- China

- /

- Electronic Equipment and Components

- /

- SHSE:688055

Here's Why InfoVision Optoelectronics (Kunshan) (SHSE:688055) Can Afford Some Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that InfoVision Optoelectronics (Kunshan) Co., Ltd. (SHSE:688055) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for InfoVision Optoelectronics (Kunshan)

What Is InfoVision Optoelectronics (Kunshan)'s Debt?

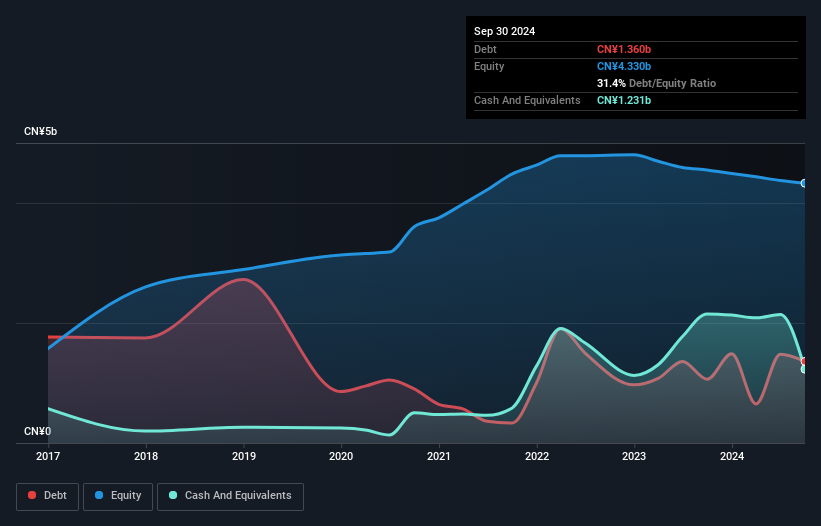

As you can see below, at the end of September 2024, InfoVision Optoelectronics (Kunshan) had CN¥1.36b of debt, up from CN¥1.06b a year ago. Click the image for more detail. However, it does have CN¥1.23b in cash offsetting this, leading to net debt of about CN¥129.9m.

A Look At InfoVision Optoelectronics (Kunshan)'s Liabilities

The latest balance sheet data shows that InfoVision Optoelectronics (Kunshan) had liabilities of CN¥2.35b due within a year, and liabilities of CN¥422.1m falling due after that. On the other hand, it had cash of CN¥1.23b and CN¥504.0m worth of receivables due within a year. So it has liabilities totalling CN¥1.04b more than its cash and near-term receivables, combined.

Of course, InfoVision Optoelectronics (Kunshan) has a market capitalization of CN¥15.1b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Carrying virtually no net debt, InfoVision Optoelectronics (Kunshan) has a very light debt load indeed. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since InfoVision Optoelectronics (Kunshan) will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year InfoVision Optoelectronics (Kunshan)'s revenue was pretty flat, and it made a negative EBIT. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Importantly, InfoVision Optoelectronics (Kunshan) had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at CN¥368m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. For example, we would not want to see a repeat of last year's loss of CN¥211m. So to be blunt we do think it is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for InfoVision Optoelectronics (Kunshan) (1 doesn't sit too well with us) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688055

InfoVision Optoelectronics (Kunshan)

InfoVision Optoelectronics (Kunshan) Co., Ltd.

Mediocre balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)