- China

- /

- Electronic Equipment and Components

- /

- SHSE:688195

Optowide Technologies Co., Ltd.'s (SHSE:688195) 50% Jump Shows Its Popularity With Investors

Optowide Technologies Co., Ltd. (SHSE:688195) shares have continued their recent momentum with a 50% gain in the last month alone. Looking further back, the 25% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

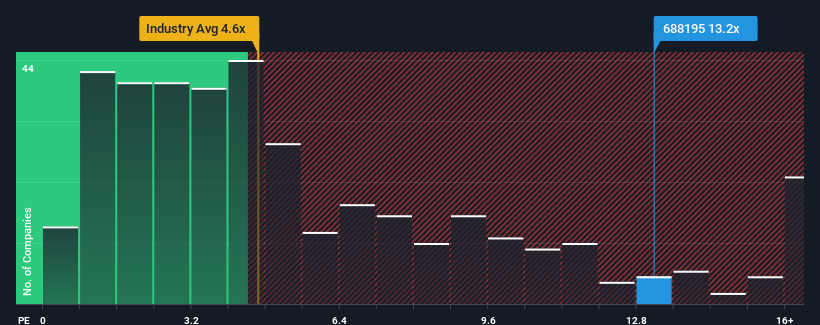

After such a large jump in price, Optowide Technologies may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 13.2x, when you consider almost half of the companies in the Electronic industry in China have P/S ratios under 4.6x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Optowide Technologies

What Does Optowide Technologies' P/S Mean For Shareholders?

Recent times have been advantageous for Optowide Technologies as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Optowide Technologies will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Optowide Technologies?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Optowide Technologies' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. Pleasingly, revenue has also lifted 48% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 44% over the next year. With the industry only predicted to deliver 27%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Optowide Technologies' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Optowide Technologies' P/S Mean For Investors?

Shares in Optowide Technologies have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Optowide Technologies shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 1 warning sign for Optowide Technologies that you should be aware of.

If you're unsure about the strength of Optowide Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688195

Optowide Technologies

Engages in the research, development, production, and sale of precision optics and fiber components in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026