In a week marked by mixed performances across major U.S. stock indexes and significant sectoral shifts, global markets have been navigating through economic reports and geopolitical developments with cautious optimism. As growth stocks continue to rally and interest rate cuts remain a focal point for investors, identifying potentially undervalued stocks becomes crucial for those looking to capitalize on market inefficiencies. In this context, understanding what constitutes a good stock—such as strong fundamentals, favorable valuation metrics, and resilience in varied market conditions—can offer valuable insights into uncovering opportunities that may be overlooked by the broader market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Komax Holding (SWX:KOMN) | CHF120.20 | CHF240.31 | 50% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.00 | CLP576.88 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1449.00 | ¥2890.08 | 49.9% |

| Privia Health Group (NasdaqGS:PRVA) | US$21.62 | US$43.17 | 49.9% |

| Pluxee (ENXTPA:PLX) | €20.555 | €40.82 | 49.6% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.10 | HK$54.18 | 50% |

| Visional (TSE:4194) | ¥8567.00 | ¥17012.91 | 49.6% |

| Cicor Technologies (SWX:CICN) | CHF58.40 | CHF116.64 | 49.9% |

| First Advantage (NasdaqGS:FA) | US$19.65 | US$39.02 | 49.6% |

| Marcus & Millichap (NYSE:MMI) | US$40.94 | US$81.25 | 49.6% |

Here's a peek at a few of the choices from the screener.

Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267)

Overview: Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. operates in the electronic technology sector and has a market cap of CN¥9.62 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. If you can provide the missing details, I would be happy to help summarize them for you.

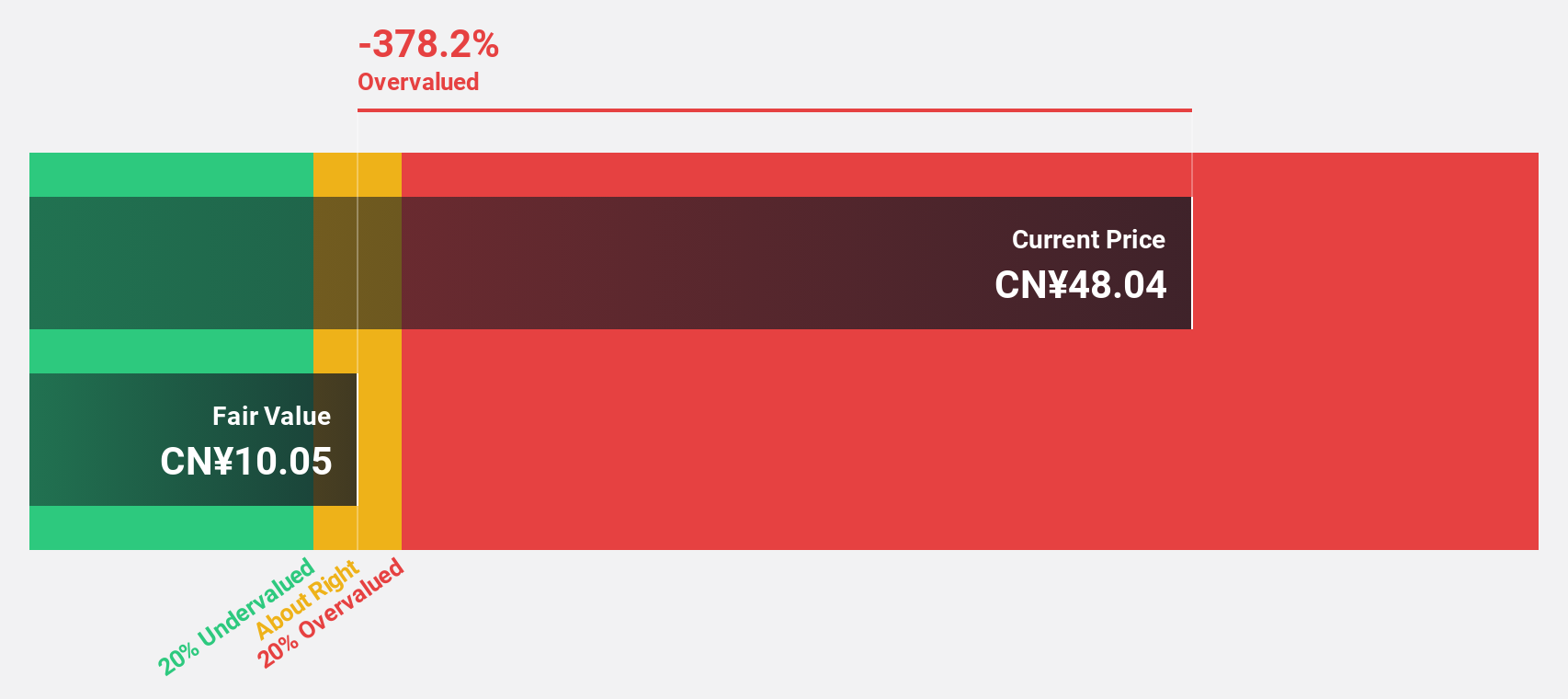

Estimated Discount To Fair Value: 40.2%

Beijing Yuanliu Hongyuan Electronic Technology is trading at CNY 42.64, significantly below its estimated fair value of CNY 71.3, indicating potential undervaluation based on cash flows. Despite a drop in net income to CNY 127.4 million for the first nine months of 2024, earnings are forecast to grow at an impressive annual rate of over 40%, outpacing the Chinese market's growth expectations. However, profit margins have decreased from last year’s figures, and its return on equity remains low at a projected 9.5%.

- Our growth report here indicates Beijing Yuanliu Hongyuan Electronic Technology may be poised for an improving outlook.

- Navigate through the intricacies of Beijing Yuanliu Hongyuan Electronic Technology with our comprehensive financial health report here.

Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016)

Overview: Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. operates in the biotechnology sector, focusing on the production and sale of dietary fiber and related products, with a market cap of CN¥5.38 billion.

Operations: Revenue segments for SHSE:605016 include the production and sale of dietary fiber and related products.

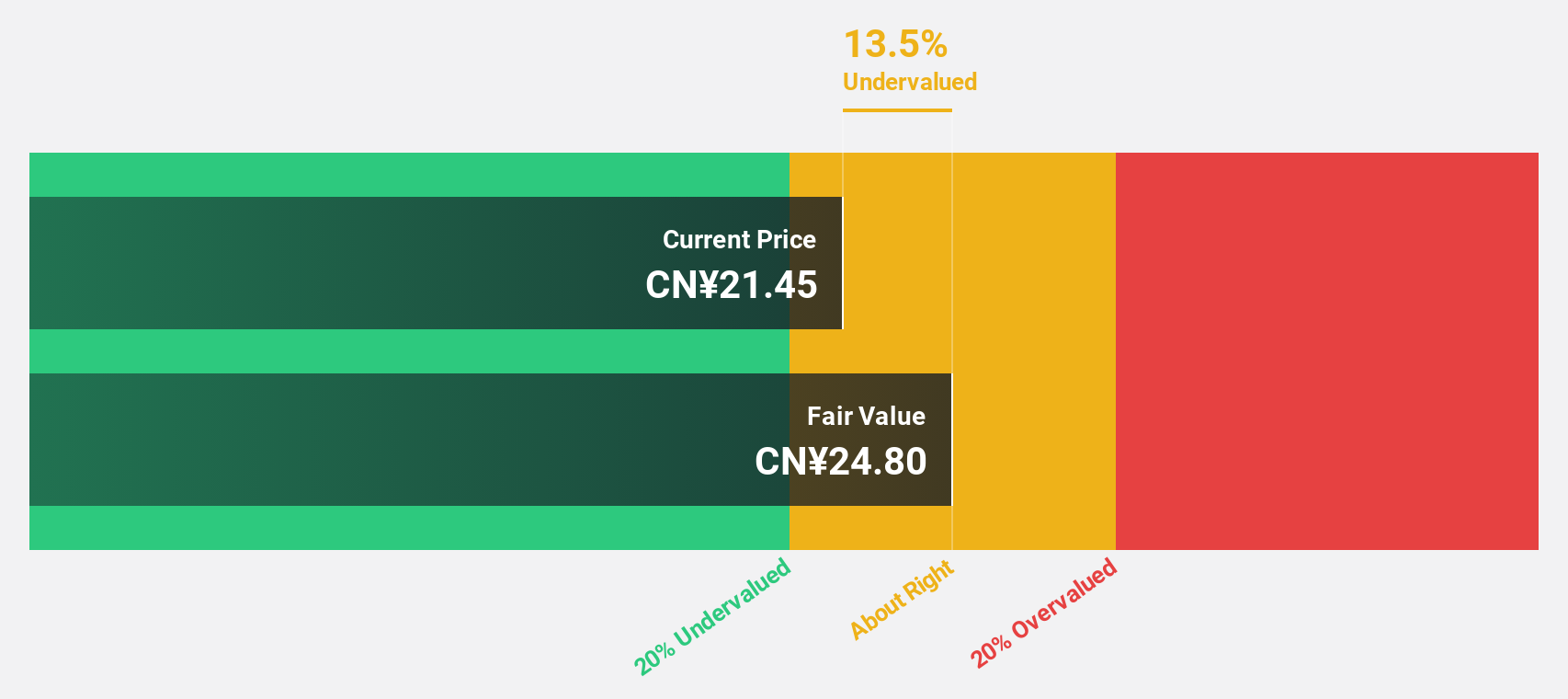

Estimated Discount To Fair Value: 48.1%

Shandong Bailong Chuangyuan Bio-Tech is trading at CN¥17.2, significantly below its estimated fair value of CN¥33.16, reflecting potential undervaluation based on cash flows. The company's earnings are forecast to grow 30.56% annually, surpassing the Chinese market's growth rate of 25.9%. Recent earnings showed a net income increase to CN¥182.59 million for the first nine months of 2024, though its dividend coverage by free cash flows remains weak at 1.07%.

- Our comprehensive growth report raises the possibility that Shandong Bailong Chuangyuan Bio-Tech is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Shandong Bailong Chuangyuan Bio-Tech.

Nihon Kohden (TSE:6849)

Overview: Nihon Kohden Corporation develops, manufactures, sells, maintains, and consults on medical electronic equipment and related systems globally with a market cap of ¥348.15 billion.

Operations: Revenue Segments (in millions of ¥): Patient Monitoring & Life Support Equipment: ¥105,000, Diagnostic & Clinical Examination Equipment: ¥90,000, Treatment Equipment: ¥60,000. The company's revenue is primarily derived from its Patient Monitoring & Life Support Equipment segment at ¥105 billion, followed by Diagnostic & Clinical Examination Equipment at ¥90 billion and Treatment Equipment at ¥60 billion.

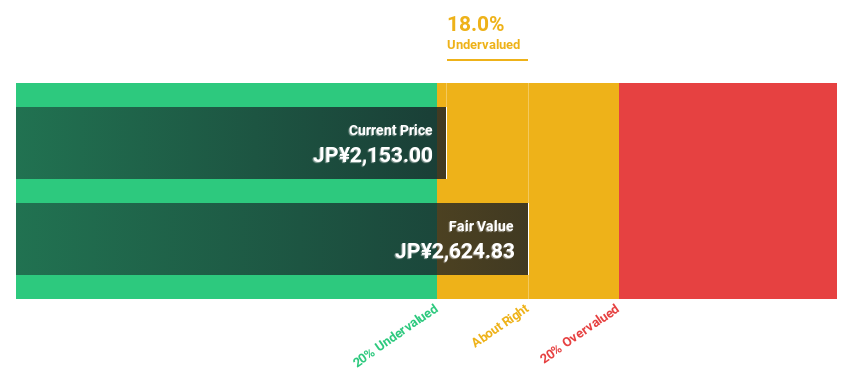

Estimated Discount To Fair Value: 19.5%

Nihon Kohden is trading at ¥2,112.5, 19.5% below its estimated fair value of ¥2,623.47, suggesting potential undervaluation based on cash flows. Despite a forecasted earnings growth of 20.1% annually, surpassing the JP market's rate of 7.9%, recent profit margins have declined from 7.7% to 4.3%. The company has introduced ATO-certified ventilators and completed a share buyback worth ¥2.31 billion but lowered its earnings guidance for FY2025 H1 significantly.

- Our earnings growth report unveils the potential for significant increases in Nihon Kohden's future results.

- Get an in-depth perspective on Nihon Kohden's balance sheet by reading our health report here.

Summing It All Up

- Unlock our comprehensive list of 908 Undervalued Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605016

Shandong Bailong Chuangyuan Bio-Tech

Shandong Bailong Chuangyuan Bio-Tech Co., Ltd.

Flawless balance sheet and undervalued.