- China

- /

- Electronic Equipment and Components

- /

- SHSE:688195

Discovering Undiscovered Gems In December 2024

Reviewed by Simply Wall St

As global markets experience mixed performances, with major indices like the S&P 500 and Nasdaq hitting record highs while the Russell 2000 sees a decline, investors are keenly observing economic indicators such as job growth and potential interest rate cuts. In this dynamic environment, identifying promising small-cap stocks can be particularly rewarding; these undiscovered gems often thrive by capitalizing on niche market opportunities and innovative strategies that align well with current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

MicroPort NeuroScientific (SEHK:2172)

Simply Wall St Value Rating: ★★★★★★

Overview: MicroPort NeuroScientific Corporation focuses on the research, development, production, and sale of neuro-interventional medical devices in China and internationally, with a market cap of HK$5.18 billion.

Operations: The company generates revenue primarily from the sale of surgical and medical equipment, amounting to CN¥774.66 million.

MicroPort NeuroScientific, a nimble player in the medical equipment space, has shown impressive financial health with no debt over the past five years. Its earnings grew by 67% last year, outpacing the industry average of -4%. The company trades at nearly 47% below its estimated fair value, suggesting potential undervaluation. Recent strategic moves include a share repurchase program worth HKD 200 million aimed at enhancing earnings per share. With high-quality past earnings and an anticipated annual growth rate of 22%, MicroPort seems well-positioned for continued success in its field.

Optowide Technologies (SHSE:688195)

Simply Wall St Value Rating: ★★★★★☆

Overview: Optowide Technologies Co., Ltd. specializes in the research, development, production, and sale of precision optics and fiber components both in China and internationally, with a market capitalization of CN¥4.99 billion.

Operations: Optowide Technologies generates revenue through the sale of precision optics and fiber components. The company's financial performance includes a notable gross profit margin trend.

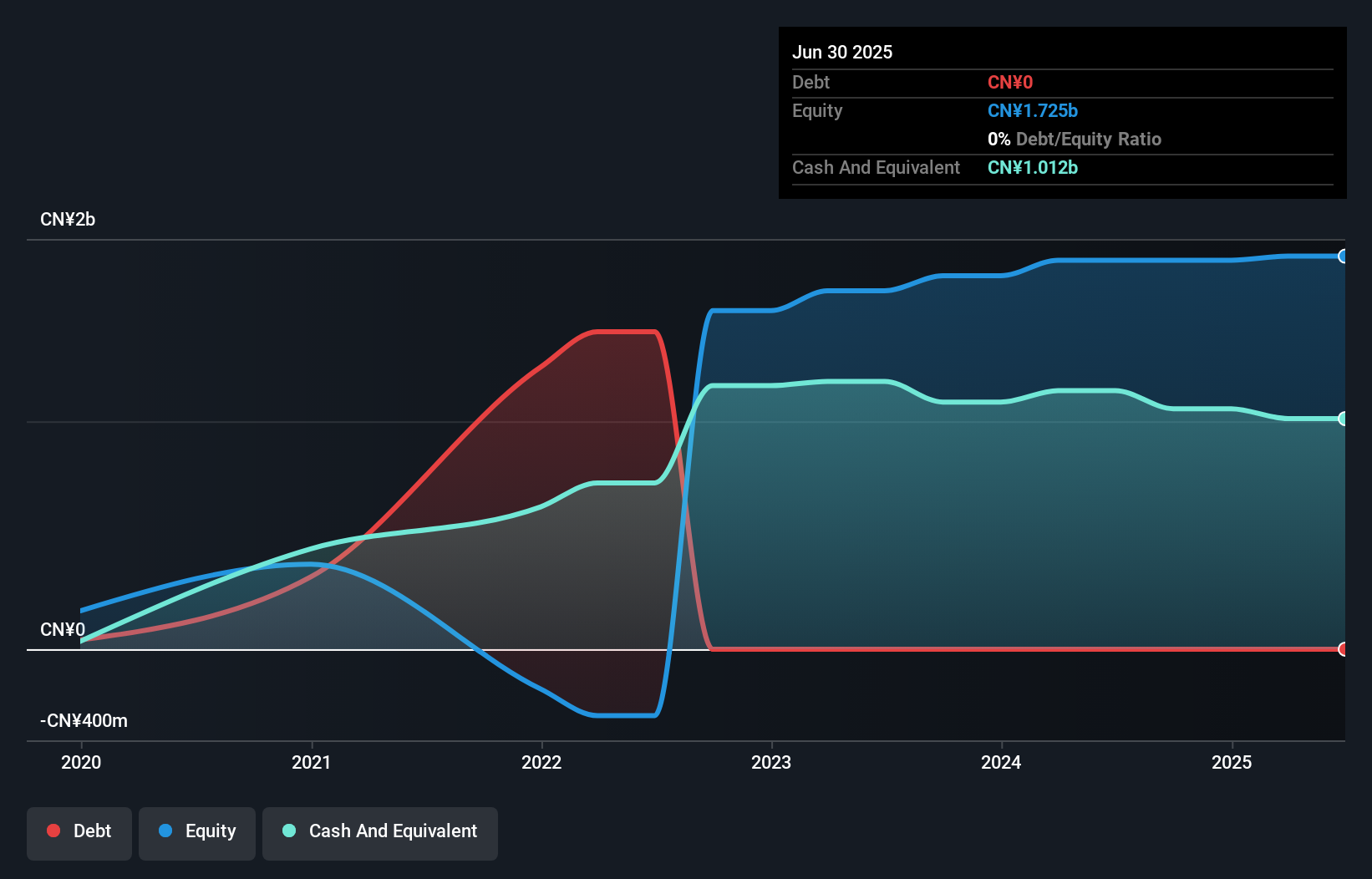

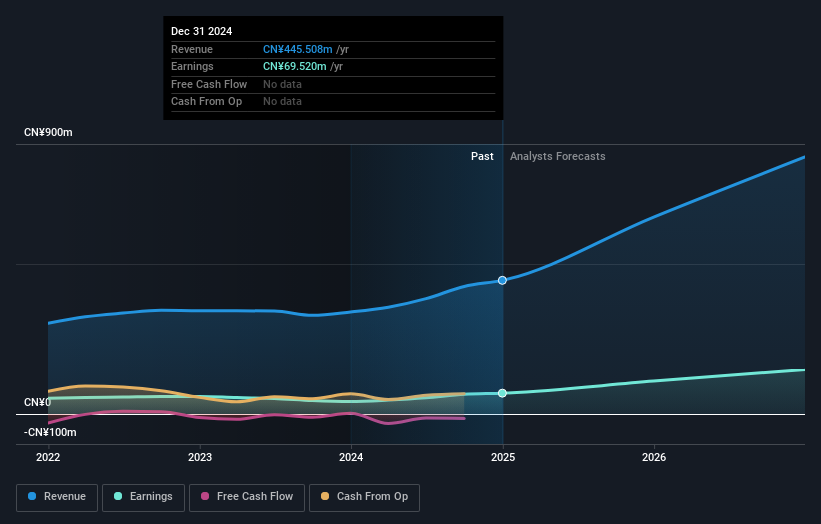

Optowide Technologies, a smaller player in the tech space, has shown impressive earnings growth of 47.3% over the past year, outpacing the Electronic industry’s 1.9%. Despite a volatile share price recently, it boasts high-quality earnings and more cash than total debt. The firm reported nine-month sales of CNY 331.85 million and net income of CNY 55.48 million for September 2024, reflecting solid financial health with basic EPS rising to CNY 0.43 from CNY 0.24 last year. Optowide's recent buyback program aims to repurchase shares worth up to CNY 20 million at adjusted prices for employee incentives and plans.

- Click here to discover the nuances of Optowide Technologies with our detailed analytical health report.

Evaluate Optowide Technologies' historical performance by accessing our past performance report.

Beijing Bewinner Communications (SZSE:002148)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Bewinner Communications Co., Ltd. operates in the telecommunications sector and has a market capitalization of CN¥3.69 billion.

Operations: The company generates revenue from its telecommunications services, totaling CN¥277.74 million.

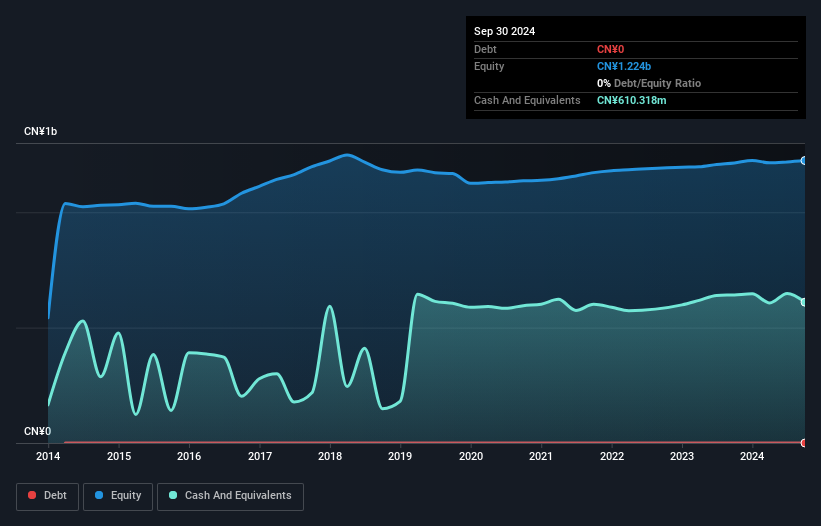

Beijing Bewinner Communications, a dynamic player in the wireless telecom sector, showcased impressive earnings growth of 63.6% over the past year, significantly outpacing the industry's 11.5%. The company remains debt-free for five years, eliminating concerns about interest payments. Despite a one-off gain of CN¥11.2 million affecting recent results, its free cash flow is positive and robust at CN¥13 million as of September 2024. Sales increased to CN¥205.91 million from CN¥193.47 million a year earlier; however, net income slightly decreased to CN¥13.56 million from CN¥13.9 million due to these unusual gains impacting overall performance stability.

- Take a closer look at Beijing Bewinner Communications' potential here in our health report.

Understand Beijing Bewinner Communications' track record by examining our Past report.

Seize The Opportunity

- Embark on your investment journey to our 4631 Undiscovered Gems With Strong Fundamentals selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688195

Optowide Technologies

Engages in the research, development, production, and sale of precision optics and fiber components in China and internationally.

High growth potential with excellent balance sheet.