- China

- /

- Semiconductors

- /

- SZSE:300223

Why Investors Shouldn't Be Surprised By Ingenic Semiconductor Co.,Ltd.'s (SZSE:300223) P/E

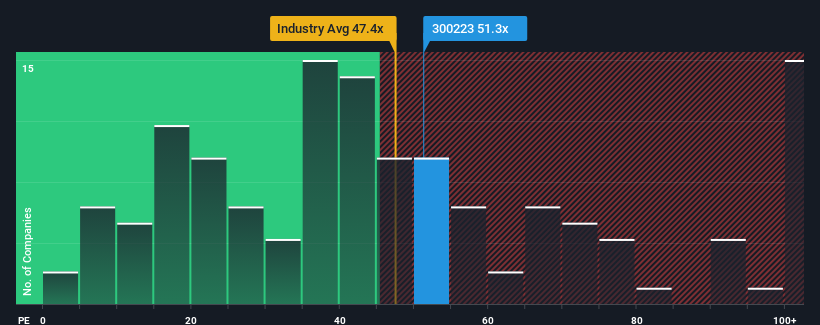

Ingenic Semiconductor Co.,Ltd.'s (SZSE:300223) price-to-earnings (or "P/E") ratio of 51.3x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 27x and even P/E's below 16x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Ingenic SemiconductorLtd hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Ingenic SemiconductorLtd

How Is Ingenic SemiconductorLtd's Growth Trending?

Ingenic SemiconductorLtd's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 24%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 146% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 30% each year over the next three years. That's shaping up to be materially higher than the 24% per annum growth forecast for the broader market.

In light of this, it's understandable that Ingenic SemiconductorLtd's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Ingenic SemiconductorLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Ingenic SemiconductorLtd with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300223

Ingenic SemiconductorLtd

Engages in the research and development, design, and sale of integrated circuit chip products in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives