- China

- /

- Semiconductors

- /

- SZSE:003040

Why Investors Shouldn't Be Surprised By Chutian Dragon Co., Ltd.'s (SZSE:003040) 39% Share Price Surge

Chutian Dragon Co., Ltd. (SZSE:003040) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

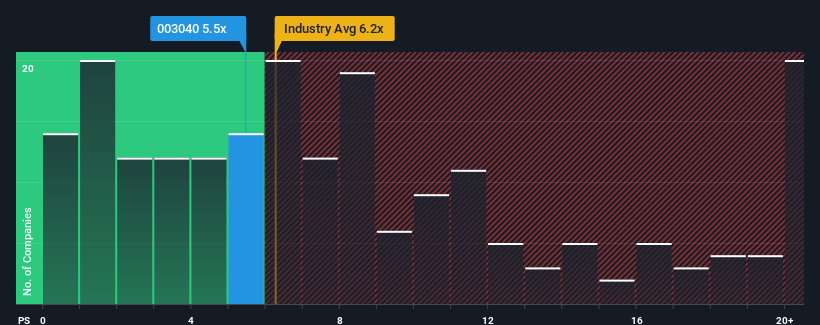

Although its price has surged higher, there still wouldn't be many who think Chutian Dragon's price-to-sales (or "P/S") ratio of 5.5x is worth a mention when the median P/S in China's Semiconductor industry is similar at about 6.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Chutian Dragon

What Does Chutian Dragon's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Chutian Dragon's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Chutian Dragon will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Chutian Dragon's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.2% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 33% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 36% growth , the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Chutian Dragon's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Chutian Dragon's P/S Mean For Investors?

Chutian Dragon's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Chutian Dragon's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Chutian Dragon, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:003040

Chutian Dragon

Engages in digital security and services, intelligent hardware and integrated solutions, and system platforms and operational services in China and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives