As global markets experience mixed performances, with major U.S. stock indexes reaching record highs while others like the Russell 2000 see declines, investors are keenly observing economic indicators such as job growth and potential Federal Reserve rate cuts. In this dynamic environment, dividend stocks can offer a reliable income stream; their appeal is often enhanced by stable yields even when market volatility presents challenges.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.33% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1932 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Goldcard Smart Group (SZSE:300349)

Simply Wall St Dividend Rating: ★★★★☆☆

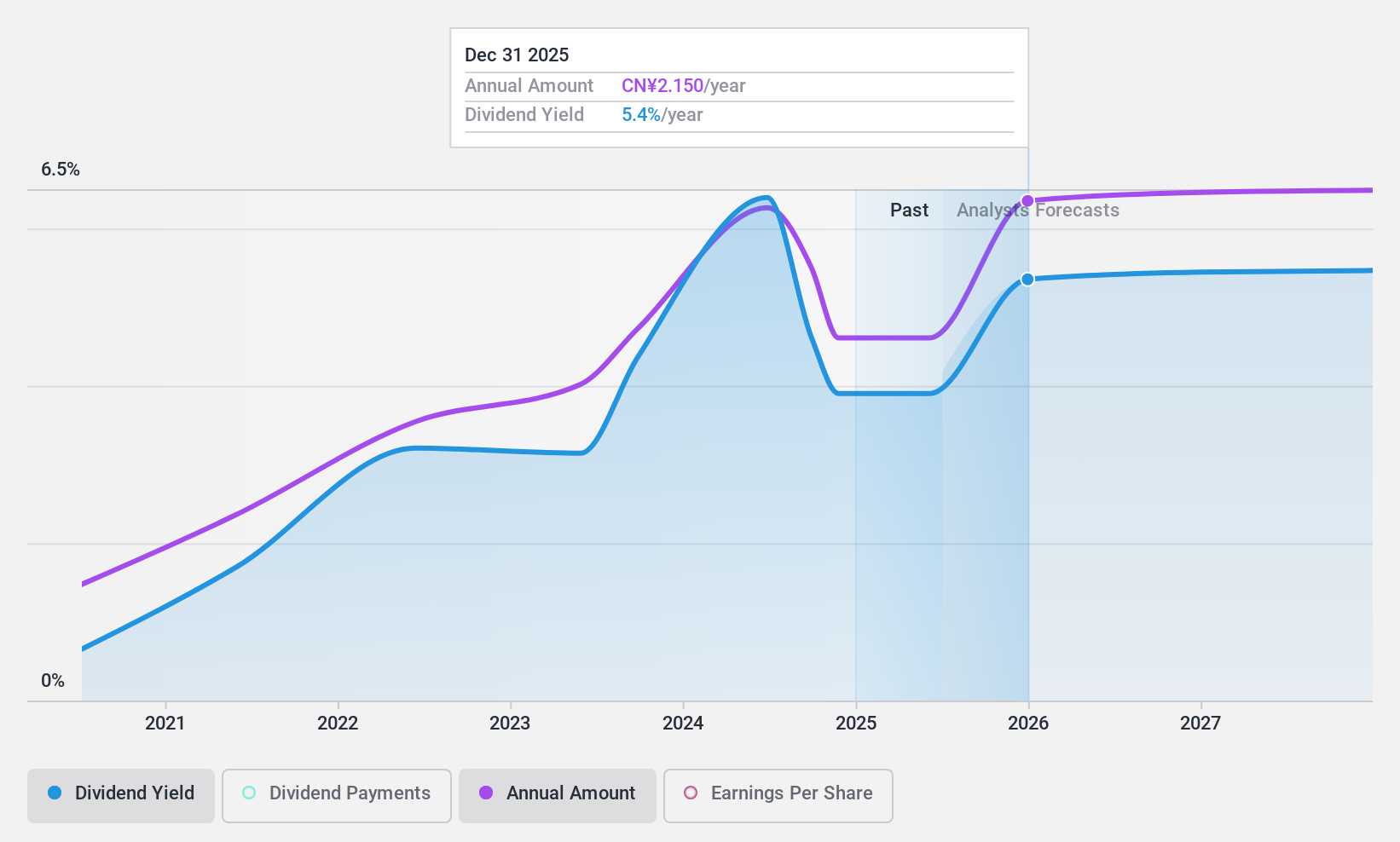

Overview: Goldcard Smart Group Co., Ltd. is a utility digitalization solution provider specializing in smart gas, smart water, and hydrogen metering in China with a market cap of CN¥5.78 billion.

Operations: Goldcard Smart Group Co., Ltd. generates revenue through its operations in smart gas, smart water, and hydrogen metering solutions within China.

Dividend Yield: 3.5%

Goldcard Smart Group's dividend yield of 3.46% places it among the top dividend payers in the CN market, yet its sustainability is questionable due to lack of free cash flow coverage. Despite a low payout ratio of 50%, dividends have been volatile and unreliable over the past decade, with recent shareholder dilution adding concern. The company trades at a favorable P/E ratio of 14.7x against the market average, indicating potential value despite revenue stagnation at CNY 2.23 billion for nine months ending September 2024.

- Click to explore a detailed breakdown of our findings in Goldcard Smart Group's dividend report.

- According our valuation report, there's an indication that Goldcard Smart Group's share price might be on the cheaper side.

Guangdong South New MediaLtd (SZSE:300770)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guangdong Southern New Media Co., Ltd. operates in China, offering IPTV, internet audio-visual, and content copyright services with a market cap of CN¥9.94 billion.

Operations: Guangdong Southern New Media Co., Ltd. generates revenue from its Information Dissemination Industry segment, amounting to CN¥1.57 billion.

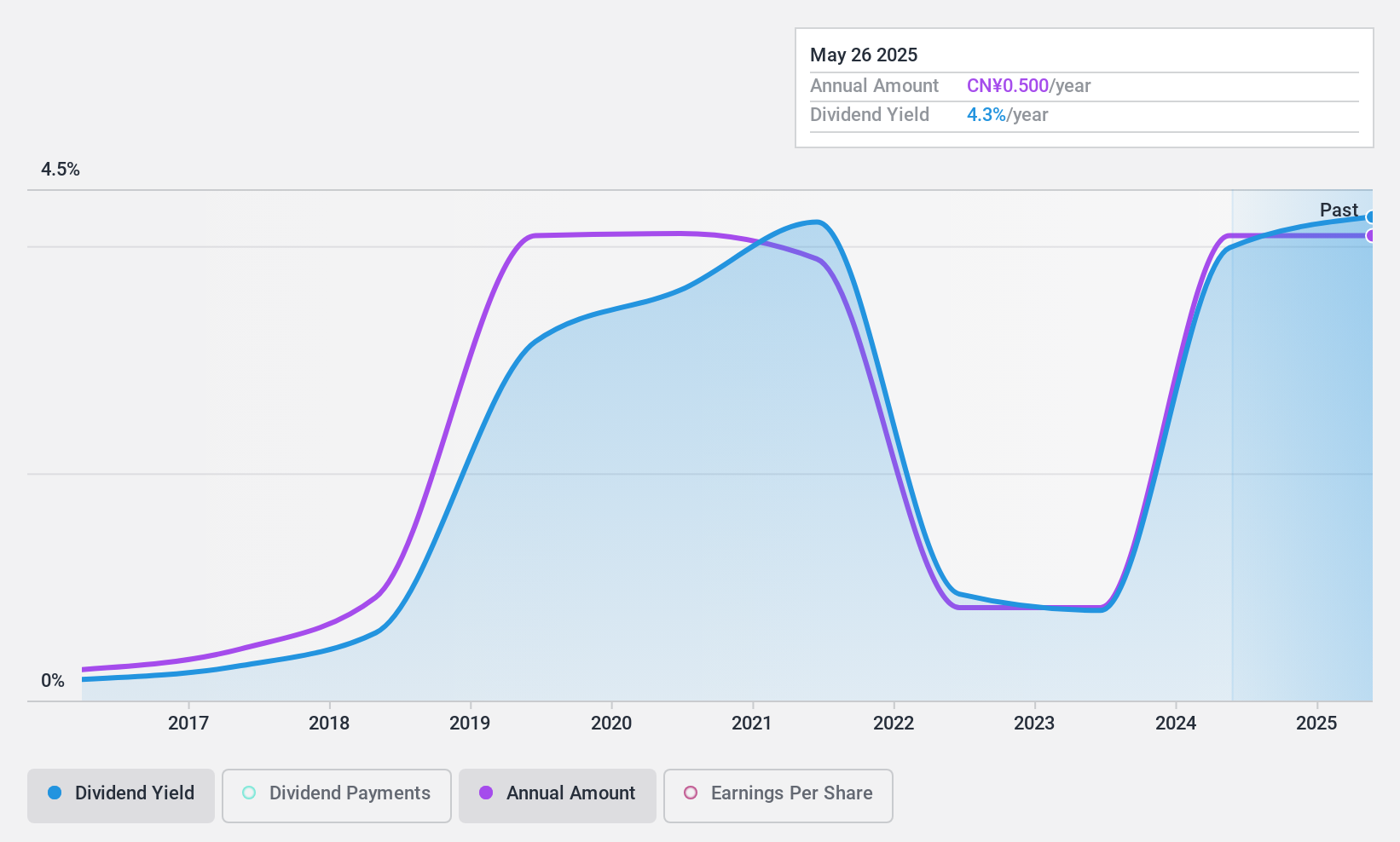

Dividend Yield: 4.3%

Guangdong South New Media's dividend yield of 4.26% ranks it in the top 25% of CN market payers, though its reliability is challenged by volatility over the past five years. Despite this, dividends are well covered by earnings (66.9%) and cash flows (49%). The company announced a special dividend for November 2024, enhancing shareholder returns. Trading at a P/E ratio of 15.7x below the market average suggests good relative value despite fluctuating earnings performance.

- Take a closer look at Guangdong South New MediaLtd's potential here in our dividend report.

- The analysis detailed in our Guangdong South New MediaLtd valuation report hints at an deflated share price compared to its estimated value.

Itoki (TSE:7972)

Simply Wall St Dividend Rating: ★★★★☆☆

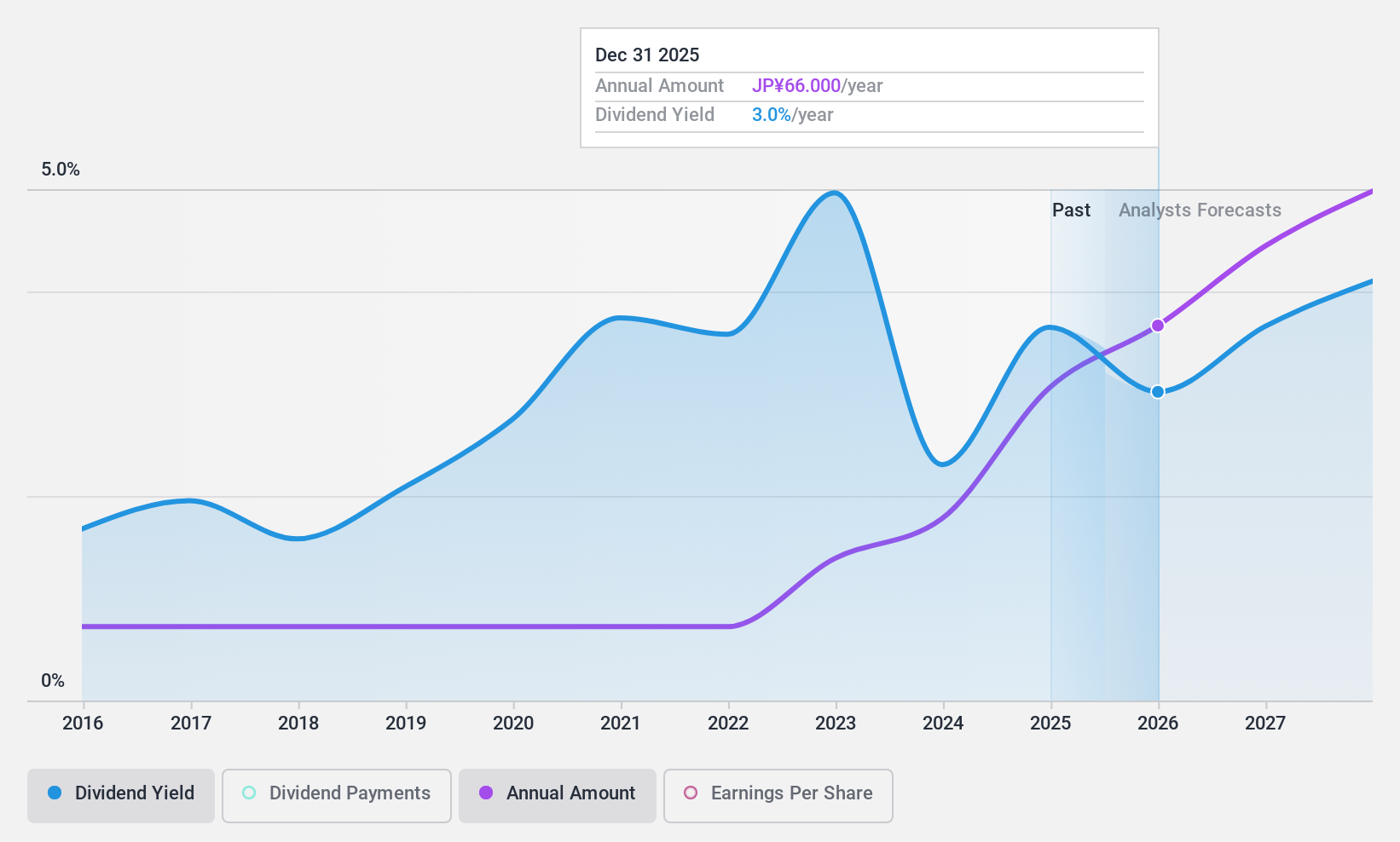

Overview: Itoki Corporation manufactures and sells office and equipment-related products and services both in Japan and internationally, with a market cap of ¥79.46 billion.

Operations: Itoki Corporation's revenue is primarily derived from its Workplace Business, which accounts for ¥100.51 billion, and its Equipment and Public Works-Related Business, contributing ¥36.10 billion.

Dividend Yield: 3.4%

Itoki's dividend payments have been stable and growing over the past decade, though current dividends are not well covered by free cash flows. The company is trading at a significant discount to its estimated fair value, suggesting good relative value. Despite recent shareholder dilution, Itoki forecasts strong earnings growth and has increased its dividend guidance for 2024 to ¥55 per share from ¥42 last year, indicating commitment to returning value to shareholders.

- Get an in-depth perspective on Itoki's performance by reading our dividend report here.

- Our valuation report here indicates Itoki may be undervalued.

Summing It All Up

- Gain an insight into the universe of 1932 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300770

Guangdong South New MediaLtd

Guangdong Southern New Media Co.,Ltd. provides IPTV, internet audio-visual, and content copyright services in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives