- China

- /

- Electronic Equipment and Components

- /

- SHSE:603375

Concerns Surrounding Wuxi Holyview MicroelectronicsLtd's (SHSE:603375) Performance

Wuxi Holyview Microelectronics Co.,Ltd.'s (SHSE:603375) robust recent earnings didn't do much to move the stock. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

View our latest analysis for Wuxi Holyview MicroelectronicsLtd

Examining Cashflow Against Wuxi Holyview MicroelectronicsLtd's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

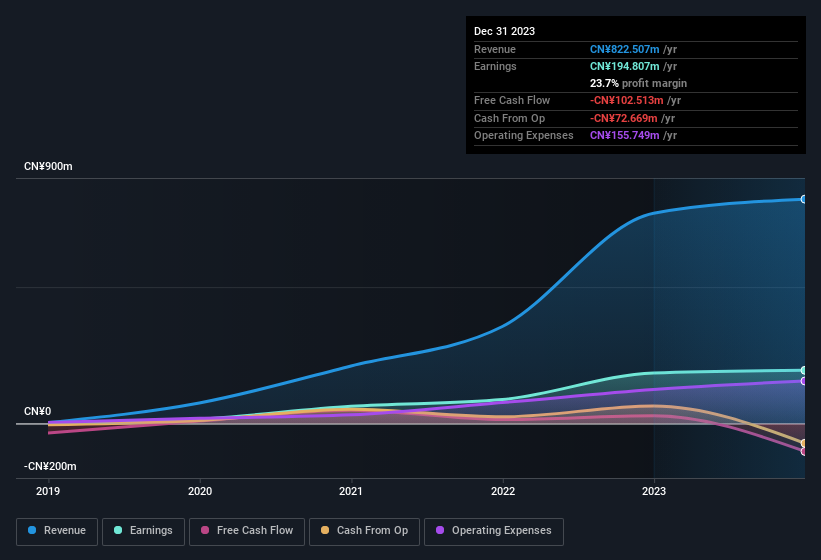

Wuxi Holyview MicroelectronicsLtd has an accrual ratio of 0.60 for the year to December 2023. As a general rule, that bodes poorly for future profitability. And indeed, during the period the company didn't produce any free cash flow whatsoever. Over the last year it actually had negative free cash flow of CN¥103m, in contrast to the aforementioned profit of CN¥194.8m. It's worth noting that Wuxi Holyview MicroelectronicsLtd generated positive FCF of CN¥28m a year ago, so at least they've done it in the past.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Wuxi Holyview MicroelectronicsLtd.

Our Take On Wuxi Holyview MicroelectronicsLtd's Profit Performance

As we have made quite clear, we're a bit worried that Wuxi Holyview MicroelectronicsLtd didn't back up the last year's profit with free cashflow. For this reason, we think that Wuxi Holyview MicroelectronicsLtd's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the good news is that its EPS growth over the last three years has been very impressive. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Our analysis shows 3 warning signs for Wuxi Holyview MicroelectronicsLtd (1 doesn't sit too well with us!) and we strongly recommend you look at these before investing.

Today we've zoomed in on a single data point to better understand the nature of Wuxi Holyview MicroelectronicsLtd's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Holyview MicroelectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603375

Wuxi Holyview MicroelectronicsLtd

Provides integrated electronic detonator solutions in China.

Excellent balance sheet unattractive dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026