As global markets adjust to the political and economic shifts following the inauguration of President Donald Trump, U.S. stocks have been buoyed by optimism surrounding potential trade deals and AI investments, with major indices like the S&P 500 reaching new highs. In this environment of heightened interest in growth sectors, particularly those related to artificial intelligence, identifying high-growth tech stocks involves looking for companies with strong innovation capabilities and market adaptability that can capitalize on these emerging trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

iFLYTEKLTD (SZSE:002230)

Simply Wall St Growth Rating: ★★★★☆☆

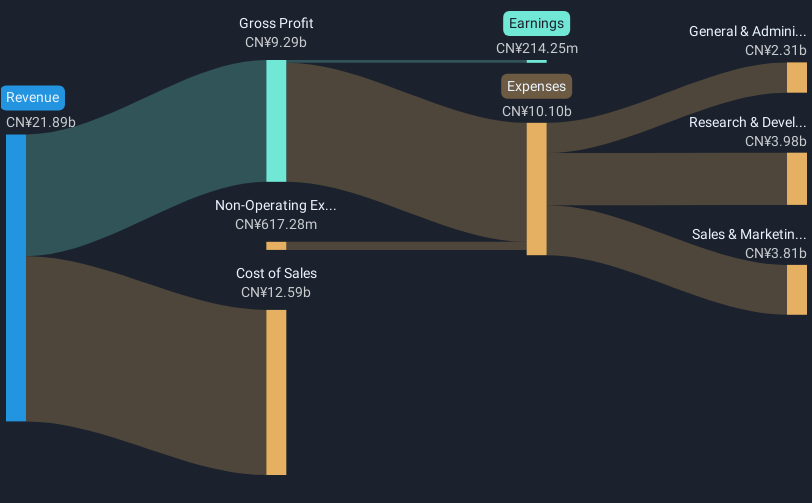

Overview: iFLYTEK CO., LTD. specializes in providing artificial intelligence (AI) technology services in China and has a market capitalization of CN¥116.22 billion.

Operations: The company focuses on artificial intelligence technology services in China. It leverages its expertise to develop and offer AI-driven solutions across various sectors, contributing significantly to its revenue streams.

iFLYTEK's strategic maneuvers, evidenced by recent shareholder meetings focused on stock repurchases and employee stock ownership plans, underscore its commitment to aligning interests with long-term growth. Despite a challenging year with earnings contraction of 10.9%, the company is poised for a robust rebound with projected annual earnings growth of 62.3%. This figure starkly outpaces the broader Chinese market's expectations of 25.1%. Moreover, iFLYTEK continues to invest in innovation as reflected in its R&D expenditures, crucial for sustaining its competitive edge in the high-tech sector. The firm’s ability to grow revenue by 17.7% annually further demonstrates resilience and adaptability amidst evolving industry dynamics, positioning it favorably for future advancements.

- Get an in-depth perspective on iFLYTEKLTD's performance by reading our health report here.

Gain insights into iFLYTEKLTD's historical performance by reviewing our past performance report.

TRS Information Technology (SZSE:300229)

Simply Wall St Growth Rating: ★★★★☆☆

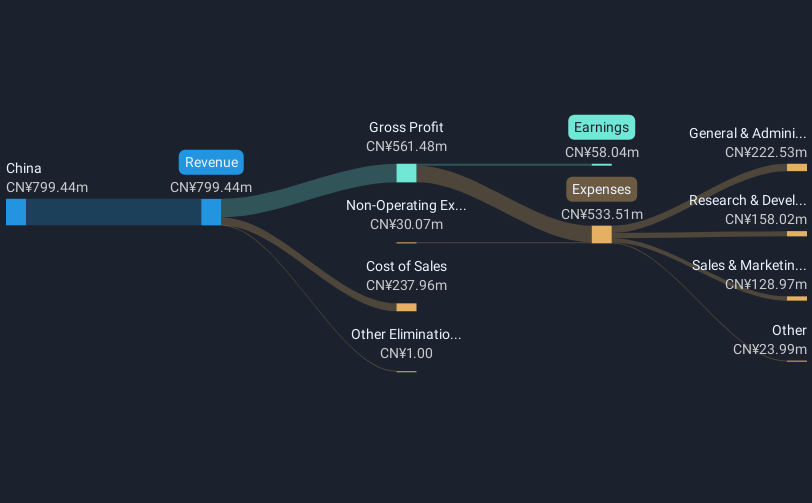

Overview: TRS Information Technology Co., Ltd. offers artificial intelligence, big data, and data security products and services in China with a market capitalization of CN¥19.32 billion.

Operations: The company generates revenue through its offerings in artificial intelligence, big data, and data security sectors within China. With a market capitalization of CN¥19.32 billion, it focuses on providing technology solutions that cater to various industries' needs for advanced data management and protection.

TRS Information Technology has demonstrated a notable uptick in its financial performance, with earnings surging by 23.9% over the past year, outstripping the broader software industry's decline of 11.2%. This growth trajectory is supported by an ambitious R&D strategy, which saw expenditures hitting CNY 44 million, representing a significant reinvestment back into innovation. Moreover, the firm's recent adjustments to its articles of association suggest strategic shifts aimed at bolstering governance and future growth prospects. With revenue also on the rise at 17.4% annually—faster than China's market average of 13.4%—TRS stands well-positioned to capitalize on emerging tech trends and maintain its competitive edge in a rapidly evolving sector.

Richinfo Technology (SZSE:300634)

Simply Wall St Growth Rating: ★★★★☆☆

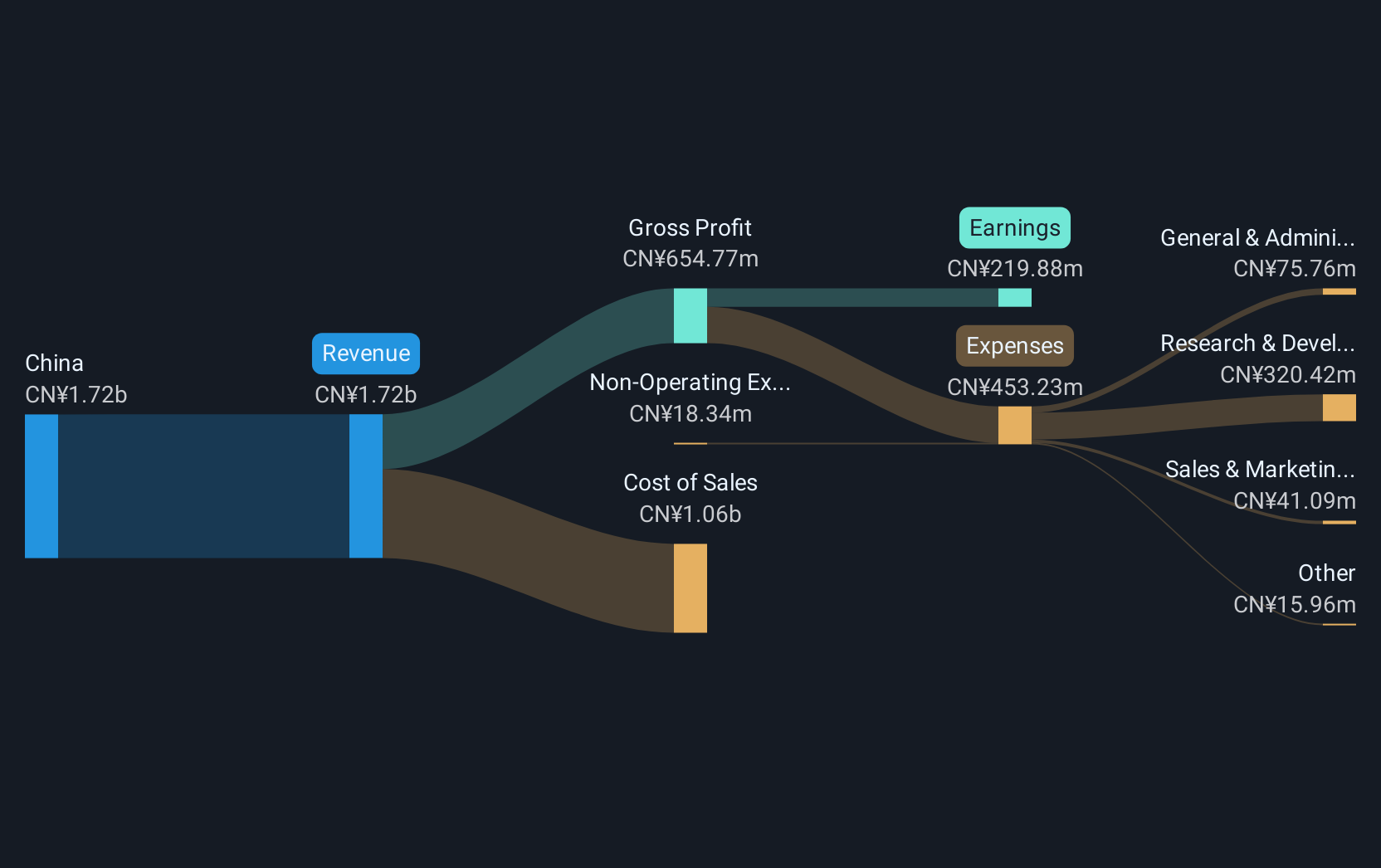

Overview: Richinfo Technology Co., Ltd. offers industrial Internet solutions and technical services in China, with a market cap of CN¥13.24 billion.

Operations: Richinfo Technology Co., Ltd. generates revenue through its industrial Internet solutions and technical services in China. The company operates with a market cap of approximately CN¥13.24 billion, focusing on providing specialized technological solutions for various industries.

Richinfo Technology's strategic focus on R&D has led to a robust 19.3% annual revenue growth, outpacing the Chinese market average of 13.4%. This investment in innovation is further evidenced by its substantial R&D expenditure, which aligns with its earnings growth forecast of 28.4% per year, suggesting a strong commitment to future technologies and market needs. Despite challenges like a highly volatile share price and lower profit margins compared to last year (13.2% from 26.3%), the company's recent dividend affirmations indicate financial stability and shareholder confidence, positioning it favorably within the tech sector for continued growth and industry relevance.

- Click to explore a detailed breakdown of our findings in Richinfo Technology's health report.

Assess Richinfo Technology's past performance with our detailed historical performance reports.

Taking Advantage

- Dive into all 1225 of the High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TRS Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300229

TRS Information Technology

Provides artificial intelligence, big data, and data security products and services in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives