- China

- /

- Tech Hardware

- /

- SZSE:002993

Asian Growth Companies With High Insider Ownership In April 2025

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets are experiencing a cautiously optimistic environment, with expectations for further stimulus measures in key economies like China providing a supportive backdrop. In this context, growth companies with high insider ownership can be particularly appealing to investors, as they often indicate strong confidence from those closest to the business and can offer resilience amid economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| AcrelLtd (SZSE:300286) | 34.2% | 34.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| M31 Technology (TPEX:6643) | 27.2% | 69.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| BIWIN Storage Technology (SHSE:688525) | 17.7% | 59.6% |

| giftee (TSE:4449) | 34.5% | 67.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Let's dive into some prime choices out of the screener.

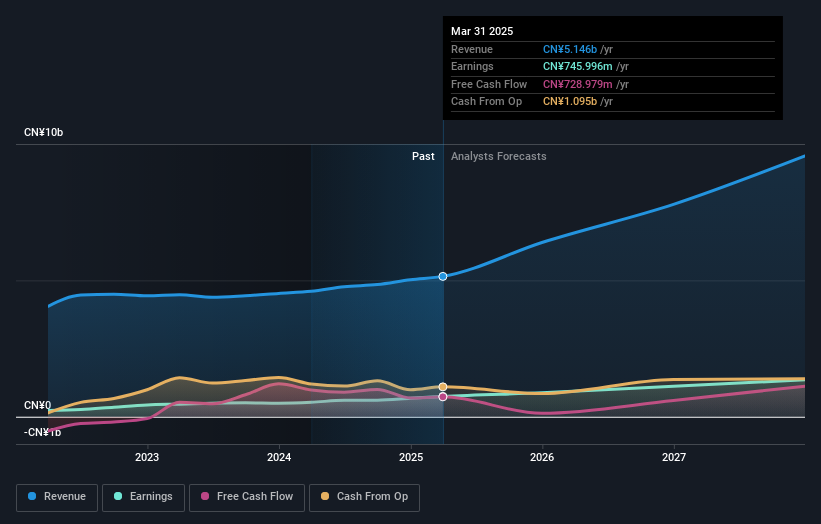

Olympic Circuit Technology (SHSE:603920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Olympic Circuit Technology Co., Ltd focuses on the manufacturing and sale of rigid PCBs and has a market cap of CN¥18.48 billion.

Operations: Olympic Circuit Technology Co., Ltd generates revenue primarily through the production and distribution of rigid printed circuit boards (PCBs).

Insider Ownership: 20.1%

Earnings Growth Forecast: 21.7% p.a.

Olympic Circuit Technology has demonstrated strong growth, with recent earnings showing a net income increase to CNY 179.84 million for Q1 2025 from CNY 108.59 million the previous year. The company's revenue is forecast to grow at 21.8% annually, outpacing the broader Chinese market's growth rate of 12.6%. Despite high volatility in its share price, it trades below estimated fair value and shows significant annual earnings growth potential of over 20%, though insider trading activity remains limited recently.

- Take a closer look at Olympic Circuit Technology's potential here in our earnings growth report.

- Our valuation report here indicates Olympic Circuit Technology may be undervalued.

Baowu Magnesium Technology (SZSE:002182)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Baowu Magnesium Technology Co., Ltd. is involved in mining and non-ferrous metal smelting and processing both in China and internationally, with a market cap of CN¥12.14 billion.

Operations: Baowu Magnesium Technology Co., Ltd. generates revenue through its operations in mining and the smelting and processing of non-ferrous metals across domestic and international markets.

Insider Ownership: 17%

Earnings Growth Forecast: 82.4% p.a.

Baowu Magnesium Technology's recent earnings report shows a decline in net income to CNY 28.18 million for Q1 2025 from CNY 60.72 million the previous year, despite revenue growth to CNY 2.03 billion. The company faces challenges with low profit margins and debt coverage but is projected to experience significant annual earnings growth of over 20%, surpassing the broader Chinese market's expectations, while maintaining limited recent insider trading activity.

- Dive into the specifics of Baowu Magnesium Technology here with our thorough growth forecast report.

- Our valuation report here indicates Baowu Magnesium Technology may be overvalued.

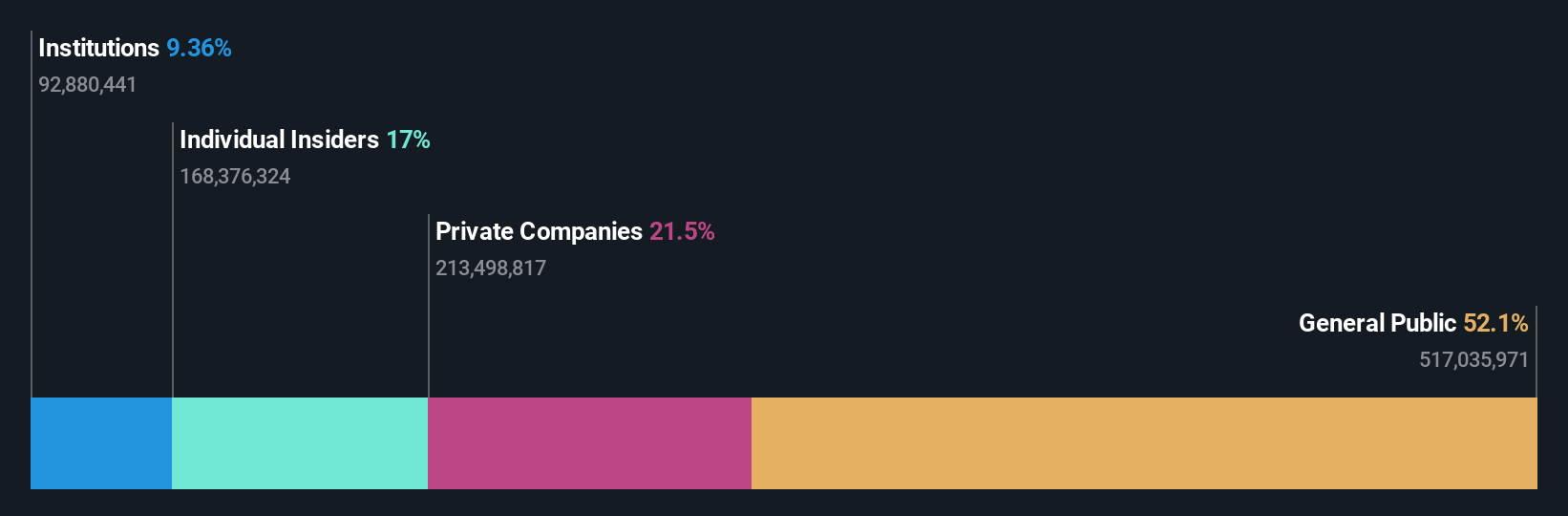

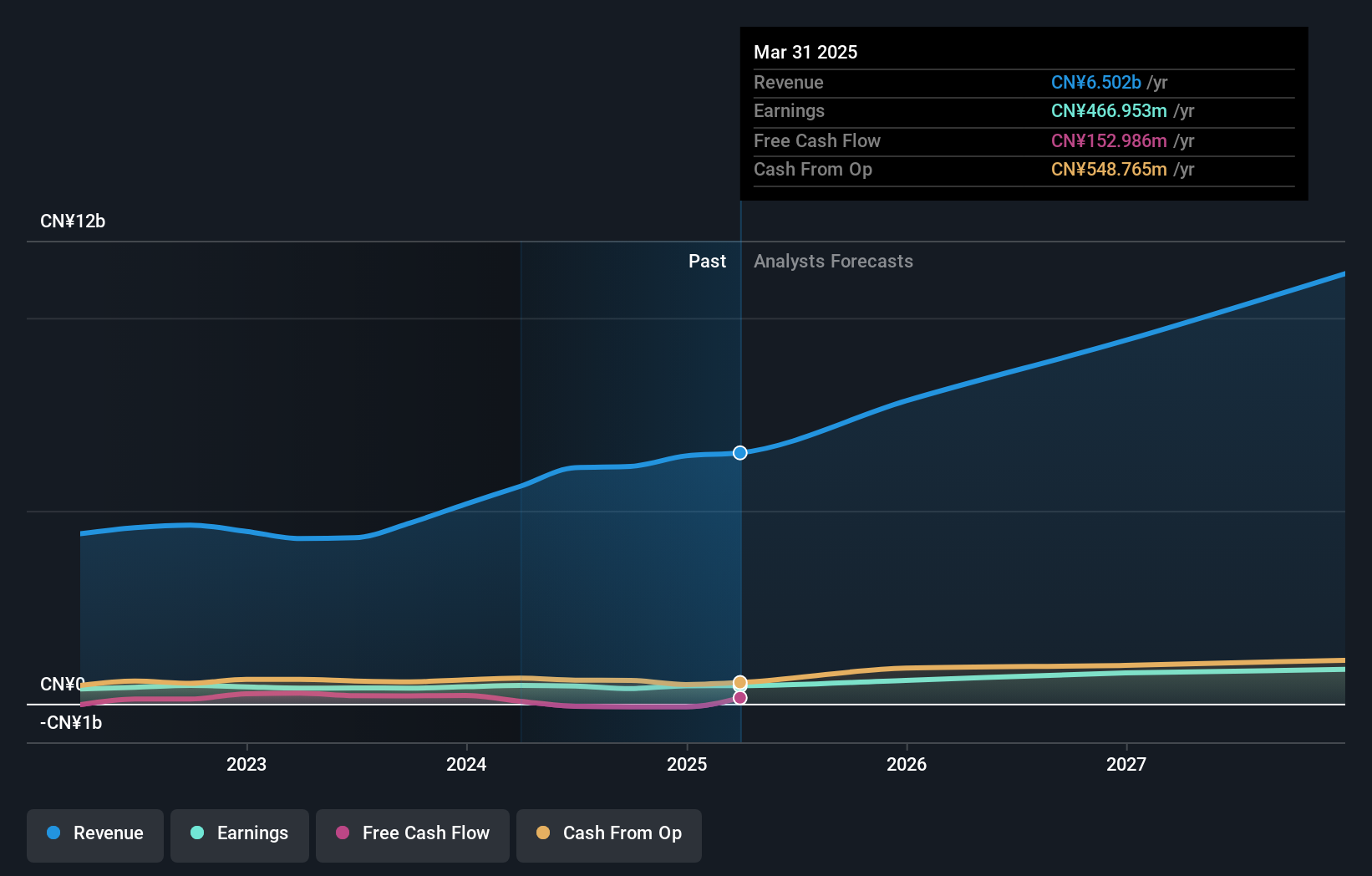

Dongguan Aohai Technology (SZSE:002993)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dongguan Aohai Technology Co., Ltd. researches, develops, produces, and sells consumer electronics products both in China and internationally with a market cap of CN¥9.77 billion.

Operations: The company generates revenue of CN¥6.50 billion from its Computer, Communications, and Other Electronic Equipment Manufacturing segment.

Insider Ownership: 18.3%

Earnings Growth Forecast: 31.3% p.a.

Dongguan Aohai Technology's earnings are projected to grow significantly, outpacing the Chinese market with a forecasted annual profit growth of 31.3%. The company trades at a favorable price-to-earnings ratio of 20.9x compared to the market average, indicating good relative value. Recent initiatives include a share buyback program worth up to CNY 80 million and an increased dividend proposal, reflecting strong insider confidence despite recent share price volatility.

- Get an in-depth perspective on Dongguan Aohai Technology's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Dongguan Aohai Technology is trading behind its estimated value.

Turning Ideas Into Actions

- Delve into our full catalog of 620 Fast Growing Asian Companies With High Insider Ownership here.

- Looking For Alternative Opportunities? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Dongguan Aohai Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002993

Dongguan Aohai Technology

Research, develops, produces, and sells consumer electronics products in China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives