- China

- /

- Electronic Equipment and Components

- /

- SHSE:688183

High Growth Tech Stocks in Asia Including Shengyi Electronics

Reviewed by Simply Wall St

Amid easing trade tensions and a mixed economic backdrop, Asian markets have shown resilience, with key indices reflecting cautious optimism as they navigate global uncertainties. In this environment, high growth tech stocks in Asia, such as Shengyi Electronics, are drawing attention for their potential to leverage technological advancements and strategic market positioning to thrive despite broader market volatility.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.85% | 28.85% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 31.40% | 31.62% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Shengyi Electronics (SHSE:688183)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shengyi Electronics Co., Ltd. focuses on the research, development, production, and sales of printed circuit boards in China with a market capitalization of CN¥20.97 billion.

Operations: Shengyi Electronics Co., Ltd. specializes in producing various printed circuit boards, with a focus on research and development to enhance its offerings. The company operates primarily within China, contributing to its market capitalization of CN¥20.97 billion.

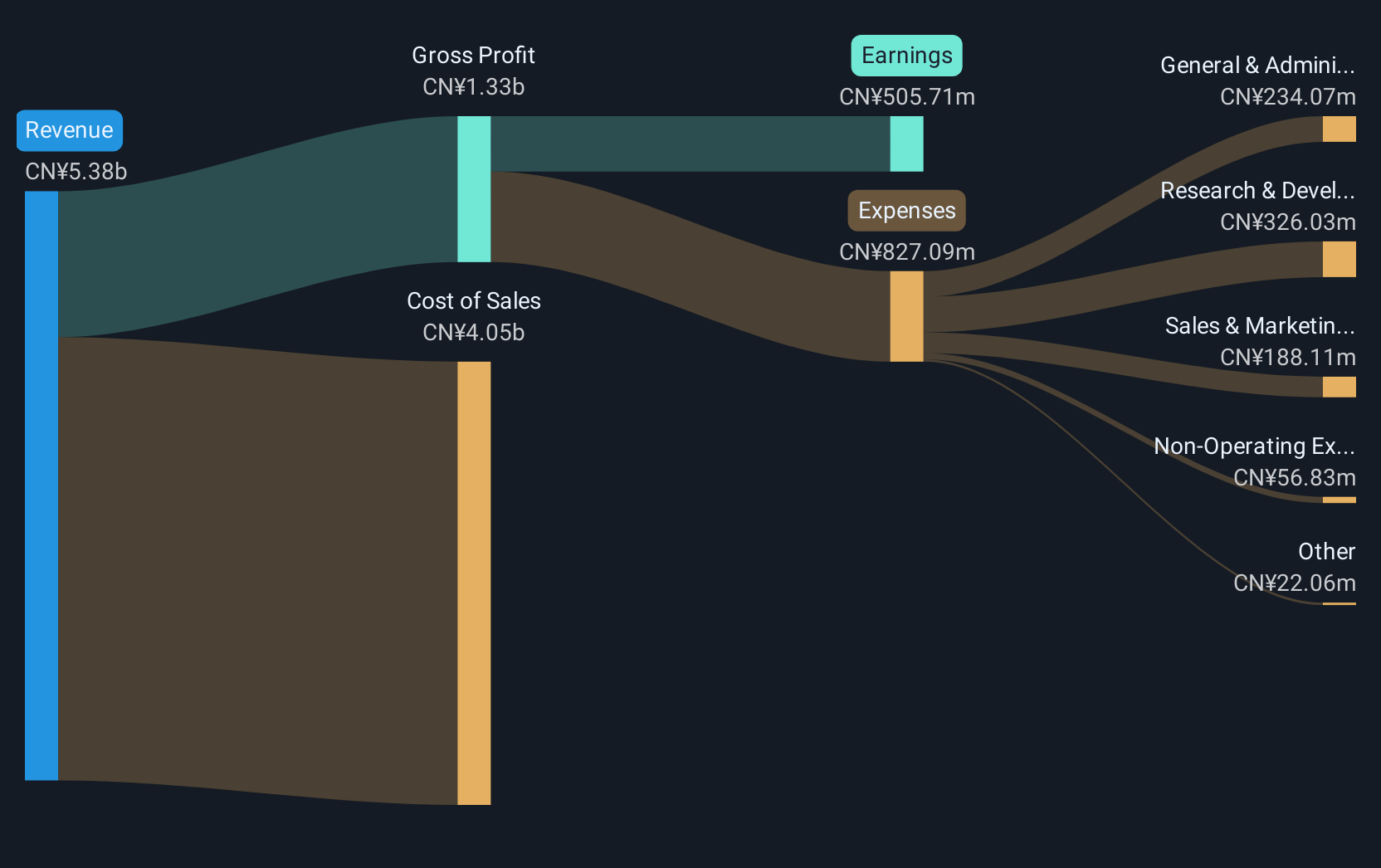

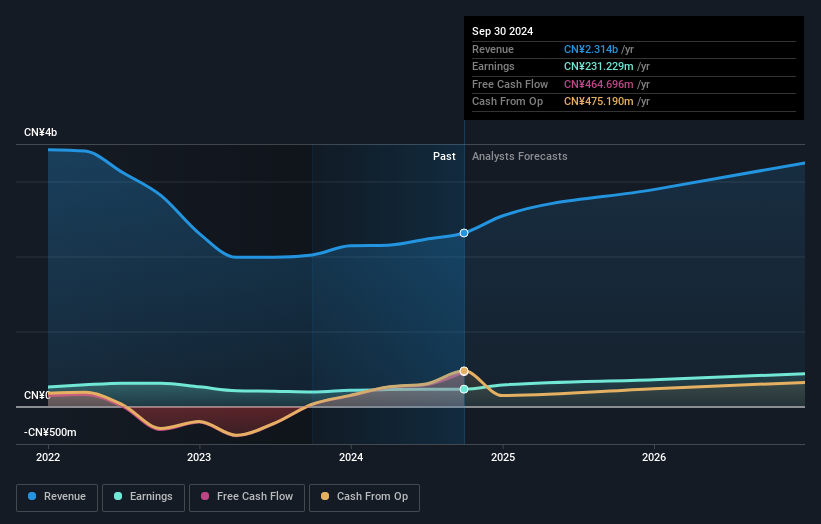

Shengyi Electronics has demonstrated a robust turnaround, transitioning from a net loss to reporting substantial profits with earnings per share shifting from a CNY 0.03 loss to CNY 0.4 gain year-over-year. This shift is underpinned by a significant revenue jump from CNY 3.27 billion to CNY 4.69 billion, marking an increase of approximately 43%. The company's inclusion in the FTSE All-World Index underscores its growing influence and recognition in the global market. Looking ahead, Shengyi is poised for continued growth with projected annual earnings increases of 40%, significantly outpacing the broader Chinese market's forecast of 23.6%. Despite its highly volatile share price recently, these financial indicators combined with an expected high return on equity of 28.3% in three years suggest strong future prospects if it maintains this trajectory.

- Click here to discover the nuances of Shengyi Electronics with our detailed analytical health report.

Explore historical data to track Shengyi Electronics' performance over time in our Past section.

Lens Technology (SZSE:300433)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lens Technology Co., Ltd. specializes in producing and selling electronic components in China, with a market cap of CN¥103.54 billion.

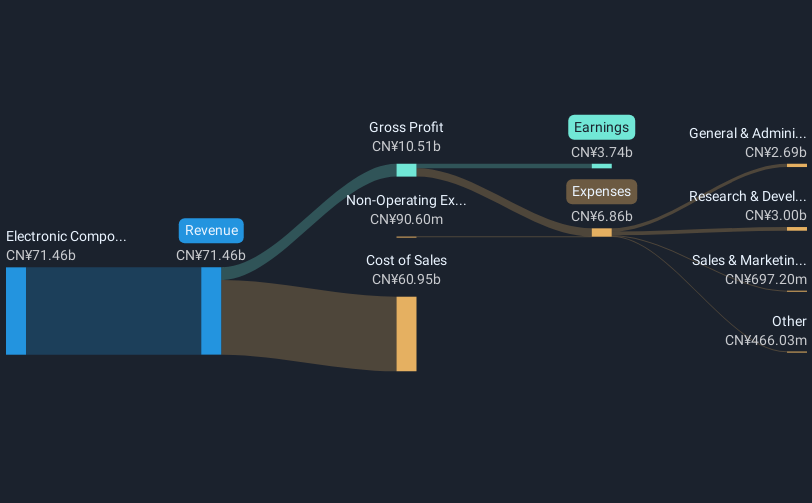

Operations: The company generates revenue primarily from electronic component manufacturing, amounting to CN¥71.46 billion.

Lens Technology has demonstrated robust financial performance, with a notable increase in quarterly sales from CNY 15.5 billion to CNY 17.1 billion and a rise in net income from CNY 309.2 million to CNY 428.88 million year-over-year. This growth is complemented by a strategic share repurchase program valued at up to CNY 1 billion, aimed at bolstering shareholder value through an equity incentive plan. The company's commitment to innovation and shareholder returns is evident in its recent approval of a generous dividend of CNY 4 per ten shares, reflecting confidence in its financial health and future prospects.

Easy Click Worldwide Network Technology (SZSE:301171)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Easy Click Worldwide Network Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥12.67 billion.

Operations: Easy Click Worldwide Network Technology focuses on the technology sector, leveraging various revenue streams within this industry. The company has a market capitalization of CN¥12.67 billion, reflecting its scale and reach in the market.

Easy Click Worldwide Network Technology has shown promising growth, with first-quarter sales doubling from CNY 480.95 million to CNY 929.12 million year-over-year, and net income increasing to CNY 55.94 million from CNY 50.09 million. This performance is part of a broader trend where the company’s earnings are expected to grow by an annual rate of 27.8%, outpacing the Chinese market forecast of 23.6%. Additionally, its revenue growth projection stands at an impressive 15.2% annually, surpassing the national average of 12.6%. These figures suggest that Easy Click is not only expanding its financial footprint but also solidifying its position in a competitive tech landscape through strategic innovations and market responsiveness.

- Take a closer look at Easy Click Worldwide Network Technology's potential here in our health report.

Key Takeaways

- Click this link to deep-dive into the 480 companies within our Asian High Growth Tech and AI Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688183

Shengyi Electronics

Engages in the research and development, production, and sales of various printed circuit boards in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives