- South Korea

- /

- IT

- /

- KOSDAQ:A042000

Top Growth Companies With High Insider Ownership February 2025

Reviewed by Simply Wall St

In the midst of fluctuating global markets, with U.S. stocks experiencing volatility due to AI competition fears and mixed earnings reports, investors are keenly observing how interest rate decisions by major central banks influence economic sentiment. As the Federal Reserve holds rates steady amidst solid economic activity and elevated inflation, alongside Europe's positive response to ECB rate cuts, identifying growth companies with high insider ownership becomes increasingly significant for those looking to navigate these uncertain times. High insider ownership often suggests that company leaders have confidence in their business's long-term prospects—a crucial factor when considering investments in today's complex market environment.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★☆☆

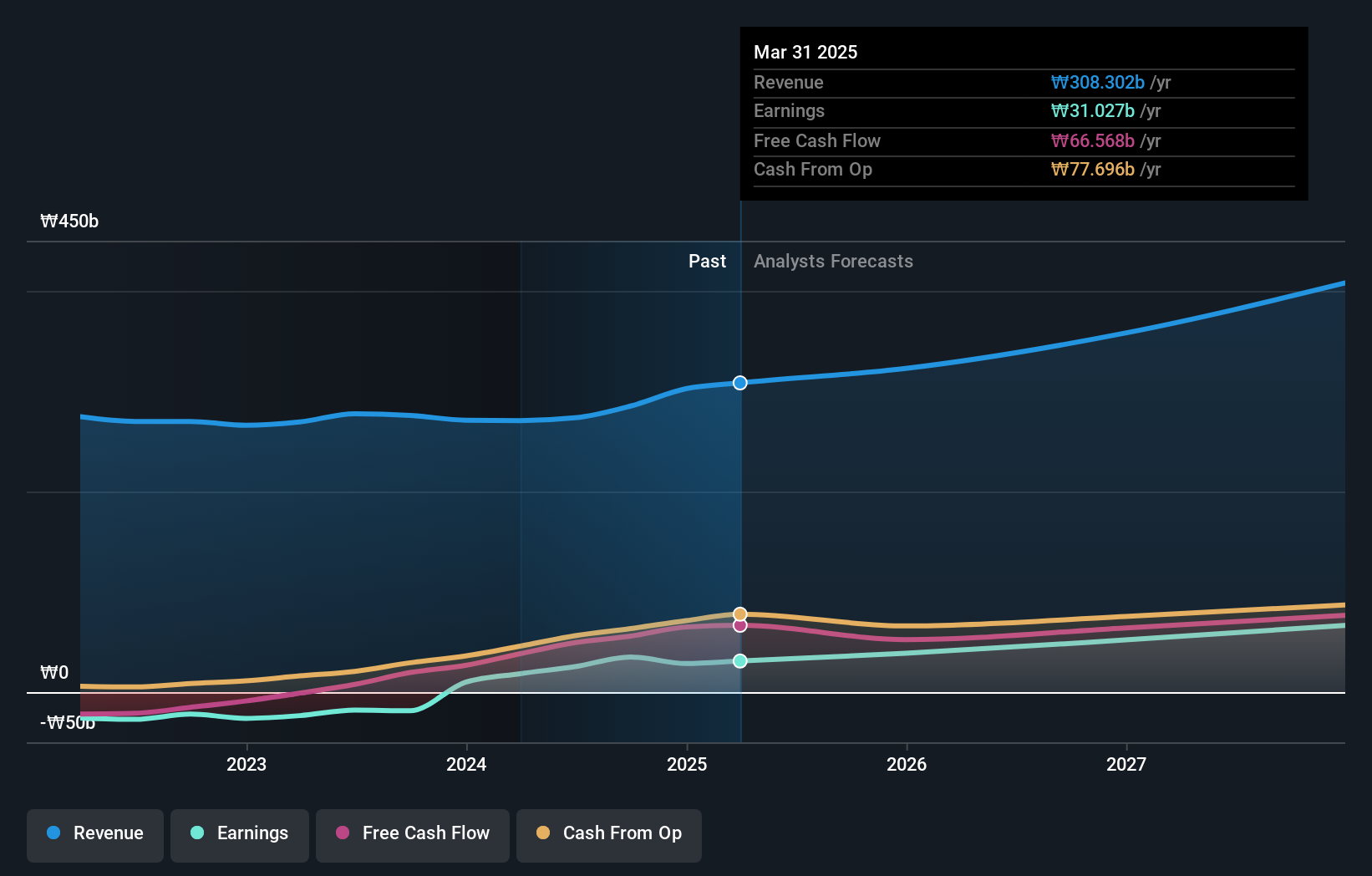

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market cap of ₩1.31 trillion.

Operations: The company's revenue is primarily derived from its Internet Business Solution segment, generating ₩237.10 billion, followed by Transit at ₩44.06 million and Clothing at ₩22.16 million.

Insider Ownership: 23.4%

Earnings Growth Forecast: 35.5% p.a.

Cafe24, a growth company with significant insider ownership, recently became profitable and is expected to see earnings grow significantly at 35.5% annually over the next three years, outpacing the Korean market's average. While its revenue growth forecast of 11.3% per year is slower than some high-growth peers, it still surpasses the broader market's rate. However, potential investors should note its highly volatile share price and financial results influenced by large one-off items.

- Take a closer look at Cafe24's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Cafe24 shares in the market.

Piesat Information Technology (SHSE:688066)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Piesat Information Technology Co., Ltd. is a company that offers satellite internet services in China, with a market capitalization of approximately CN¥4.52 billion.

Operations: The company generates revenue from its Satellite Application segment, amounting to CN¥1.58 billion.

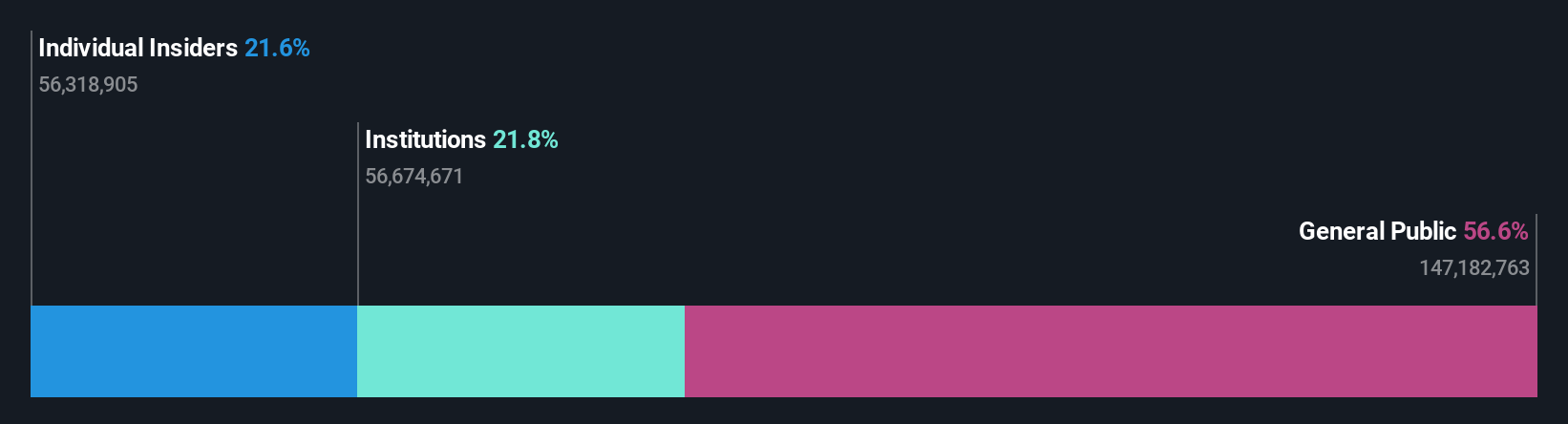

Insider Ownership: 21.6%

Earnings Growth Forecast: 104.4% p.a.

Piesat Information Technology forecasts a robust earnings growth of 104.44% annually, with revenue expected to increase by 25.4% per year, outpacing the Chinese market's average. Despite trading at good value compared to peers and industry, its financial position is challenged by debt not well covered by operating cash flow. The company anticipates profitability within three years but faces a highly volatile share price and low return on equity forecast at 11.1%.

- Delve into the full analysis future growth report here for a deeper understanding of Piesat Information Technology.

- Upon reviewing our latest valuation report, Piesat Information Technology's share price might be too pessimistic.

Sansec Technology (SHSE:688489)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansec Technology Co., Ltd. focuses on the research, development, and production of commercial cryptographic products and solutions for internet information security in China, with a market cap of CN¥3.63 billion.

Operations: Sansec Technology Co., Ltd.'s revenue is generated from its expertise in creating cryptographic products and solutions tailored for internet information security within the Chinese market.

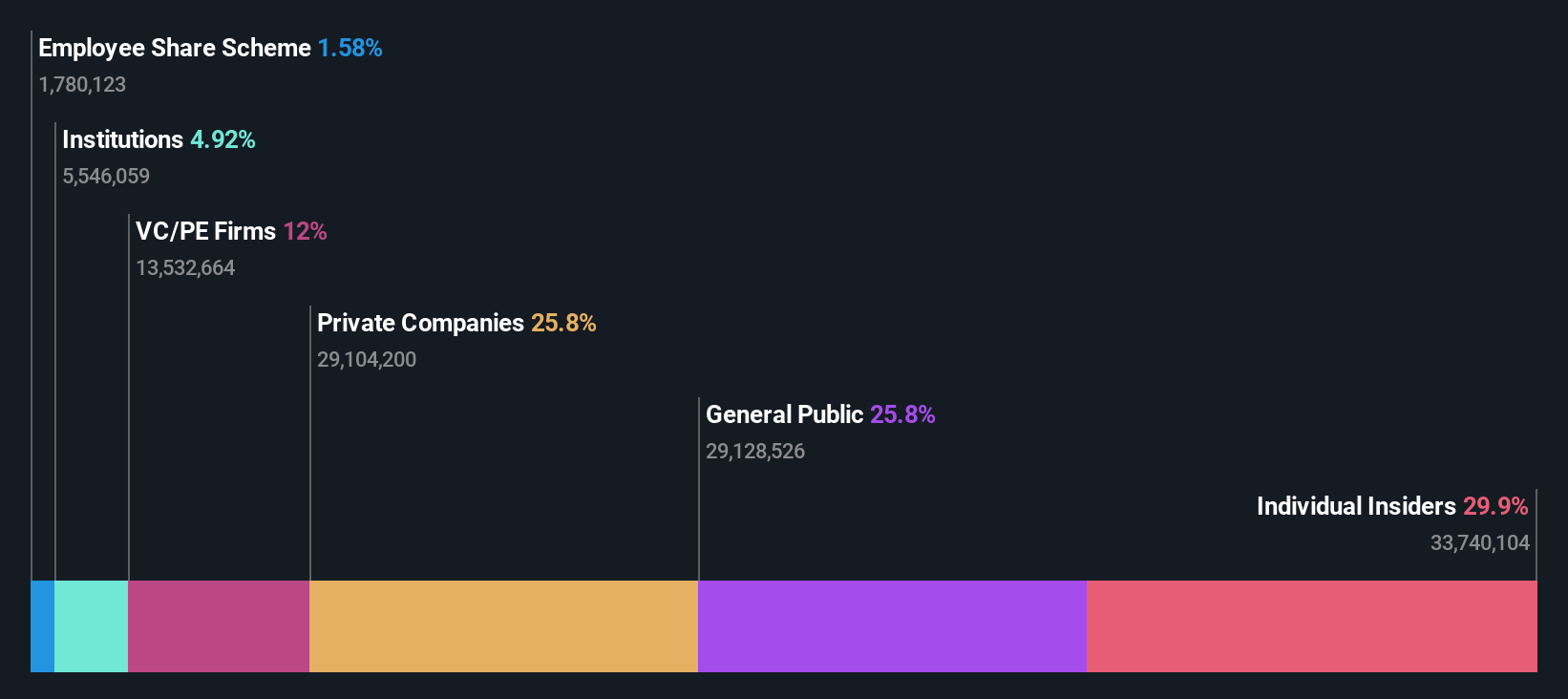

Insider Ownership: 30%

Earnings Growth Forecast: 44.1% p.a.

Sansec Technology is poised for substantial growth, with earnings expected to increase by 44.1% annually and revenue projected to grow at 25.3% per year, surpassing the Chinese market average. Despite strong growth prospects, the company's return on equity is forecasted to remain low at 6.8%. Recent events include its removal from the S&P Global BMI Index and completion of a share buyback plan worth CNY 79.96 million, indicating strategic financial maneuvers amidst evolving market conditions.

- Dive into the specifics of Sansec Technology here with our thorough growth forecast report.

- Our expertly prepared valuation report Sansec Technology implies its share price may be too high.

Seize The Opportunity

- Embark on your investment journey to our 1478 Fast Growing Companies With High Insider Ownership selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A042000

Flawless balance sheet with solid track record.

Market Insights

Community Narratives