- China

- /

- Electronic Equipment and Components

- /

- SHSE:688100

High Insider Ownership Growth Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance—highlighted by record highs in major U.S. indices and significant outperformance of growth stocks over value stocks—investors are keenly observing economic indicators and central bank policies for future direction. In this environment, identifying growth companies with high insider ownership can be particularly appealing, as such ownership often signals confidence in the company's prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.6% | 65.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's dive into some prime choices out of the screener.

Willfar Information Technology (SHSE:688100)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Willfar Information Technology Co., Ltd. offers smart utility services and IoT solutions both in China and internationally, with a market cap of CN¥17.96 billion.

Operations: The company's revenue is derived from providing smart utility services and IoT solutions across domestic and international markets.

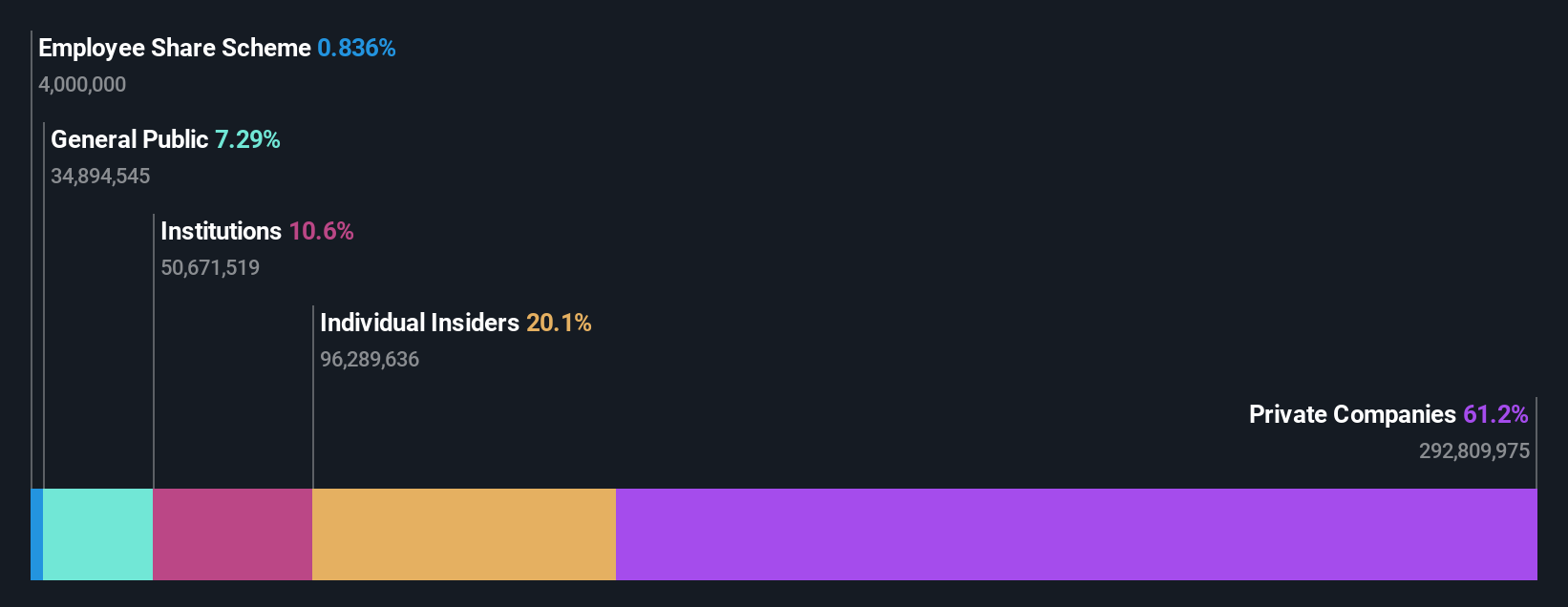

Insider Ownership: 21.2%

Earnings Growth Forecast: 21.9% p.a.

Willfar Information Technology shows promising growth potential, with earnings expected to increase by 21.9% annually, though slightly below the broader CN market's forecast. The company's revenue is projected to grow at a robust 22% per year, surpassing both industry peers and the market average. Trading at a favorable price-to-earnings ratio of 30.2x compared to the CN market's 37.3x, it offers good relative value without recent insider trading activity impacting its outlook.

- Click here and access our complete growth analysis report to understand the dynamics of Willfar Information Technology.

- The valuation report we've compiled suggests that Willfar Information Technology's current price could be quite moderate.

Unionman TechnologyLtd (SHSE:688609)

Simply Wall St Growth Rating: ★★★★★★

Overview: Unionman Technology Co., Ltd. engages in the production, sale, and servicing of multimedia information terminals, smart home network communication equipment, IoT communication modules, optical communication modules, smart security equipment, and related software systems and platforms with a market cap of approximately CN¥5.66 billion.

Operations: The company's revenue from the Computer, Communications, and Other Electronic Intelligent Equipment Manufacturing Industry segment is CN¥2.48 billion.

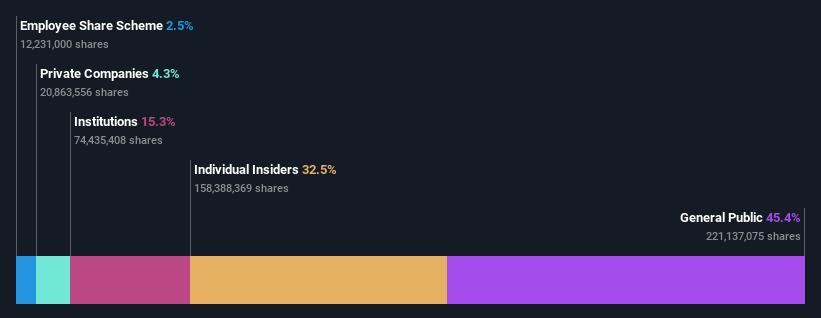

Insider Ownership: 32.4%

Earnings Growth Forecast: 88.3% p.a.

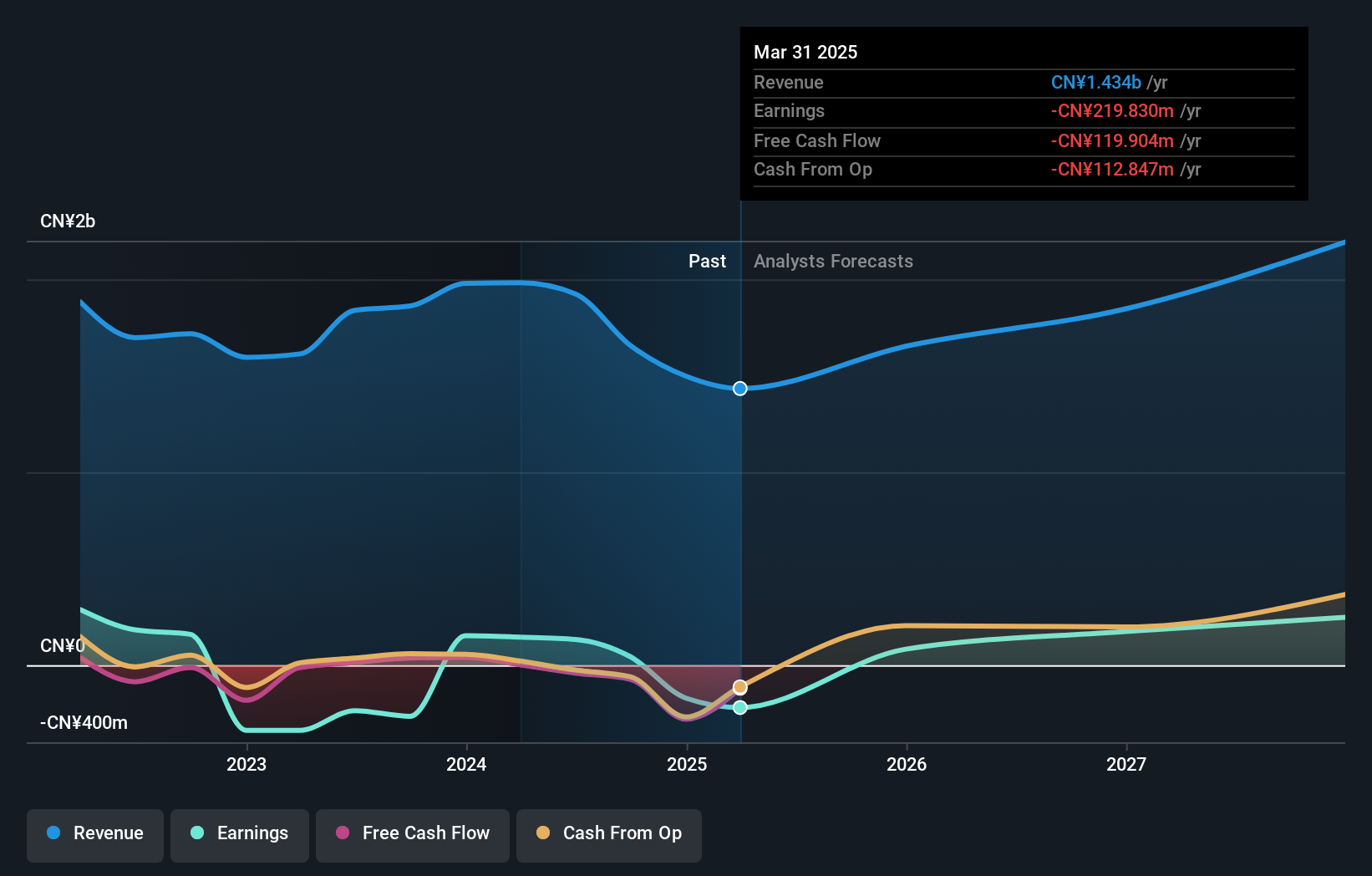

Unionman Technology Ltd. is forecast to achieve profitability within three years, with anticipated revenue growth of 34.4% annually, surpassing the CN market's 13.7%. Despite recent volatility in its share price and a net loss of CNY 105.15 million for the first nine months of 2024, earnings are expected to grow by 88.3% per year. The company's return on equity is projected to reach a high level at 24.9%, although its debt coverage by operating cash flow remains inadequate.

- Click to explore a detailed breakdown of our findings in Unionman TechnologyLtd's earnings growth report.

- Our valuation report unveils the possibility Unionman TechnologyLtd's shares may be trading at a premium.

Beijing SuperMap Software (SZSE:300036)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing SuperMap Software Co., Ltd. provides geographic information system (GIS) and geospatial intelligence software products and services both in China and internationally, with a market cap of CN¥9.18 billion.

Operations: The company generates revenue from its geographic information system (GIS) and geospatial intelligence software products and services, catering to both domestic and international markets.

Insider Ownership: 18%

Earnings Growth Forecast: 53.1% p.a.

Beijing SuperMap Software is projected to grow earnings by 53.1% annually, outpacing the CN market's 25.9%, despite a volatile share price and a recent decline in net income to CNY 26.31 million for the first nine months of 2024 from CNY 135.44 million a year ago. The company has completed a share buyback of over CNY 140 million, representing 2.02% of its shares, indicating strong insider confidence amidst high forecasted revenue growth at 26.6% per year.

- Delve into the full analysis future growth report here for a deeper understanding of Beijing SuperMap Software.

- Our valuation report here indicates Beijing SuperMap Software may be undervalued.

Taking Advantage

- Reveal the 1510 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Willfar Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688100

Willfar Information Technology

Provides smart utility services and IoT solutions in China and internationally.

High growth potential with solid track record.