- Japan

- /

- Hospitality

- /

- TSE:9166

Asian Growth Companies Insiders Are Eager To Own

Reviewed by Simply Wall St

In the midst of global economic uncertainties and trade tensions, Asian markets have shown resilience with modest gains in regions like Japan, while China remains focused on boosting consumption to drive growth. In such a landscape, companies with high insider ownership often signal confidence from those closest to the business, making them intriguing prospects for investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 34.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 45.7% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| UTour Group (SZSE:002707) | 24.1% | 32.7% |

| Oscotec (KOSDAQ:A039200) | 21.2% | 148.5% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

We'll examine a selection from our screener results.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$66.82 billion.

Operations: The company's revenue is primarily derived from the research, development, production, and sale of biopharmaceutical products, totaling CN¥1.87 billion.

Insider Ownership: 19%

Akeso is poised for significant growth with high insider ownership, bolstered by its innovative drug portfolio and strategic clinical developments. Recent approvals for penpulimab and promising Phase III results for ivonescimab highlight Akeso's robust pipeline in oncology. The company trades at 49% below estimated fair value, with revenue expected to grow 28.1% annually, outpacing the Hong Kong market. Despite no recent insider trading activity, Akeso's comprehensive development strategy positions it well in the competitive landscape of cancer immunotherapy.

- Get an in-depth perspective on Akeso's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Akeso is trading beyond its estimated value.

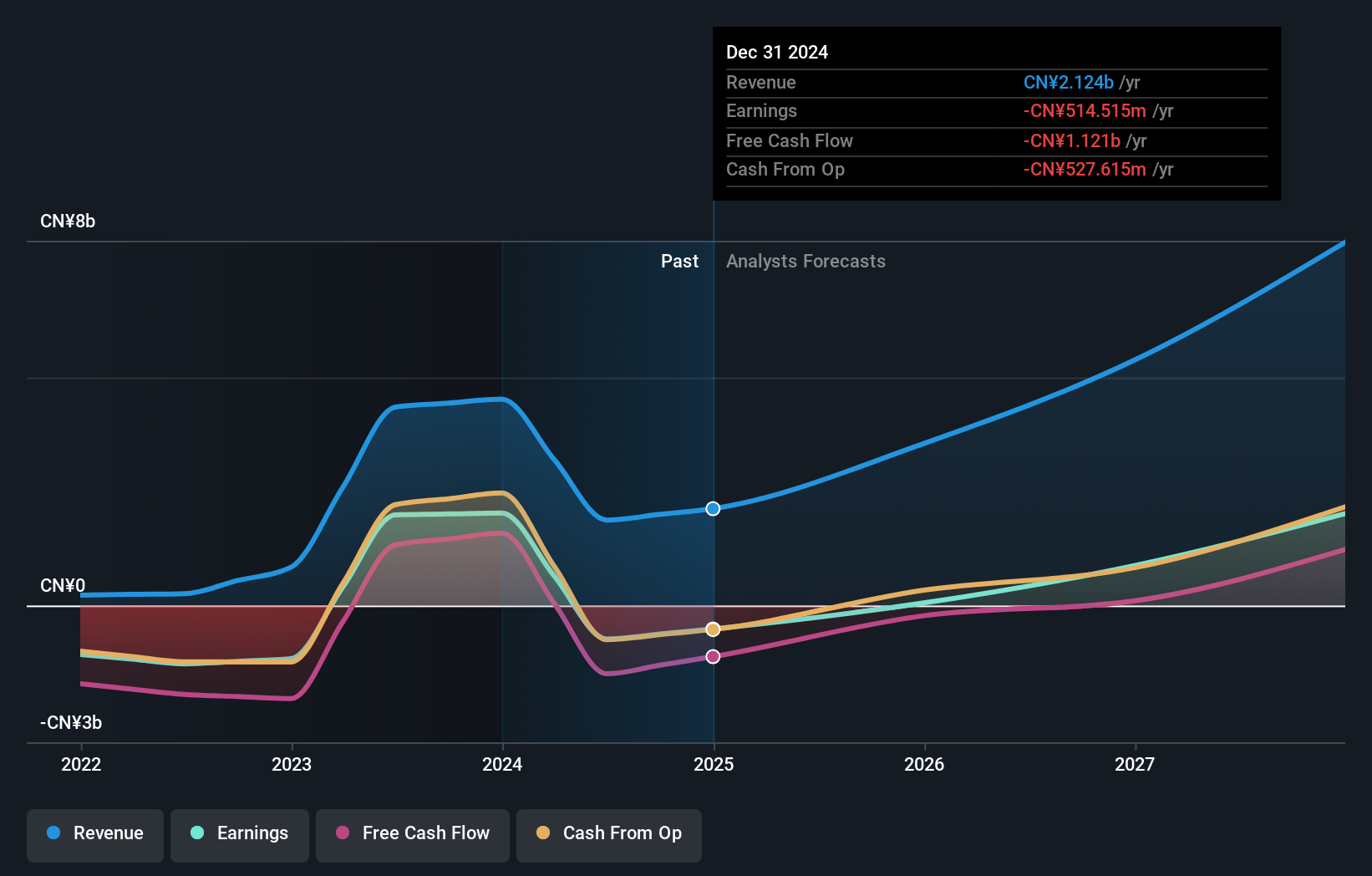

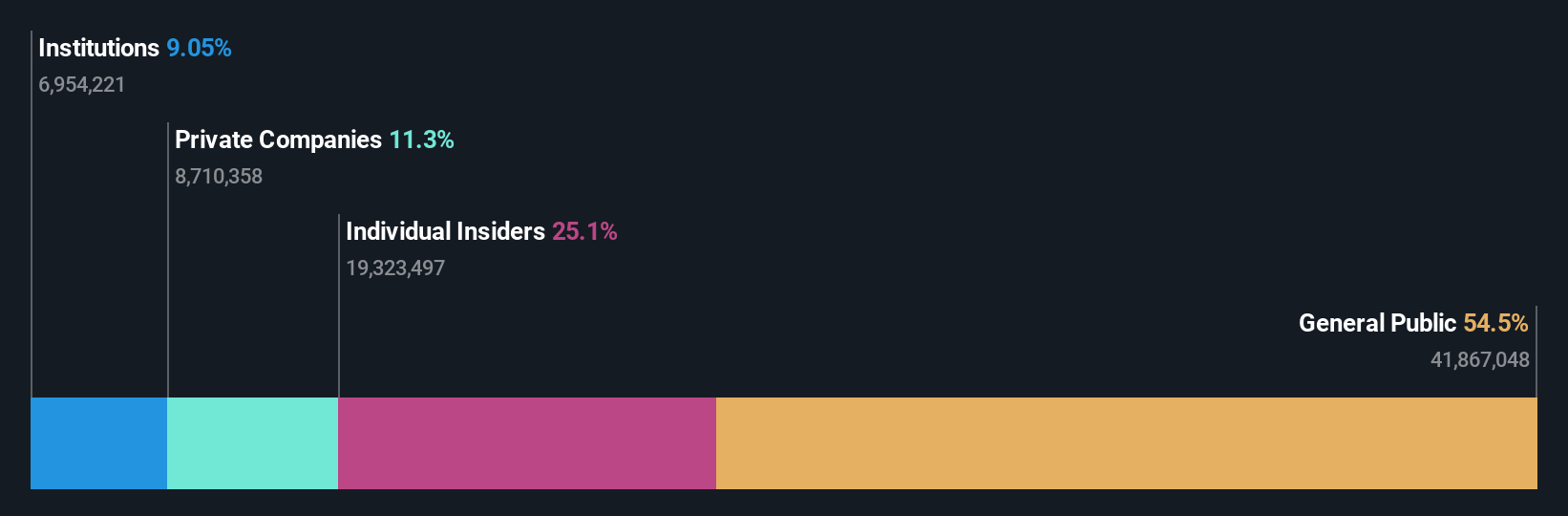

BeijingABT NetworksLtd (SHSE:688168)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BeijingABT Networks Co., Ltd. develops and provides visualized network security technology solutions in China, with a market cap of CN¥5.93 billion.

Operations: The company generates revenue of CN¥743.94 million from its network security segment.

Insider Ownership: 25.1%

BeijingABT Networks Ltd. shows potential for future growth despite recent financial setbacks, with a net loss of CNY 116.52 million in 2024 compared to a profit the previous year. Analysts forecast it will become profitable within three years, outpacing market averages in profit growth. However, its revenue is expected to grow at 14.9% annually, slower than desired but still above the Chinese market average of 13%. The stock has experienced high volatility recently without significant insider trading activity.

- Unlock comprehensive insights into our analysis of BeijingABT NetworksLtd stock in this growth report.

- Our comprehensive valuation report raises the possibility that BeijingABT NetworksLtd is priced higher than what may be justified by its financials.

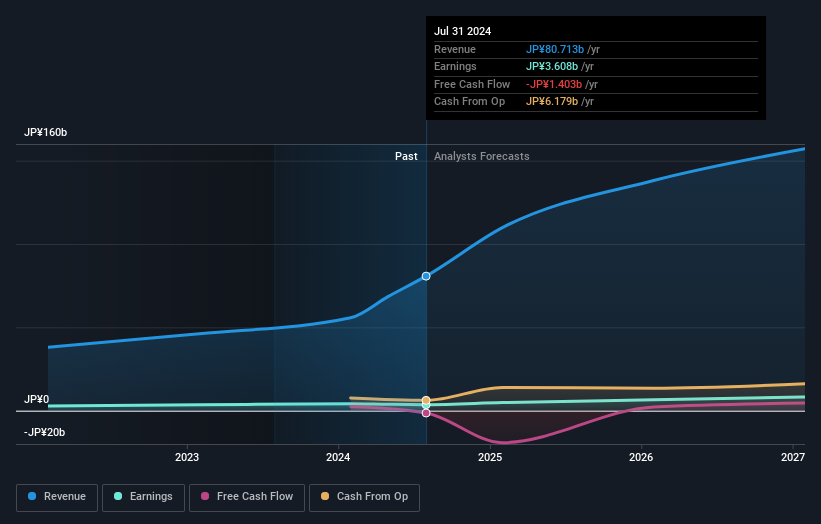

GENDA (TSE:9166)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GENDA Inc., with a market cap of ¥213.54 billion, operates amusement arcades primarily under the GiGO brand in Japan through its subsidiaries.

Operations: Revenue Segments (in millions of ¥): Amusement arcades: ¥null

Insider Ownership: 23%

GENDA Inc. is poised for significant earnings growth, projected at 22.4% annually, surpassing the JP market's average of 8%. Despite this, its Return on Equity is forecast to remain low at 15.8%, and profit margins have declined from last year’s 7.5% to 3%. While revenue growth of 8.2% outpaces the market's 4.2%, it remains below high-growth thresholds. The company faces financial challenges with debt coverage by operating cash flow and a volatile share price recently noted without substantial insider trading activity reported in the past three months.

- Navigate through the intricacies of GENDA with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that GENDA's current price could be inflated.

Where To Now?

- Click here to access our complete index of 644 Fast Growing Asian Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9166

GENDA

Through its subsidiaries, operates amusement arcades primarily under the GiGO brand in Japan.

Reasonable growth potential with mediocre balance sheet.