- China

- /

- Electronic Equipment and Components

- /

- SHSE:603267

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate a complex economic landscape, U.S. stock indexes are climbing toward record highs, with the Nasdaq Composite leading the charge and growth stocks outperforming value shares. Despite small-cap stocks lagging behind larger indices like the S&P 500, investors remain optimistic about high-growth tech opportunities amid ongoing inflationary pressures and shifting trade policies. In this environment, identifying promising tech stocks involves focusing on companies demonstrating resilience and innovation in adapting to evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 25.35% | 25.09% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1205 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

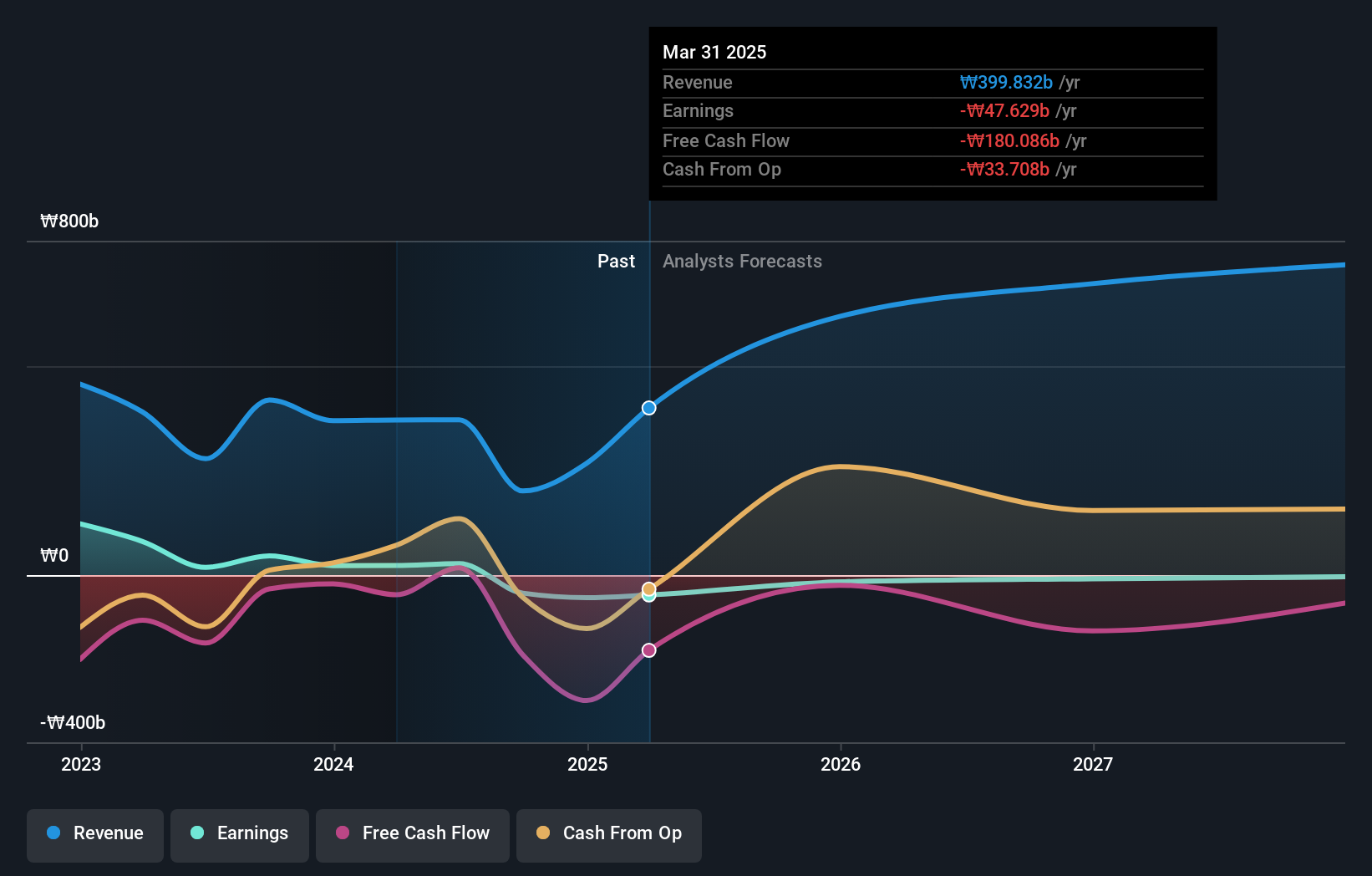

SK bioscienceLtd (KOSE:A302440)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SK bioscience Co., Ltd. is involved in the research, development, production, and distribution of vaccines and biopharmaceuticals both in Korea and internationally, with a market cap of ₩3.78 trillion.

Operations: SK bioscience generates revenue primarily from its pharmaceuticals segment, which amounts to ₩201.30 billion. The company's operations focus on the development and distribution of vaccines and biopharmaceuticals across both domestic and international markets.

SK bioscienceLtd is navigating the high-growth tech landscape with its innovative mRNA vaccine platform, which recently received approval for Phase 1/2 trials in Australia. This move aligns with global efforts like the 100 Days Mission to expedite vaccine development against pandemic threats. The company's strategic partnership with CEPI, backed by up to $140 million in funding, underscores its commitment to rapid response capabilities and equitable access. With projected annual revenue growth of 17.9% and anticipated profitability within three years, SK bioscienceLtd is poised to make significant strides in a market expected to reach around $58.90 billion by 2033, growing at a CAGR of 17.06%. This positions the firm well within the biotech sector’s evolving competitive landscape, focusing on addressing urgent global health challenges through advanced technology.

- Get an in-depth perspective on SK bioscienceLtd's performance by reading our health report here.

Examine SK bioscienceLtd's past performance report to understand how it has performed in the past.

Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. operates in the electronic technology sector and has a market cap of CN¥8.27 billion.

Operations: Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd. generates its revenue primarily from the electronic technology sector, with its market cap standing at CN¥8.27 billion.

Beijing Yuanliu Hongyuan Electronic Technology is making notable strides in the high-growth tech sector, with a forecasted annual revenue growth of 24%, significantly outpacing the Chinese market average of 13.3%. This growth is underpinned by robust R&D investments, which have been strategically allocated to foster innovations that keep them competitive. Despite a challenging past year where earnings dipped by 59.9%, the company's earnings are expected to rebound impressively, with an anticipated annual growth rate of 40.9%. This potential turnaround is supported by their commitment to enhancing product offerings and optimizing operational efficiencies, positioning them well for future market demands.

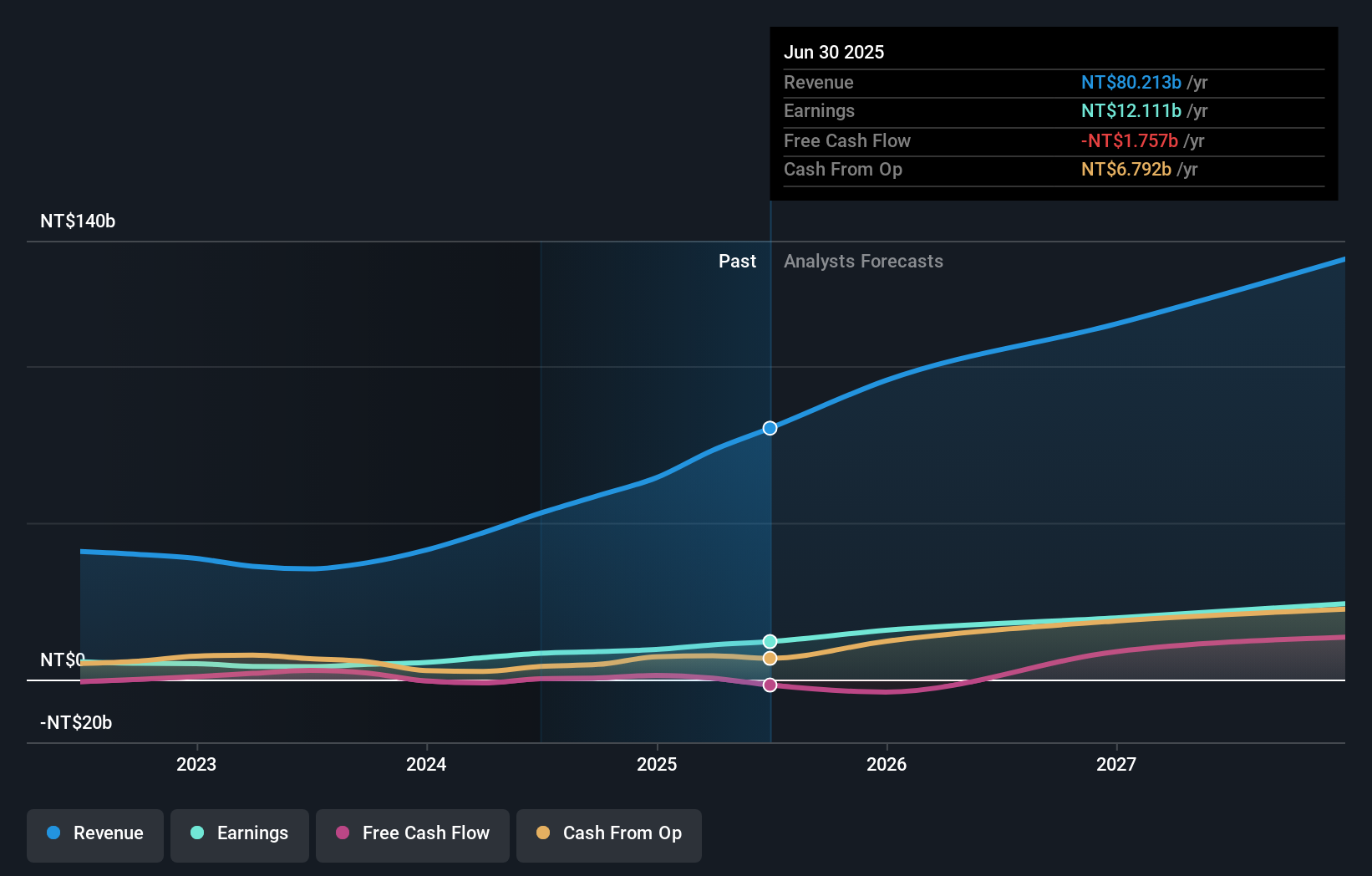

Elite Material (TWSE:2383)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Elite Material Co., Ltd. focuses on producing and selling copper clad laminates, electronic-industrial specialty chemicals and raw materials, and electronic components across Taiwan, China, and globally with a market cap of NT$205.06 billion.

Operations: The company generates revenue primarily from foreign departments, contributing NT$54.56 billion, while domestic operations add NT$14.61 billion. The focus is on copper clad laminates and electronic-industrial specialty chemicals and components, serving markets in Taiwan, China, and internationally.

Elite Material Co., Ltd. stands out in the tech sector with its robust R&D investments, which have significantly contributed to its competitive edge. The company's earnings growth of 83.4% over the past year outstrips the electronic industry's average of 7.8%, highlighting its effective strategy and execution despite a volatile share price recently. With an anticipated annual revenue growth rate of 15.4%, Elite Material is set to outperform the Taiwanese market average of 11.3%. This performance is supported by recent presentations at high-profile investment forums, signaling ongoing engagement with strategic investors and stakeholders in shaping future growth trajectories.

- Click here to discover the nuances of Elite Material with our detailed analytical health report.

Assess Elite Material's past performance with our detailed historical performance reports.

Where To Now?

- Dive into all 1205 of the High Growth Tech and AI Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Yuanliu Hongyuan Electronic Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603267

Beijing Yuanliu Hongyuan Electronic Technology

Beijing Yuanliu Hongyuan Electronic Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives