- China

- /

- Communications

- /

- SHSE:603496

Why We're Not Concerned About EmbedWay Technologies (Shanghai) Corporation's (SHSE:603496) Share Price

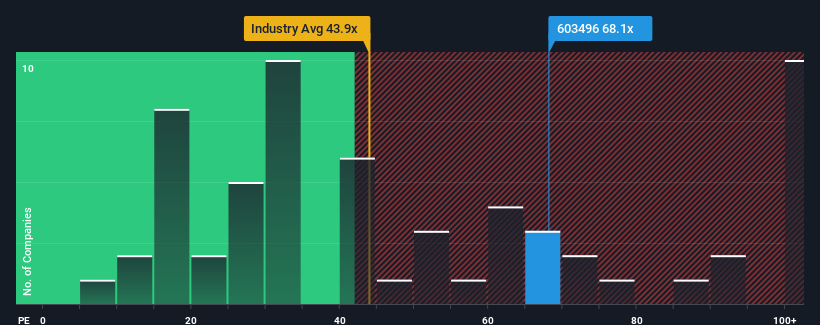

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 27x, you may consider EmbedWay Technologies (Shanghai) Corporation (SHSE:603496) as a stock to avoid entirely with its 68.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for EmbedWay Technologies (Shanghai) as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for EmbedWay Technologies (Shanghai)

Is There Enough Growth For EmbedWay Technologies (Shanghai)?

There's an inherent assumption that a company should far outperform the market for P/E ratios like EmbedWay Technologies (Shanghai)'s to be considered reasonable.

Retrospectively, the last year delivered an exceptional 25% gain to the company's bottom line. The latest three year period has also seen an excellent 112% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 35% per year as estimated by the dual analysts watching the company. With the market only predicted to deliver 24% per year, the company is positioned for a stronger earnings result.

With this information, we can see why EmbedWay Technologies (Shanghai) is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On EmbedWay Technologies (Shanghai)'s P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that EmbedWay Technologies (Shanghai) maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for EmbedWay Technologies (Shanghai) with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on EmbedWay Technologies (Shanghai), explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EmbedWay Technologies (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603496

EmbedWay Technologies (Shanghai)

Engages in the provision of network visibility, intelligent system platforms, and intelligent computing solutions and services in China.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)