Market is not liking Leon Technology's (SZSE:300603) earnings decline as stock retreats 15% this week

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Leon Technology Co., Ltd. (SZSE:300603) shareholders for doubting their decision to hold, with the stock down 33% over a half decade. And the share price decline continued over the last week, dropping some 15%.

With the stock having lost 15% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Leon Technology

While Leon Technology made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last five years Leon Technology saw its revenue shrink by 17% per year. That's definitely a weaker result than most pre-profit companies report. On the face of it we'd posit the share price fall of 6% compound, over five years is well justified by the fundamental deterioration. This loss means the stock shareholders are probably pretty annoyed. Risk averse investors probably wouldn't like this one much.

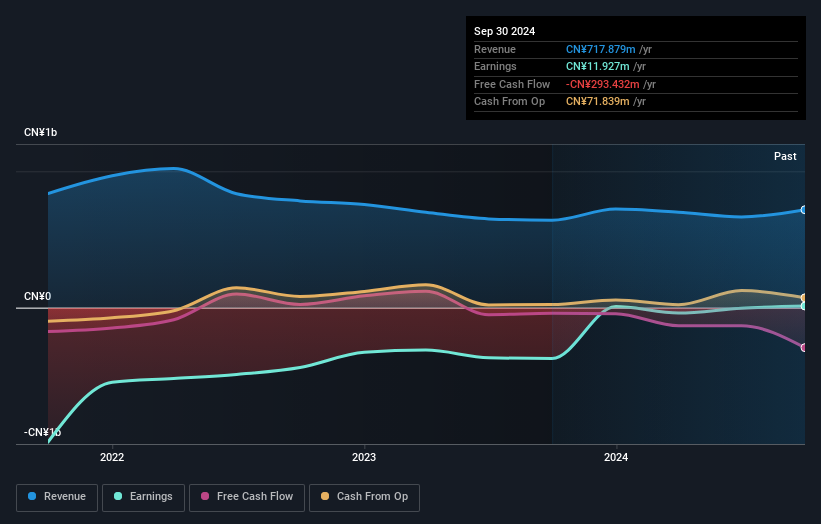

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Leon Technology's financial health with this free report on its balance sheet.

A Different Perspective

Leon Technology shareholders are down 4.8% for the year, but the market itself is up 7.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 6% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Leon Technology you should be aware of, and 1 of them is significant.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300603

Leon Technology

Provides information and communication technology services in China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives