- China

- /

- Communications

- /

- SHSE:600498

Returns On Capital At Fiberhome Telecommunication Technologies (SHSE:600498) Paint A Concerning Picture

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. In light of that, when we looked at Fiberhome Telecommunication Technologies (SHSE:600498) and its ROCE trend, we weren't exactly thrilled.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Fiberhome Telecommunication Technologies, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

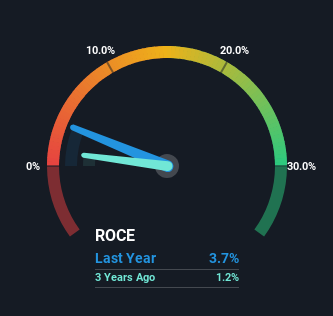

0.037 = CN¥771m ÷ (CN¥42b - CN¥22b) (Based on the trailing twelve months to June 2024).

So, Fiberhome Telecommunication Technologies has an ROCE of 3.7%. In absolute terms, that's a low return and it also under-performs the Communications industry average of 4.7%.

View our latest analysis for Fiberhome Telecommunication Technologies

In the above chart we have measured Fiberhome Telecommunication Technologies' prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Fiberhome Telecommunication Technologies .

How Are Returns Trending?

On the surface, the trend of ROCE at Fiberhome Telecommunication Technologies doesn't inspire confidence. Around five years ago the returns on capital were 7.5%, but since then they've fallen to 3.7%. Meanwhile, the business is utilizing more capital but this hasn't moved the needle much in terms of sales in the past 12 months, so this could reflect longer term investments. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

On a side note, Fiberhome Telecommunication Technologies' current liabilities are still rather high at 51% of total assets. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

Our Take On Fiberhome Telecommunication Technologies' ROCE

In summary, Fiberhome Telecommunication Technologies is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. Since the stock has declined 46% over the last five years, investors may not be too optimistic on this trend improving either. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

One more thing, we've spotted 1 warning sign facing Fiberhome Telecommunication Technologies that you might find interesting.

While Fiberhome Telecommunication Technologies may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600498

Fiberhome Telecommunication Technologies

Fiberhome Telecommunication Technologies Co., Ltd.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026