- South Korea

- /

- Hospitality

- /

- KOSE:A032350

Asian Stocks Trading At Estimated Discounts In October 2025

Reviewed by Simply Wall St

Amid the backdrop of renewed U.S.-China trade tensions and economic uncertainties, Asian markets are navigating a complex landscape, with indices showing mixed performances. In this environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential discounts, as these stocks may offer opportunities for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.15 | CN¥38.16 | 49.8% |

| TaewoongLtd (KOSDAQ:A044490) | ₩35600.00 | ₩69644.59 | 48.9% |

| Suzhou Hengmingda Electronic Technology (SZSE:002947) | CN¥44.65 | CN¥89.14 | 49.9% |

| Sheng Siong Group (SGX:OV8) | SGD2.15 | SGD4.28 | 49.8% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥959.00 | ¥1910.64 | 49.8% |

| Insource (TSE:6200) | ¥927.00 | ¥1803.64 | 48.6% |

| Genesem (KOSDAQ:A217190) | ₩9730.00 | ₩19382.18 | 49.8% |

| Essex Bio-Technology (SEHK:1061) | HK$4.77 | HK$9.46 | 49.6% |

| DuChemBIOLtd (KOSDAQ:A176750) | ₩9180.00 | ₩17999.49 | 49% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥30.29 | CN¥59.73 | 49.3% |

Let's explore several standout options from the results in the screener.

Lotte Tour Development (KOSE:A032350)

Overview: Lotte Tour Development Co., Ltd., along with its subsidiaries, provides travel and tourism services in South Korea and has a market cap of ₩1.42 trillion.

Operations: The company's revenue segments include the Dream Tower Integrated Resort Division, which contributes ₩438.36 billion, the Travel Related Service Sector (excluding Internet Journalism) at ₩87.56 billion, and the Internet Media Sector with ₩2.87 billion.

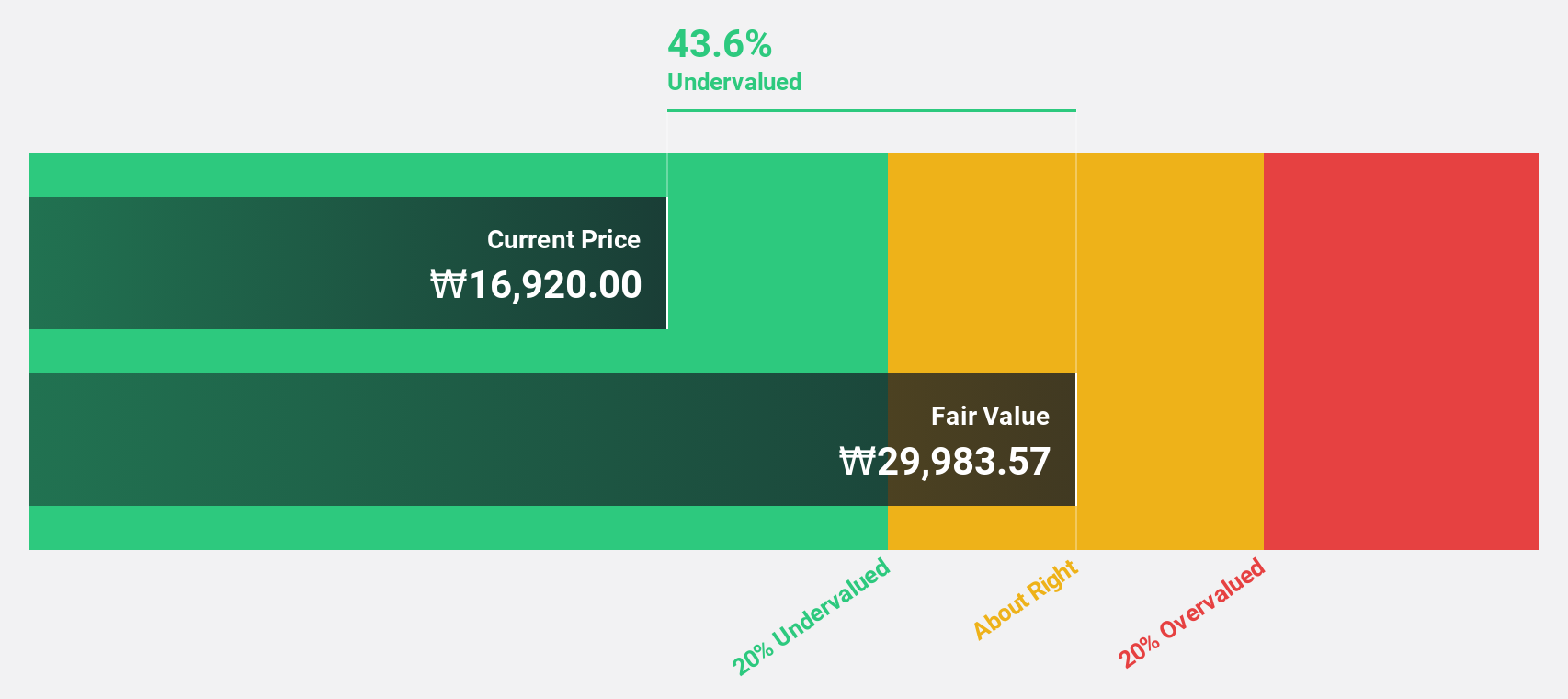

Estimated Discount To Fair Value: 43.4%

Lotte Tour Development's recent earnings reveal a significant turnaround, with a net income of ₩5.95 billion for Q2 2025, compared to a loss last year. The company is trading at 43.4% below its estimated fair value and is highly undervalued based on discounted cash flow analysis, with shares priced at ₩17,900 against an estimated fair value of ₩31,647.31. Revenue growth is expected to outpace the market significantly over the next few years.

- Insights from our recent growth report point to a promising forecast for Lotte Tour Development's business outlook.

- Navigate through the intricacies of Lotte Tour Development with our comprehensive financial health report here.

EROAD (NZSE:ERD)

Overview: EROAD Limited offers electronic on-board units and software as a service to the transport industry across New Zealand, the United States, and Australia, with a market cap of NZ$540.67 million.

Operations: EROAD's revenue segments are comprised of NZ$13.70 million from Australia, NZ$103.90 million from New Zealand, NZ$81.20 million from North America, and NZ$72.50 million attributed to Corporate & Development activities.

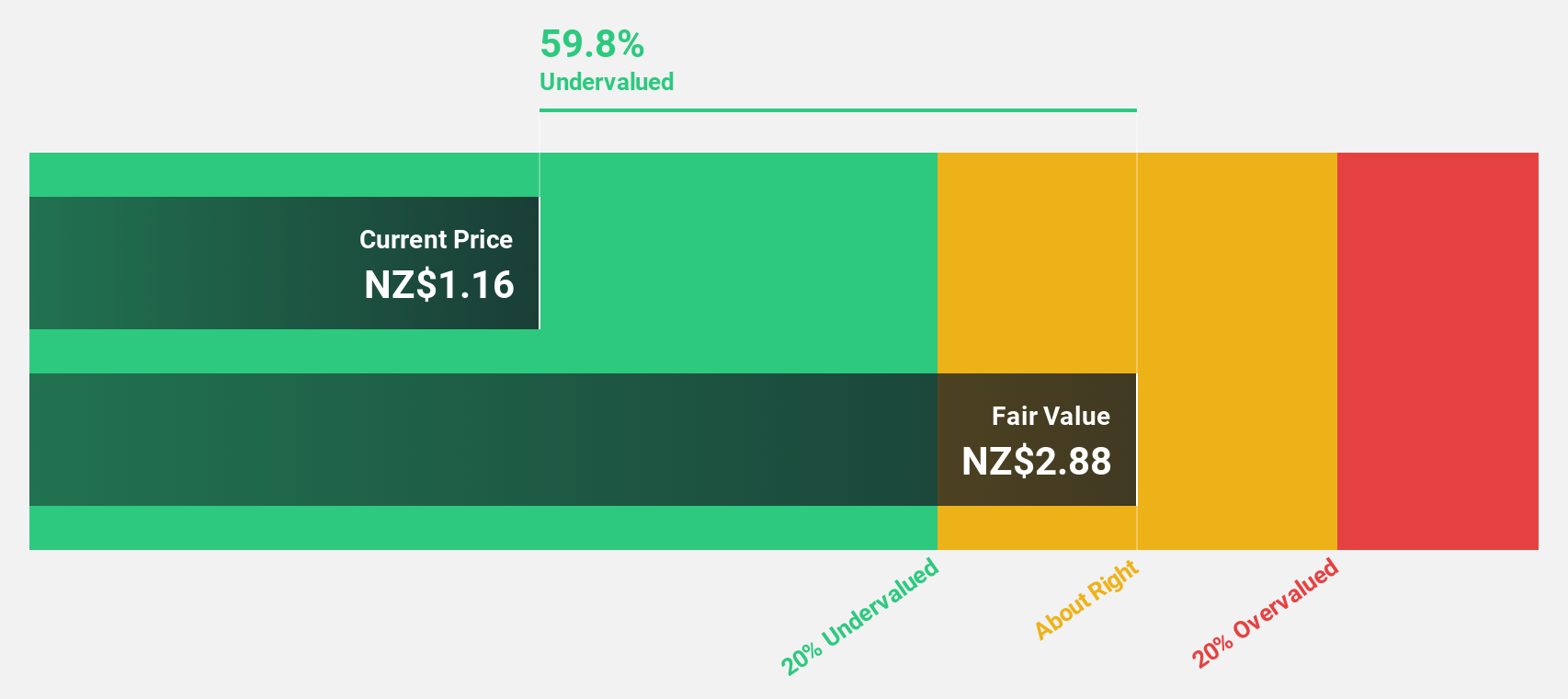

Estimated Discount To Fair Value: 35.9%

EROAD is trading at NZ$2.89, significantly below its estimated fair value of NZ$4.51, suggesting it may be undervalued based on cash flows. Despite a forecasted low return on equity of 5.7% in three years, earnings are expected to grow significantly at 40.93% annually, outpacing the New Zealand market's growth rate. Recent strategic partnerships and technological innovations bolster EROAD's position in the telematics sector, enhancing its potential for future revenue growth despite current volatility.

- Upon reviewing our latest growth report, EROAD's projected financial performance appears quite optimistic.

- Dive into the specifics of EROAD here with our thorough financial health report.

Shenzhen Newway Photomask Making (SHSE:688401)

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company involved in the design, development, and production of mask products in China, with a market capitalization of approximately CN¥10.09 billion.

Operations: The company's revenue is primarily derived from its Electronic Components & Parts segment, totaling CN¥1.02 billion.

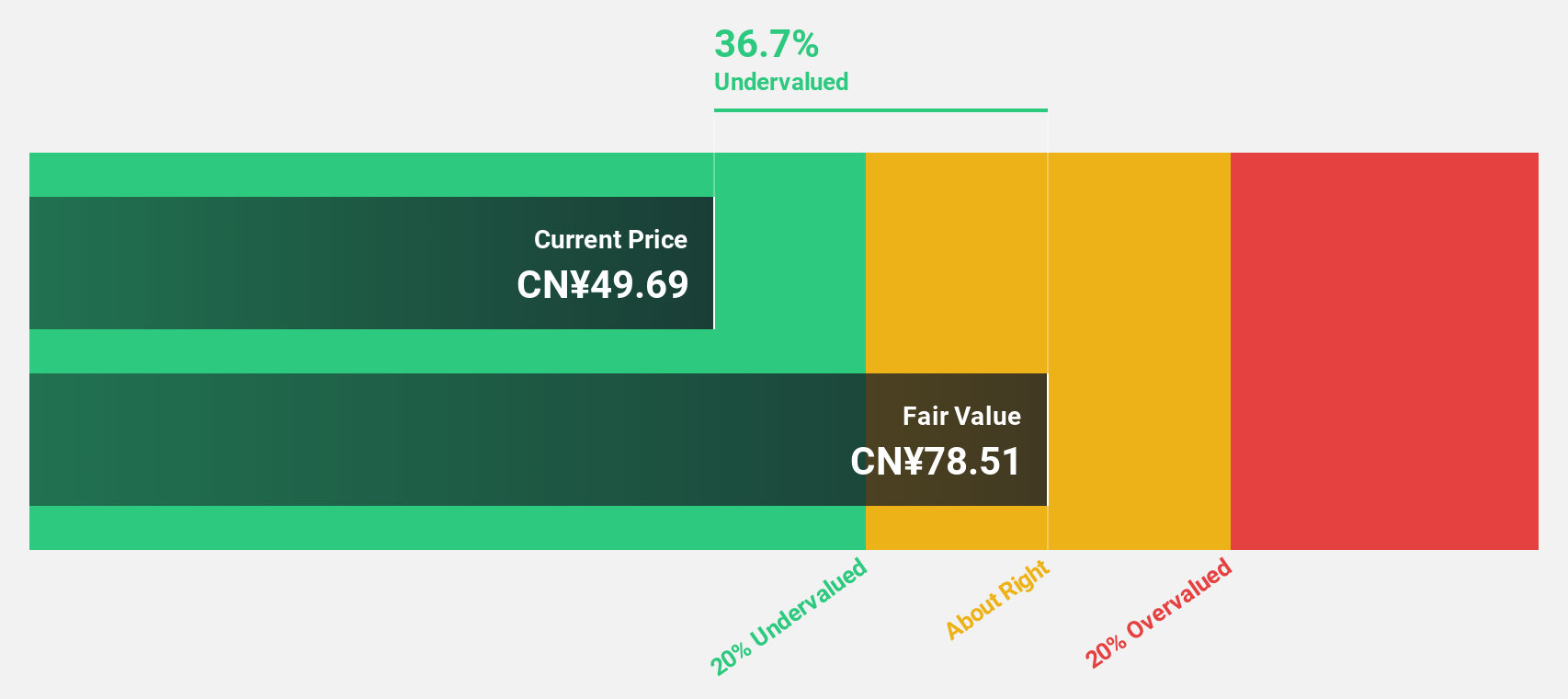

Estimated Discount To Fair Value: 33.3%

Shenzhen Newway Photomask Making is trading at CN¥52.68, below its estimated fair value of CN¥78.98, indicating potential undervaluation based on cash flows. Despite recent share price volatility, the company reported strong half-year results with revenue reaching CNY 544.03 million and net income at CNY 106.43 million. Earnings and revenue are forecast to grow significantly faster than the Chinese market, potentially enhancing its investment appeal amidst a competitive industry landscape.

- Our comprehensive growth report raises the possibility that Shenzhen Newway Photomask Making is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen Newway Photomask Making.

Seize The Opportunity

- Delve into our full catalog of 275 Undervalued Asian Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A032350

Lotte Tour Development

Engages in the provision of travel and tourism services in South Korea.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)