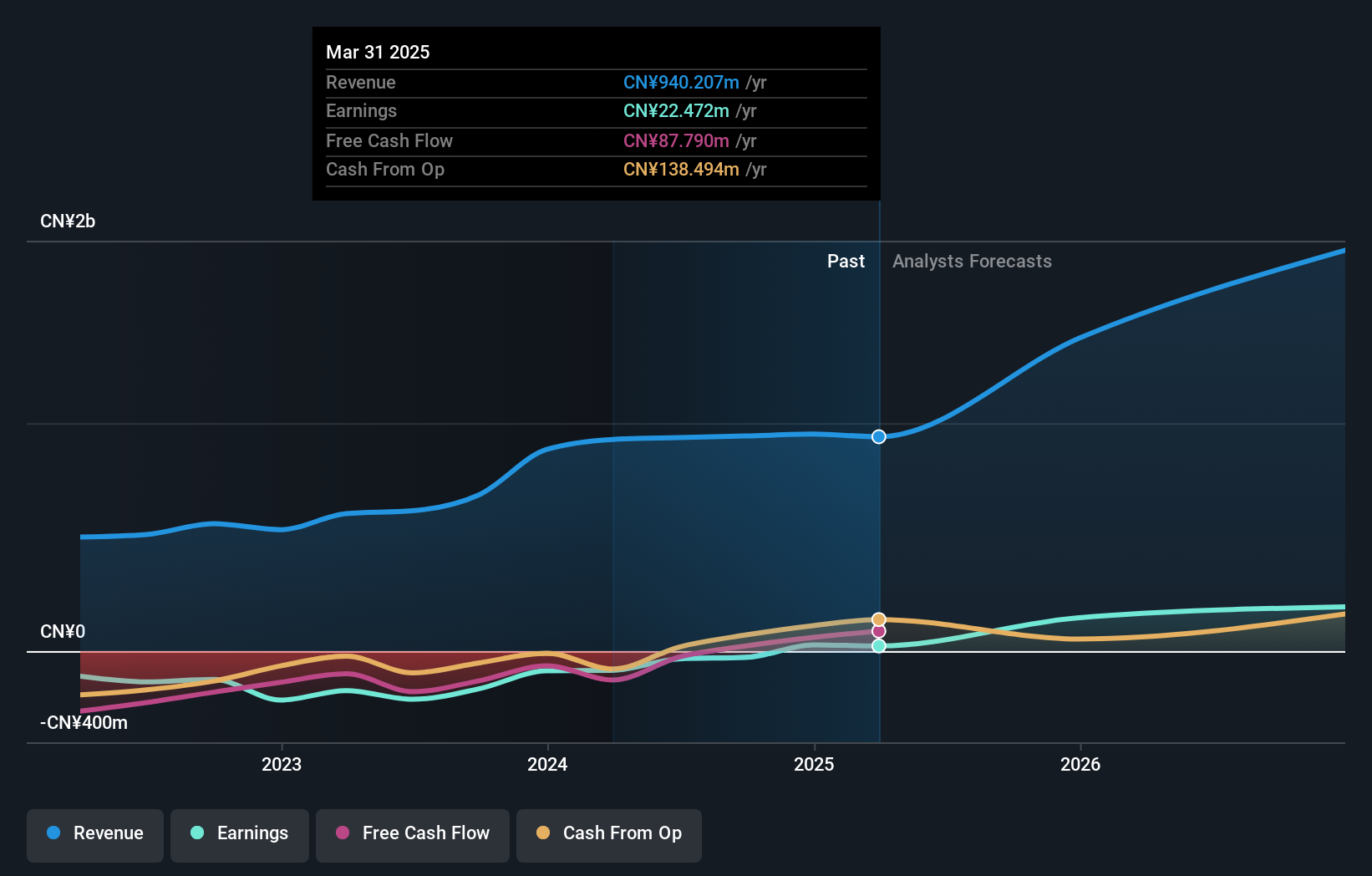

Genew Technologies, recently added to the S&P Global BMI Index, is navigating a transformative phase with significant investment in innovation despite recent financial setbacks. In H1 2025, the company reported a revenue drop to CNY 350.16 million from CNY 375.77 million year-over-year and shifted from a net profit to a loss of CNY 47.59 million. However, its aggressive R&D spending and strategic acquisitions, like the recent purchase of a 5% stake by Zhiyuan Capital for CNY 220 million, underscore its commitment to growth in high-tech sectors. With revenue projected to grow at an annual rate of 37.6% and earnings expected to surge by 111.63%, Genew is poised for recovery and profitability that could outpace broader market trends.

- Navigate through the intricacies of Genew TechnologiesLtd with our comprehensive health report here.

Gain insights into Genew TechnologiesLtd's past trends and performance with our Past report.

Zhejiang ZUCH Technology (SZSE:301280)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang ZUCH Technology Co., Ltd. specializes in providing electric connectors in China and has a market capitalization of CN¥6.92 billion.

Operations: Zhejiang ZUCH Technology Co., Ltd. generates revenue primarily through the sale of electric connectors within China. The company's market capitalization stands at CN¥6.92 billion, reflecting its position in the industry.

Zhejiang ZUCH Technology, recently included in the S&P Global BMI Index, demonstrates robust growth dynamics within Asia's high-tech landscape. In H1 2025, the firm achieved a revenue increase to CNY 899.58 million from CNY 793.75 million year-over-year, although net income slightly decreased to CNY 88.52 million from CNY 98.83 million. This financial performance is underpinned by substantial R&D investments which are crucial for maintaining competitive advantage and driving future growth in its sector, reflecting a strategic focus on innovation despite market challenges.

Turning Ideas Into Actions

- Click here to access our complete index of 189 Asian High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HYBE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A352820

HYBE

Engages in the music production, publishing, and artist development and management businesses.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)