- China

- /

- Semiconductors

- /

- SHSE:688209

Discovering Asia's Undiscovered Gems in October 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by economic uncertainties and shifting monetary policies, Asian small-cap stocks are capturing attention for their potential resilience and growth. In this environment, identifying promising opportunities requires a keen eye for companies with strong fundamentals and the ability to adapt to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CYMECHS | 8.28% | -3.30% | -18.05% | ★★★★★★ |

| Namuga | 14.63% | -4.73% | 24.37% | ★★★★★★ |

| Anapass | 9.88% | 18.10% | 57.00% | ★★★★★★ |

| BIO-FD&CLtd | 0.15% | 2.82% | 18.20% | ★★★★★★ |

| Neosem | 1.52% | 22.22% | 22.14% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 34.33% | 7.40% | 2.05% | ★★★★★☆ |

| Messe eSangLtd | 0.21% | 35.18% | 96.55% | ★★★★★☆ |

| Chinyang Holdings | 31.14% | 7.30% | -20.39% | ★★★★★☆ |

| Daewon Cable | 23.95% | 7.90% | 48.06% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Viva Biotech Holdings (SEHK:1873)

Simply Wall St Value Rating: ★★★★★☆

Overview: Viva Biotech Holdings is an investment holding company that offers structure-based drug discovery services to biotechnology and pharmaceutical clients globally, with a market capitalization of HK$6.01 billion.

Operations: Viva Biotech Holdings generates revenue primarily from its Drug Discovery Services and Contract Development Manufacture Organisation (CDMO) and Commercialisation Services, with the latter contributing CN¥995.92 million. The company's net profit margin shows notable trends that could be of interest to investors analyzing its financial performance.

Viva Biotech Holdings, a nimble player in the life sciences sector, recently joined the S&P Global BMI Index. This company has shown resilience by turning profitable last year and maintaining a satisfactory net debt to equity ratio of 5.7%. Despite earnings forecasted to dip by 35.1% annually over three years, revenue is expected to rise by 15.72% each year. The price-to-earnings ratio stands at an attractive 31.9x compared to the industry average of 52.4x, suggesting potential value for investors seeking growth opportunities in this space. Recent buybacks totaling HKD 30.49 million underscore confidence in future prospects.

- Click here and access our complete health analysis report to understand the dynamics of Viva Biotech Holdings.

Understand Viva Biotech Holdings' track record by examining our Past report.

Jiangxi Jiangnan New Material Technology (SHSE:603124)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangxi Jiangnan New Material Technology Co., Ltd. operates in the new materials sector and has a market capitalization of CN¥12.70 billion.

Operations: The company generates revenue primarily through its operations in the new materials sector.

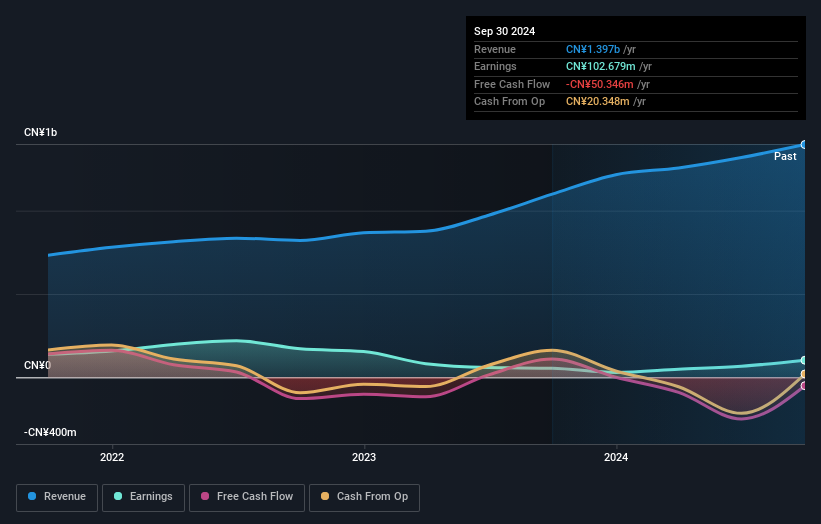

Jiangxi Jiangnan New Material Technology, a promising player in the materials sector, reported half-year sales of CNY 4.82 billion, up from CNY 4.11 billion the previous year. Despite net income rising to CNY 105.59 million from CNY 98.33 million, earnings per share slightly decreased to CNY 0.83 from CNY 0.9 due to increased shares outstanding or other factors not specified here. The company's debt profile is strong with a satisfactory net debt to equity ratio of 12%, and its interest payments are well-covered by EBIT at a ratio of 6.8x, indicating robust financial management amidst industry volatility and growth challenges in free cash flow generation.

- Navigate through the intricacies of Jiangxi Jiangnan New Material Technology with our comprehensive health report here.

Learn about Jiangxi Jiangnan New Material Technology's historical performance.

Shenzhen Injoinic TechnologyLtd (SHSE:688209)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Injoinic Technology Co., Ltd. is an IC design company that focuses on designing, developing, manufacturing, and selling digital-analog hybrid chips with a market capitalization of CN¥9.74 billion.

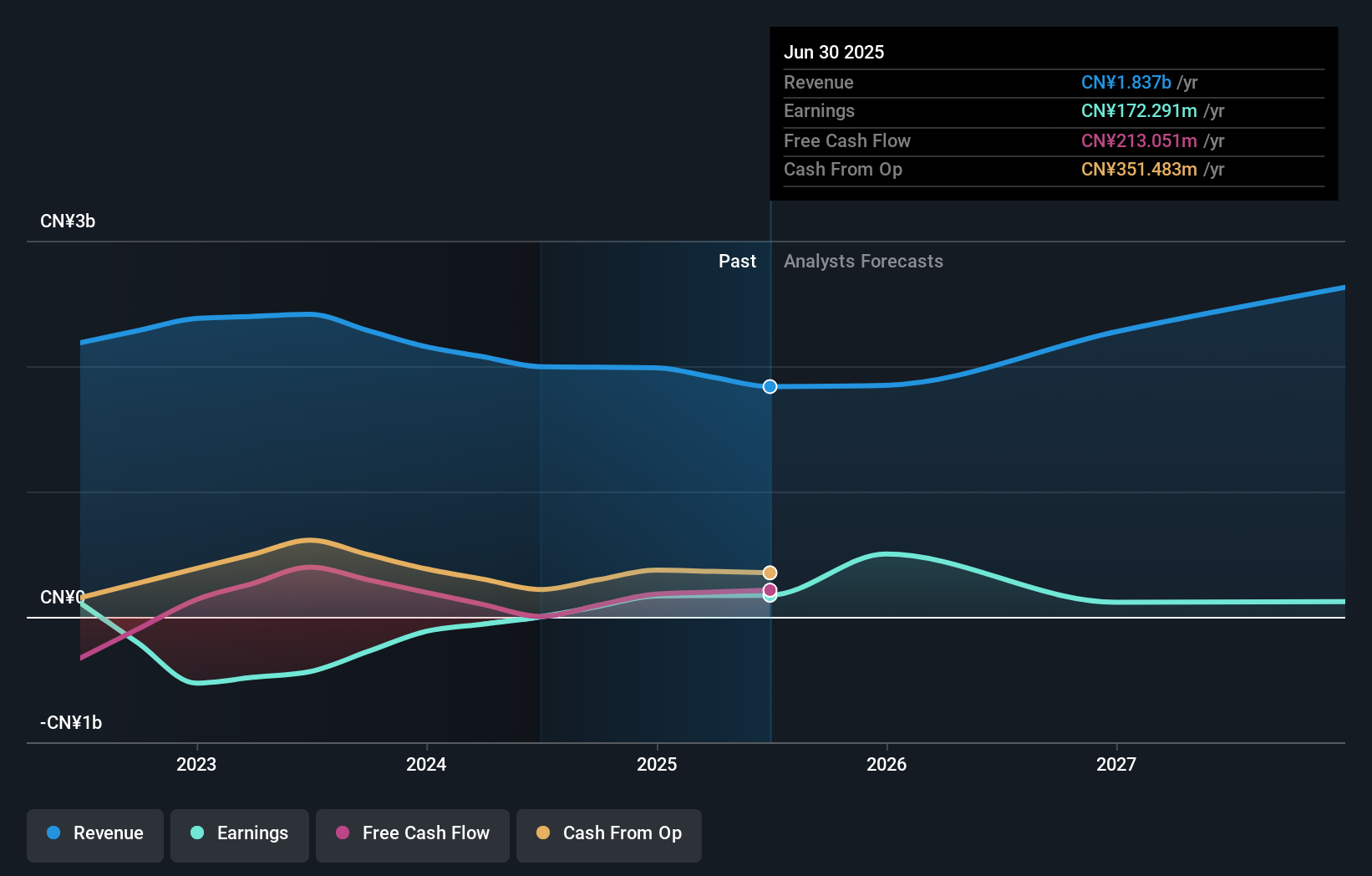

Operations: Injoinic's primary revenue stream comes from its integrated circuit segment, generating CN¥1.51 billion. The company's financial performance is highlighted by a notable gross profit margin trend that reflects its operational efficiency and cost management strategies.

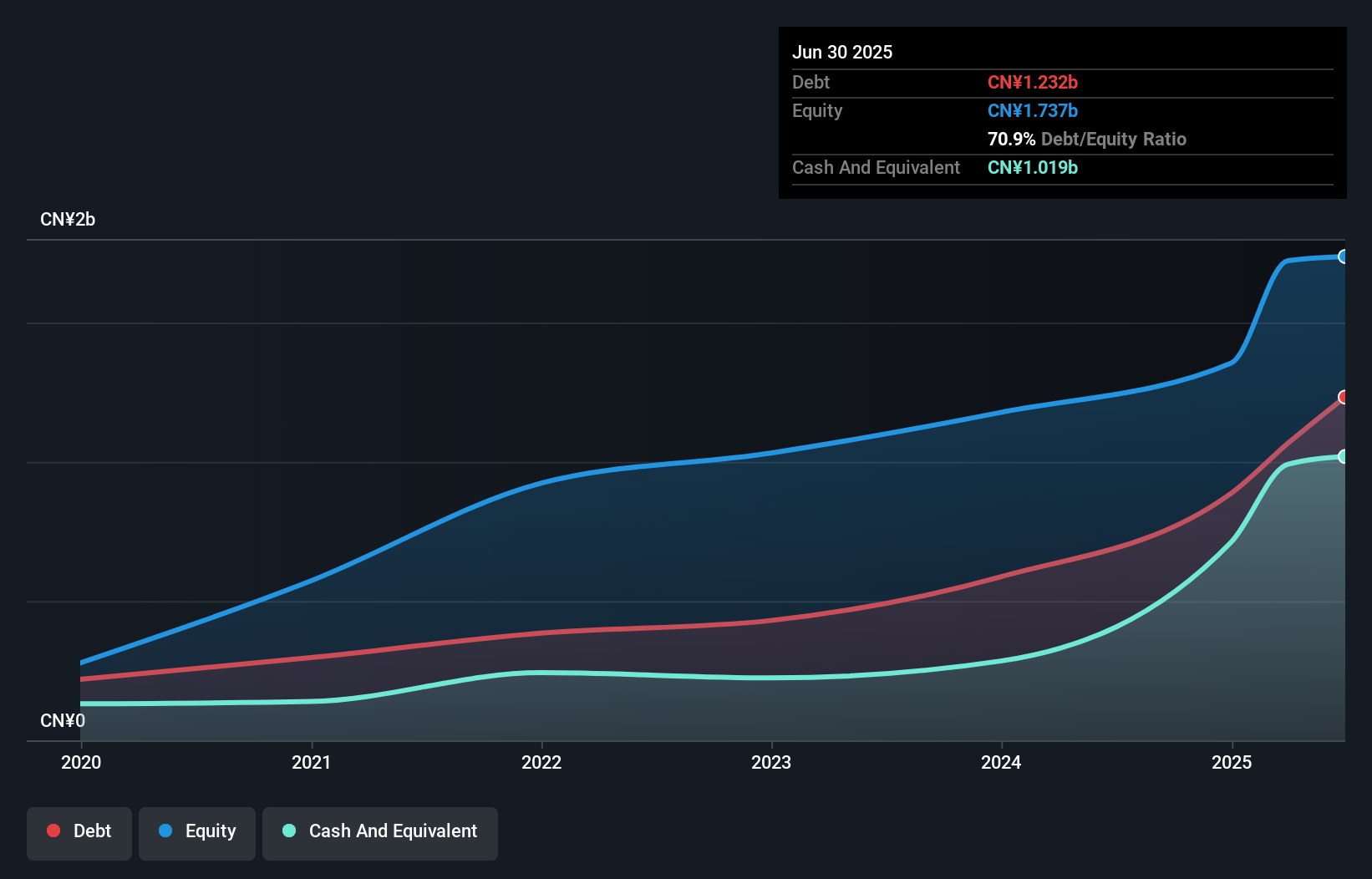

Shenzhen Injoinic Technology, a small player in the semiconductor space, has shown impressive earnings growth of 106.7% over the past year, outpacing the industry average of 10.4%. Despite this surge, it's trading at a notable 38.7% below its estimated fair value. The company's recent half-year results reveal sales climbing to CNY 698 million from last year's CNY 601 million and net income rising to CNY 51.92 million from CNY 39.05 million previously. With no debt on its balance sheet and high-quality earnings reported, it seems well-positioned for future opportunities in its sector.

Make It Happen

- Explore the 2383 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688209

Shenzhen Injoinic TechnologyLtd

Engages in the research, development, and sale of power management chips and fast charging protocol chips in China.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)