- China

- /

- Electronic Equipment and Components

- /

- SHSE:688071

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets continue to respond positively to the Trump administration's emerging policies, with major indices like the S&P 500 reaching record highs amid AI enthusiasm and a potential easing of trade tensions, investors are keenly observing how these developments might impact small-cap tech stocks. In this environment, identifying high-growth tech stocks involves looking for companies that can leverage AI advancements and navigate shifting trade dynamics effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1224 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. focuses on the R&D, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market cap of CN¥22.30 billion.

Operations: Raytron Technology Co., Ltd. specializes in developing and producing uncooled infrared imaging and MEMS sensor technologies. The company generates revenue primarily through the sale of these advanced sensor products, catering to various industrial applications within China.

Raytron TechnologyLtd. demonstrates robust growth dynamics, with earnings surging by 29.1% annually, outpacing the broader Chinese market's 25% expansion. This performance is anchored in a significant R&D commitment, which has been strategically aligned to foster innovation and maintain competitive advantage; last year alone, R&D expenses were substantial, underscoring the firm's dedication to technological advancement. Recent activities include a notable share repurchase program where Raytron bought back 320,600 shares for CNY 15.58 million in the last quarter of 2024, reflecting confidence in its financial health and future prospects. Moreover, its recent special shareholders meeting suggests active engagement and strategic planning at high corporate levels—essential for sustaining growth trajectories in the fast-evolving tech landscape.

Shanghai W-Ibeda High Tech.GroupLtd (SHSE:688071)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai W-Ibeda High Tech.Group Co.,Ltd. is a company focused on the development and production of high-tech automotive components, with a market capitalization of CN¥2.71 billion.

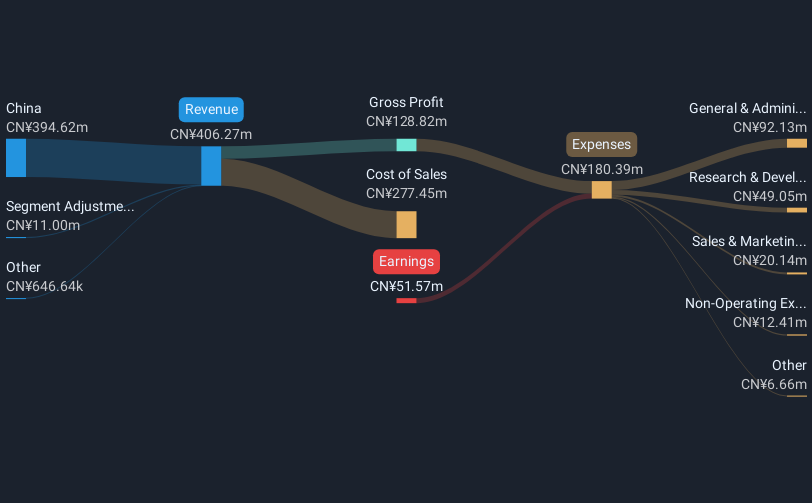

Operations: Shanghai W-Ibeda High Tech.Group Co.,Ltd. generates revenue primarily from its Auto Parts & Accessories segment, contributing CN¥406.27 million to its financial performance.

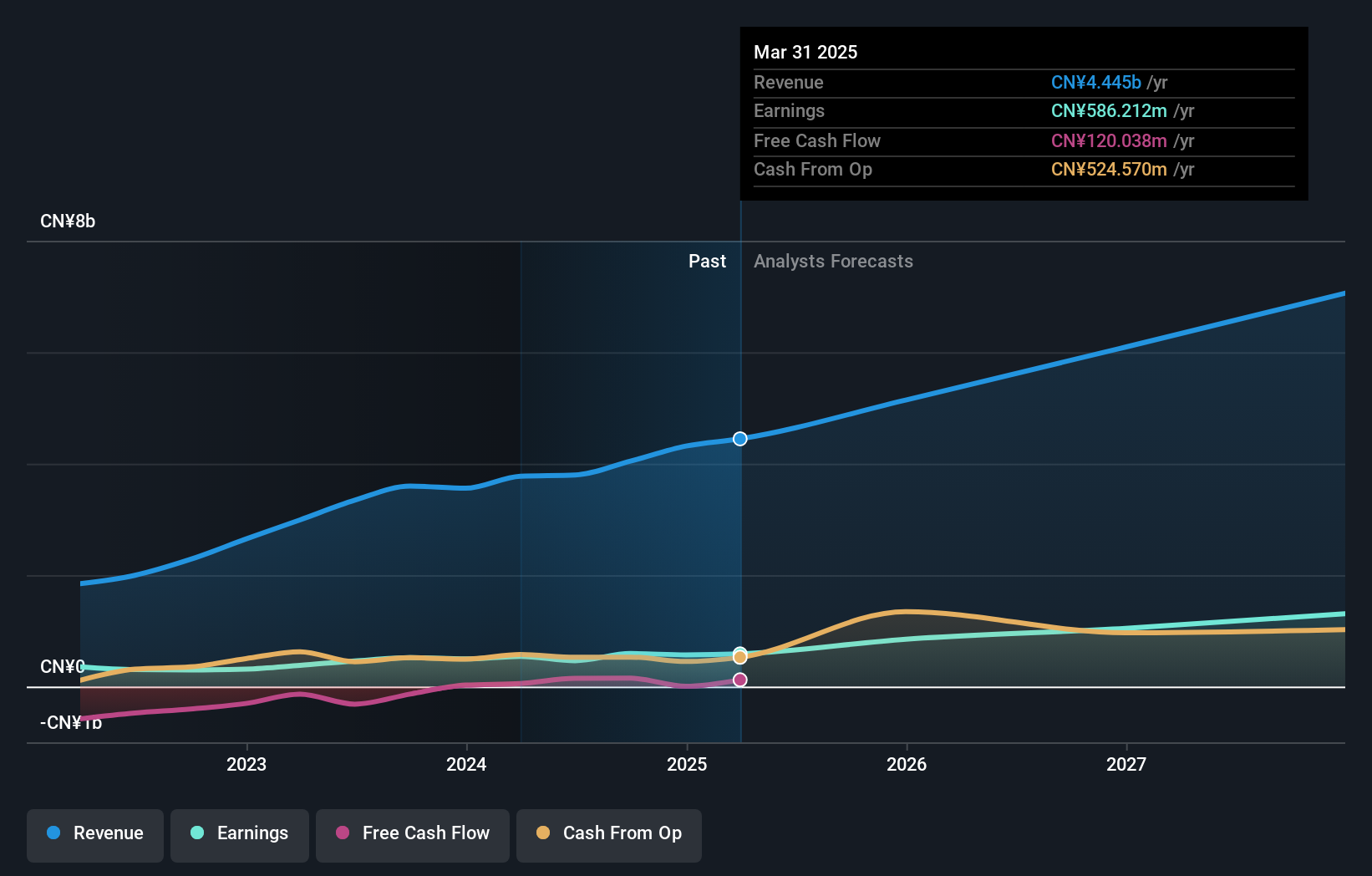

Shanghai W-Ibeda High Tech.GroupLtd. is navigating the competitive tech landscape with a projected annual revenue growth of 37%, significantly outpacing the Chinese market's average of 13.3%. Despite current unprofitability, earnings are expected to soar by an impressive 179.25% annually, hinting at a robust turnaround strategy. The company's commitment to innovation is evident in its R&D expenditures, crucial for sustaining long-term growth in its sector. However, financial stability remains a concern as debt is not adequately covered by operating cash flow, reflecting potential risks amidst these high growth projections.

- Click here and access our complete health analysis report to understand the dynamics of Shanghai W-Ibeda High Tech.GroupLtd.

Learn about Shanghai W-Ibeda High Tech.GroupLtd's historical performance.

Hualan Biological Vaccine (SZSE:301207)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hualan Biological Vaccine Inc. focuses on the research, development, production, and sale of vaccines in China with a market cap of CN¥10.14 billion.

Operations: The company generates revenue primarily through the sale of vaccines developed in-house, leveraging its expertise in research and production. Its business model is centered around advancing vaccine technology to meet healthcare needs within China.

With an annual revenue growth forecast at 28%, Hualan Biological Vaccine outstrips the broader Chinese market's average of 13.3%. This robust expansion is complemented by a projected earnings increase of 33.3% per year, positioning the company well within the high-growth trajectory in biotechnology. Investment in R&D is aggressive, ensuring sustained innovation and market relevance, with expenditures significantly contributing to its strategic positioning against competitors. However, despite these promising growth metrics, challenges persist due to negative earnings growth over the past year compared to a modest industry average increase of 1.3%. Looking ahead, while Hualan faces hurdles, its strong focus on R&D and revenue acceleration may bolster its standing in the evolving vaccine sector.

- Dive into the specifics of Hualan Biological Vaccine here with our thorough health report.

Understand Hualan Biological Vaccine's track record by examining our Past report.

Key Takeaways

- Access the full spectrum of 1224 High Growth Tech and AI Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688071

Shanghai W-Ibeda High Tech.GroupLtd

Shanghai W-Ibeda High Tech.Group Co.,Ltd.

High growth potential with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)