- China

- /

- Metals and Mining

- /

- SZSE:000807

3 Dividend Stocks With Yields Up To 3.8% For Your Investment Strategy

Reviewed by Simply Wall St

In a week marked by mixed performances across global markets, major U.S. stock indexes such as the S&P 500 and Nasdaq Composite reached record highs, while growth stocks notably outpaced value counterparts. Amidst these dynamic market conditions, dividend stocks can offer a stable income stream and potential for capital appreciation, making them an attractive option for investors looking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.41% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.83% | ★★★★★★ |

Click here to see the full list of 1929 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

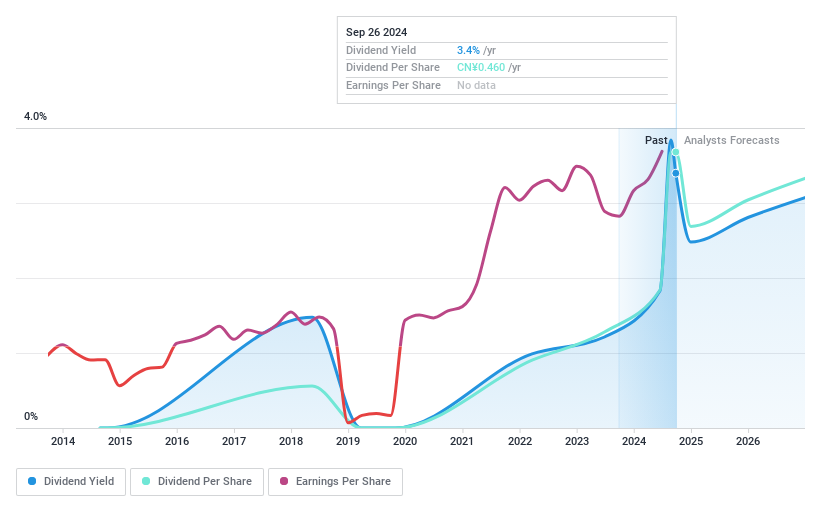

Yunnan Aluminium (SZSE:000807)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yunnan Aluminium Co., Ltd. manufactures and sells aluminum in China with a market cap of CN¥48.76 billion.

Operations: Yunnan Aluminium Co., Ltd. generates its revenue from the manufacturing and sale of aluminum in China.

Dividend Yield: 3.1%

Yunnan Aluminium's recent earnings report shows strong financial performance, with net income rising to CNY 3.82 billion for the first nine months of 2024. The company's dividend yield is in the top 25% of CN market payers, supported by a low payout ratio of 30.3%, ensuring dividends are well covered by earnings and cash flows. However, its dividend history is unstable, having been volatile over its seven-year payment period despite recent increases.

- Unlock comprehensive insights into our analysis of Yunnan Aluminium stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Yunnan Aluminium is priced lower than what may be justified by its financials.

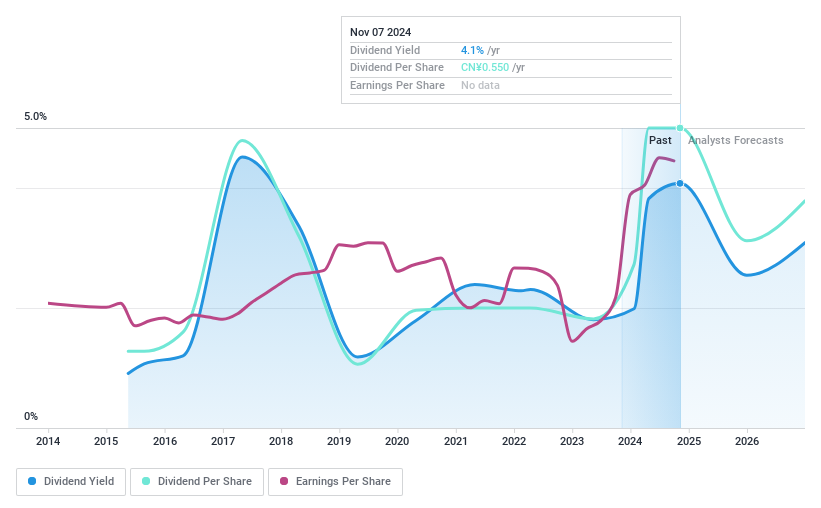

Zhejiang Giuseppe Garment (SZSE:002687)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhejiang Giuseppe Garment Co., Ltd is a Chinese company that produces and sells business, men's, and casual wear under the George White brands, with a market cap of CN¥2.43 billion.

Operations: Zhejiang Giuseppe Garment Co., Ltd generates revenue through the production and sale of business, men's, and casual wear under its George White brands in China.

Dividend Yield: 3.9%

Zhejiang Giuseppe Garment's dividend yield ranks in the top 25% of the CN market, supported by a reasonable payout ratio of 74.7%, ensuring coverage by both earnings and cash flows. However, its dividend history is unstable and has been volatile over the past decade. Recent earnings reported a decline with net income at CNY 52.88 million for nine months ending September 2024, compared to CNY 124.41 million previously, impacting overall financial stability.

- Click to explore a detailed breakdown of our findings in Zhejiang Giuseppe Garment's dividend report.

- Our expertly prepared valuation report Zhejiang Giuseppe Garment implies its share price may be too high.

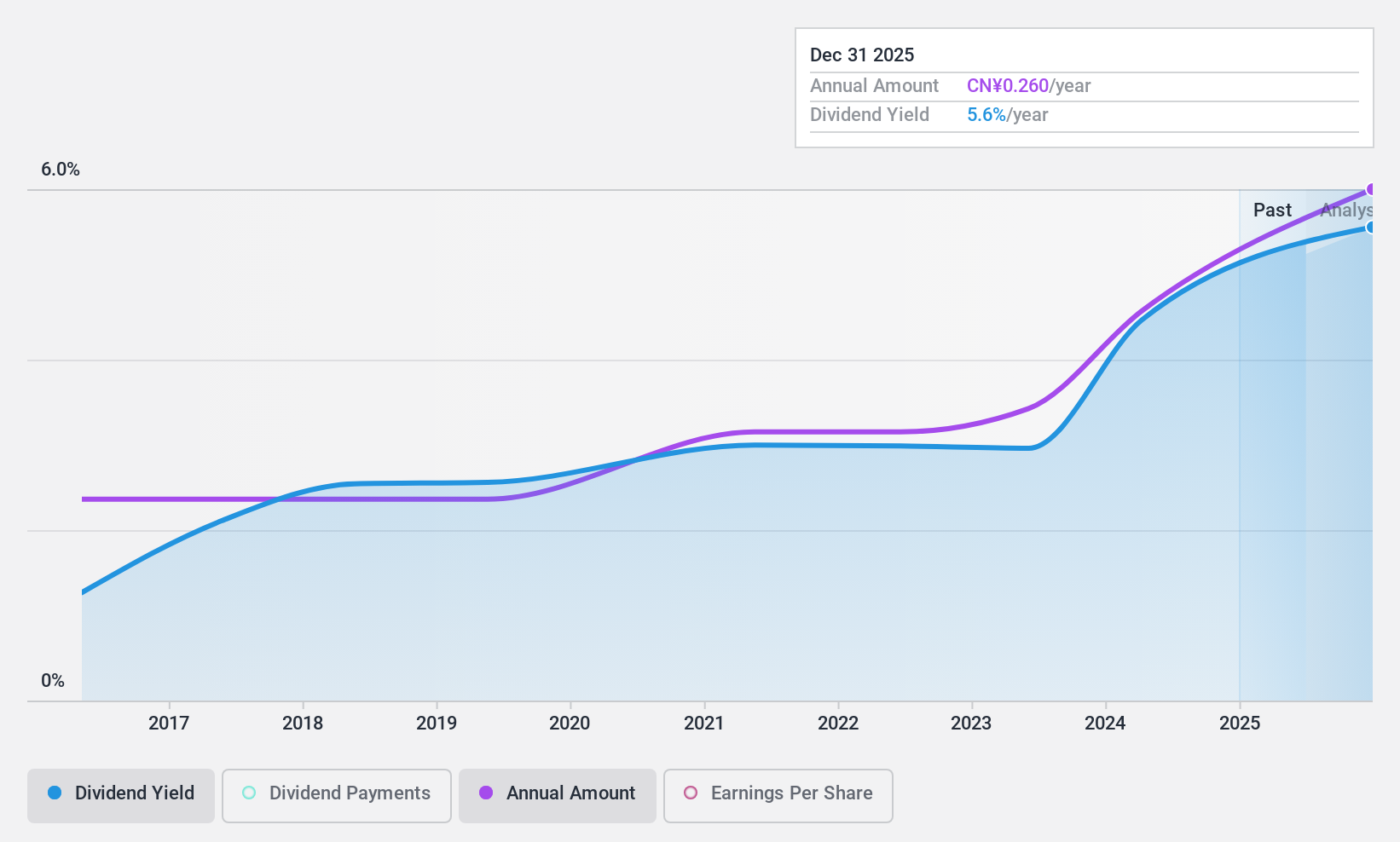

Sichuan Guoguang Agrochemical (SZSE:002749)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sichuan Guoguang Agrochemical Co., Ltd. focuses on the research, development, manufacture, marketing, and distribution of agrochemical products and materials both in China and internationally with a market cap of CN¥6.64 billion.

Operations: Sichuan Guoguang Agrochemical Co., Ltd.'s revenue segments primarily include the production and sale of agrochemical products and materials.

Dividend Yield: 3.8%

Sichuan Guoguang Agrochemical's dividend yield is among the top 25% in the CN market, supported by a payout ratio of 68.6%, indicating coverage by earnings and cash flows. Despite a volatile dividend history over the past decade, payments have increased. Recent earnings show growth with net income rising to CNY 270.01 million for nine months ending September 2024, up from CNY 222.83 million previously, reflecting potential financial stability improvements.

- Click here to discover the nuances of Sichuan Guoguang Agrochemical with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Sichuan Guoguang Agrochemical shares in the market.

Summing It All Up

- Gain an insight into the universe of 1929 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000807

Flawless balance sheet, undervalued and pays a dividend.