- China

- /

- Electrical

- /

- SZSE:002335

Insider Confidence In December 2024's Leading Growth Stocks

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by mixed performances and geopolitical developments, major U.S. stock indexes have seen record highs driven by a rally in growth stocks, despite some sectors facing declines. This environment highlights the importance of insider ownership as a potential indicator of confidence in growth companies; when insiders hold significant stakes, it may suggest alignment with shareholder interests and belief in the company's future prospects amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's uncover some gems from our specialized screener.

SICC (SHSE:688234)

Simply Wall St Growth Rating: ★★★★★☆

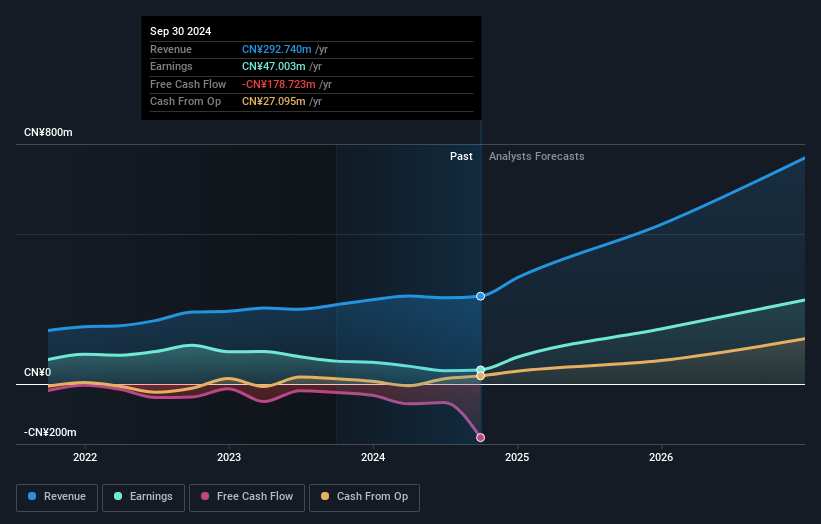

Overview: SICC Co., Ltd. is involved in the research, development, production, and sale of silicon carbide semiconductor materials both in China and internationally, with a market cap of CN¥25.35 billion.

Operations: The company generates revenue primarily from its semiconductor material segment, amounting to CN¥1.71 billion.

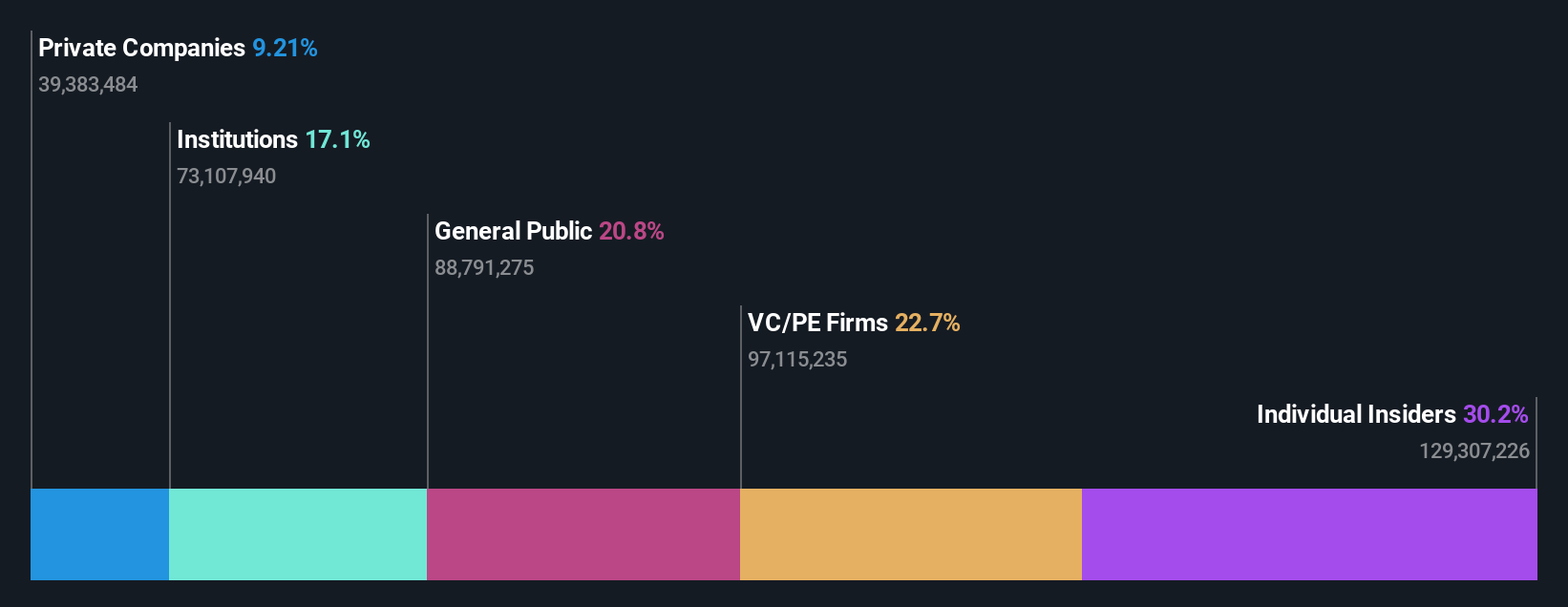

Insider Ownership: 30.2%

Revenue Growth Forecast: 27% p.a.

SICC Co., Ltd. is experiencing robust growth with forecasted revenue and earnings expected to rise significantly at 27% and 37.68% per year, respectively, outpacing the CN market averages. The company recently became profitable, reporting net income of CNY 143.03 million for the first nine months of 2024 compared to a loss last year. Despite this growth trajectory, SICC's share price has been highly volatile recently, and its future return on equity is projected to be low at 13.3%.

- Unlock comprehensive insights into our analysis of SICC stock in this growth report.

- Our expertly prepared valuation report SICC implies its share price may be too high.

Great Microwave Technology (SHSE:688270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Great Microwave Technology Co., Ltd. focuses on the research, development, production, and sale of integrated circuit chips and microsystems in China with a market cap of CN¥9.55 billion.

Operations: Great Microwave Technology Co., Ltd. generates its revenue from the research, development, production, and sale of integrated circuit chips and microsystems in China.

Insider Ownership: 21%

Revenue Growth Forecast: 41.6% p.a.

Great Microwave Technology is poised for substantial growth, with earnings projected to rise 67.24% annually, significantly outpacing the CN market. Despite a decline in profit margins from 28.9% to 16.1%, revenue is expected to grow at an impressive rate of 41.6% per year. The company has announced a CNY 40 million share repurchase program, reflecting confidence in its future prospects, although its share price has been volatile recently and return on equity remains low at 10.4%.

- Take a closer look at Great Microwave Technology's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Great Microwave Technology's current price could be inflated.

Kehua Data (SZSE:002335)

Simply Wall St Growth Rating: ★★★★☆☆

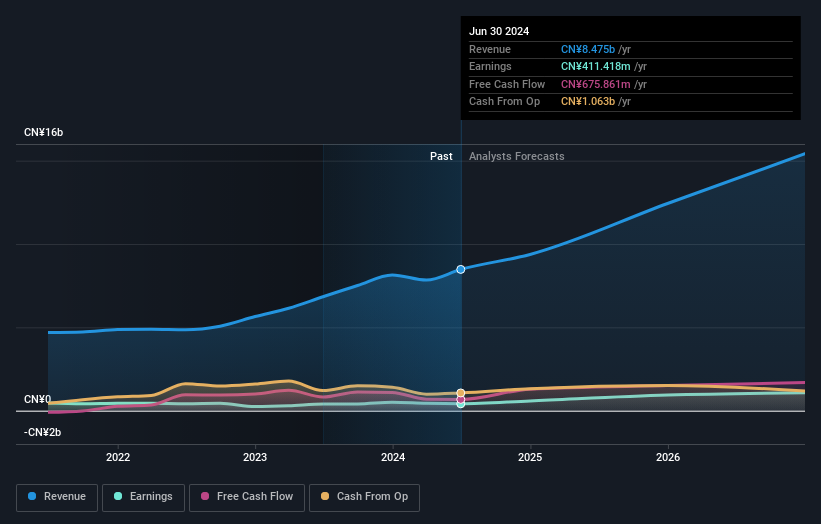

Overview: Kehua Data Co., Ltd. offers integrated solutions for power protection and energy conservation globally, with a market cap of CN¥10.70 billion.

Operations: Revenue segments for Kehua Data include integrated solutions for power protection and energy conservation.

Insider Ownership: 21.5%

Revenue Growth Forecast: 18.7% p.a.

Kehua Data's earnings are projected to grow significantly at 42% annually, surpassing the CN market. However, recent financial results show a decline in net income from CNY 445.19 million to CNY 238.07 million over nine months, with profit margins decreasing from 5.4% to 3.7%. Despite trading at a substantial discount of 44.1% below its estimated fair value, return on equity is forecasted low at 12.8%, and insider trading activity remains unchanged recently.

- Click here to discover the nuances of Kehua Data with our detailed analytical future growth report.

- Our valuation report here indicates Kehua Data may be overvalued.

Where To Now?

- Discover the full array of 1511 Fast Growing Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kehua Data might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002335

Kehua Data

Provides integrated solutions for power protection and energy conservation worldwide.

Flawless balance sheet with reasonable growth potential.