High Growth Tech Stocks To Watch For Potential Portfolio Boost

Reviewed by Simply Wall St

Amidst a backdrop of record highs in U.S. stock indices, driven by optimism surrounding AI investments and potential trade deals, growth stocks have recently outperformed their value counterparts for the first time this year. In such an environment, identifying high-growth tech stocks can be crucial for investors looking to capitalize on emerging trends and technological advancements that align with current market enthusiasm.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.37% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1228 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

ZwsoftLtd (SHSE:688083)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zwsoft Co., Ltd. specializes in developing and selling CAD/CAM/CAE software solutions in China, with a market capitalization of approximately CN¥10.42 billion.

Operations: Zwsoft Co., Ltd. generates revenue primarily through the development and sale of CAD/CAM/CAE software solutions in China. The company focuses on providing comprehensive design software to various industries, contributing to its market presence and financial performance.

ZwsoftLtd has demonstrated robust growth, with earnings surging by 133.1% over the past year, significantly outpacing the software industry's decline of 11.2%. This performance is underpinned by a substantial one-off gain of CN¥134.5 million, which skews the financial results but highlights potential volatility in earnings quality. Despite this, projections remain positive with expected annual earnings growth of 29.9%, surpassing China's market forecast of 25%. However, revenue growth forecasts at 17% annually are modest compared to some market peers projected above 20%, indicating room for strategic enhancements in market positioning and product offerings to sustain competitive advantage.

- Take a closer look at ZwsoftLtd's potential here in our health report.

Gain insights into ZwsoftLtd's historical performance by reviewing our past performance report.

Qi An Xin Technology Group (SHSE:688561)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qi An Xin Technology Group Inc. is a cyber-security company offering cybersecurity products and services to government, enterprises, and institutions both in China and internationally, with a market cap of CN¥17.08 billion.

Operations: Qi An Xin Technology Group generates revenue primarily from the Information Security Industry, amounting to CN¥5.47 billion.

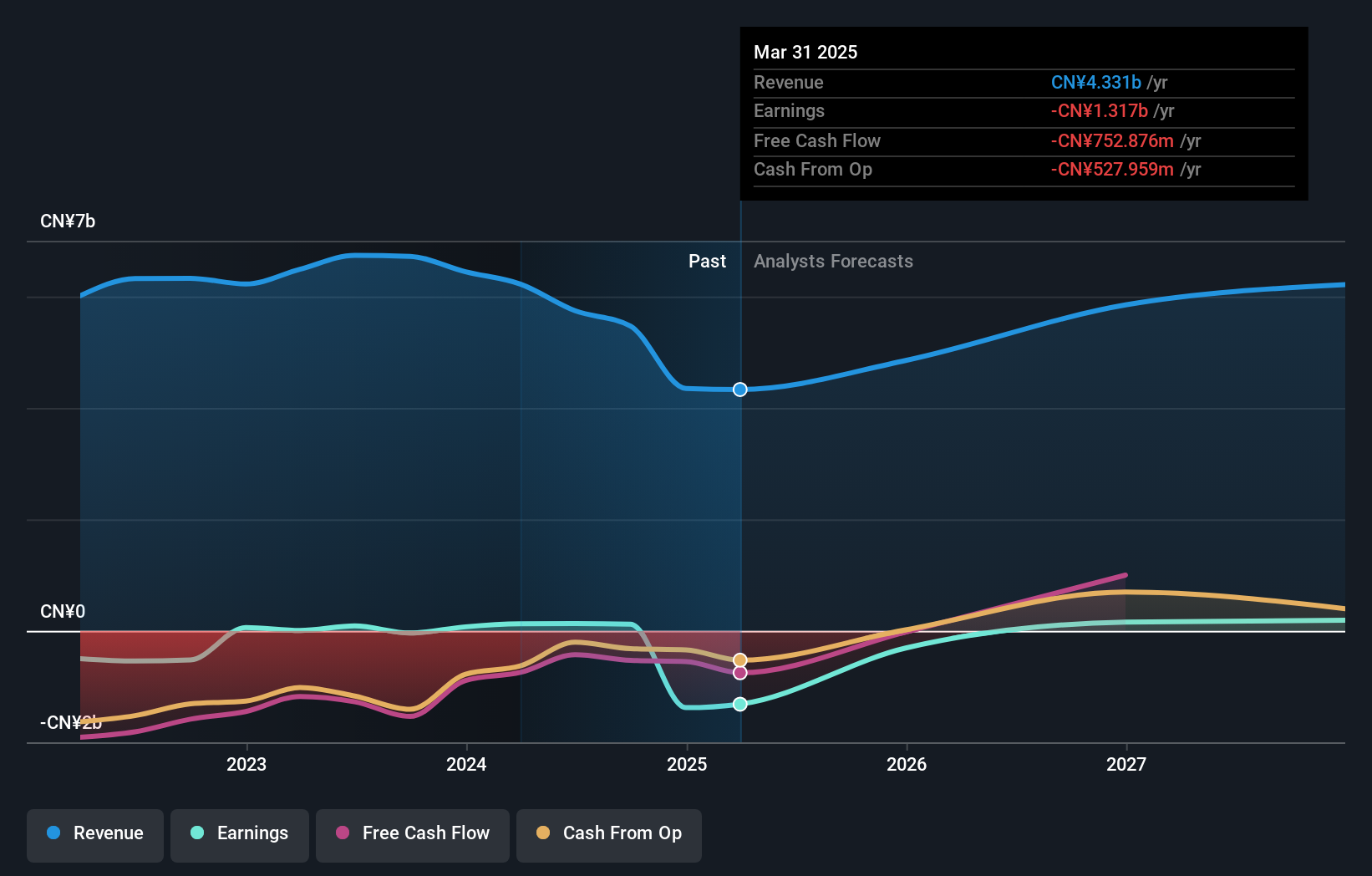

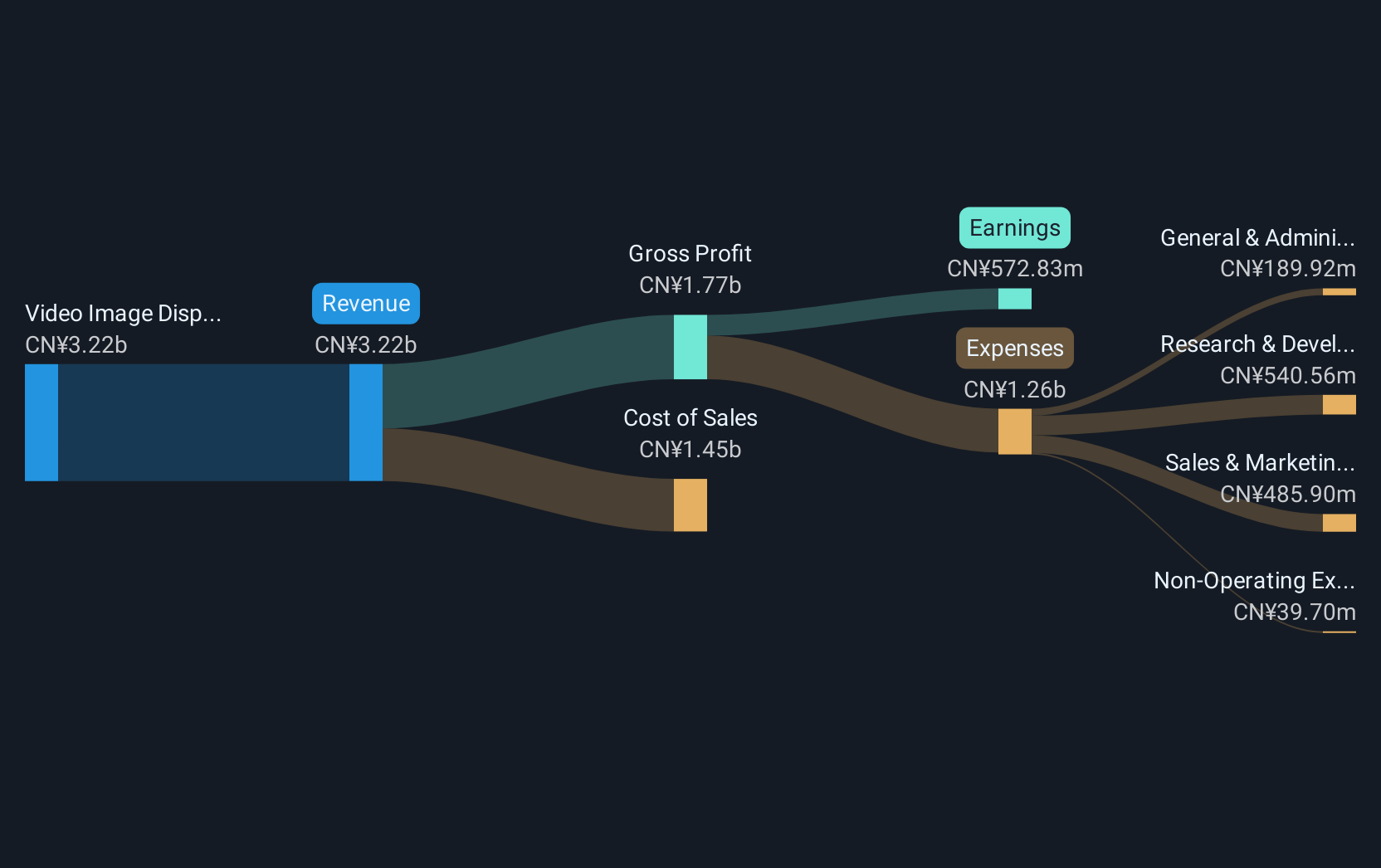

Qi An Xin Technology Group has shown promising growth metrics, with a notable annualized revenue increase of 14.9% and an even more impressive earnings surge of 38.5% per year, outpacing the broader Chinese market's expectations. This performance is bolstered by significant research and development investment, which has grown to comprise a substantial portion of its revenue, reflecting the company's commitment to innovation in cybersecurity solutions. Recent events like their special shareholders meeting suggest strategic moves that could further influence their market position and financial trajectory in a highly competitive tech landscape.

- Dive into the specifics of Qi An Xin Technology Group here with our thorough health report.

Learn about Qi An Xin Technology Group's historical performance.

Xi'an NovaStar Tech (SZSE:301589)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an NovaStar Tech Co., Ltd. specializes in providing LED display control solutions in China and has a market capitalization of CN¥15.28 billion.

Operations: NovaStar Tech focuses on electronic components and parts, generating revenue of CN¥3.28 billion from this segment.

Xi'an NovaStar Tech has been actively enhancing shareholder value, evidenced by its recent share repurchase program where it bought back shares worth CNY 149.88 million. This aligns with its robust financial performance, showing a remarkable annual revenue growth of 30.2% and earnings growth of 35.3%. The company's commitment to innovation is underscored by its R&D spending, which significantly contributes to these growth figures, positioning it well in the competitive tech landscape despite a challenging market environment.

- Click here and access our complete health analysis report to understand the dynamics of Xi'an NovaStar Tech.

Gain insights into Xi'an NovaStar Tech's past trends and performance with our Past report.

Turning Ideas Into Actions

- Gain an insight into the universe of 1228 High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ZwsoftLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688083

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)