- China

- /

- Semiconductors

- /

- SZSE:300102

Shareholders Shouldn’t Be Too Comfortable With Xiamen Changelight's (SZSE:300102) Strong Earnings

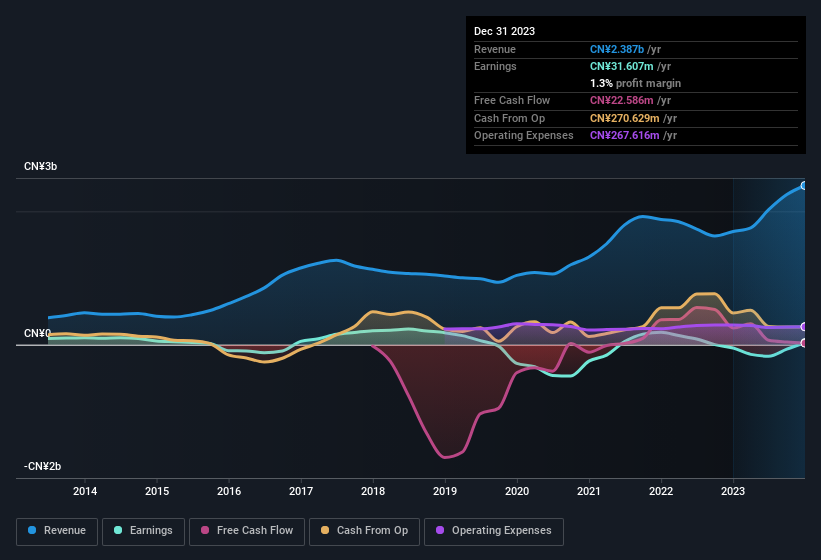

Even though Xiamen Changelight Co., Ltd. (SZSE:300102) posted strong earnings recently, the stock hasn't reacted in a large way. We think that investors might be worried about the foundations the earnings are built on.

View our latest analysis for Xiamen Changelight

Operating Revenue Or Not?

Companies will classify their revenue streams as either operating revenue or other revenue. Oftentimes, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has made a very large contribution to total profit. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. It's worth noting that Xiamen Changelight saw a big increase in non-operating revenue over the last year. In fact, our data indicates that non-operating revenue increased from CN¥244.4m to CN¥640.4m. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Xiamen Changelight.

The Impact Of Unusual Items On Profit

As well as that spike in non-operating revenue, we should also consider the CN¥63m boost to profit coming from unusual items, over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. Xiamen Changelight had a rather significant contribution from unusual items relative to its profit to December 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Xiamen Changelight's Profit Performance

In the last year Xiamen Changelight's non-operating revenue really gave it a boost, but not in a way that is necessarily going to be sustained. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated and everything else is equal. On reflection, the above-mentioned factors give us the strong impression that Xiamen Changelight'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Case in point: We've spotted 1 warning sign for Xiamen Changelight you should be aware of.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300102

Xiamen Changelight

Researches, develops, produces, and sells compound semiconductor optoelectronic products in China and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026