Jiangsu Lopal Tech And 2 More High Growth Stocks Insiders Heavily Invest In

Reviewed by Simply Wall St

In a week marked by volatility and competitive pressures in the technology sector, global markets have been closely watching central bank decisions and corporate earnings reports to gauge economic stability. As investors navigate these uncertain times, companies with strong insider ownership often attract attention due to the confidence insiders show in their growth potential. In this context, understanding what makes a stock attractive involves looking at both its growth prospects and the level of investment by those who know it best—its insiders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 10.1% | 86% |

Below we spotlight a couple of our favorites from our exclusive screener.

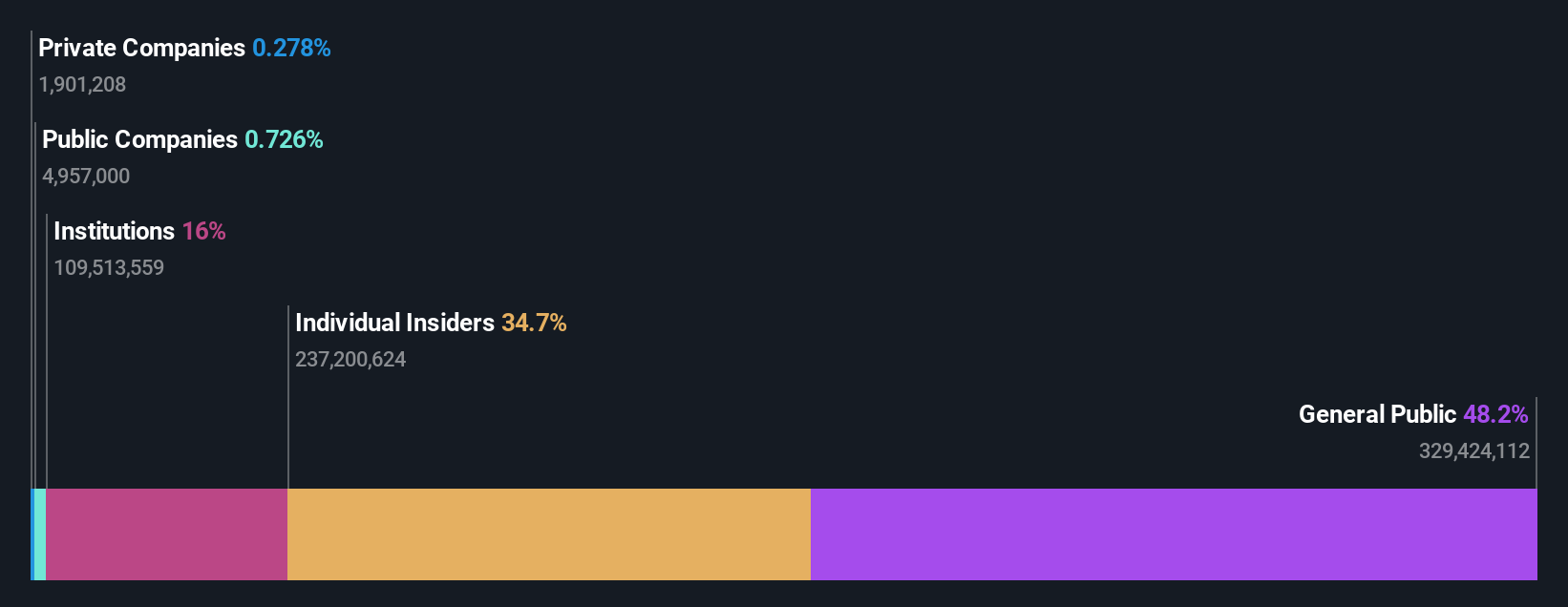

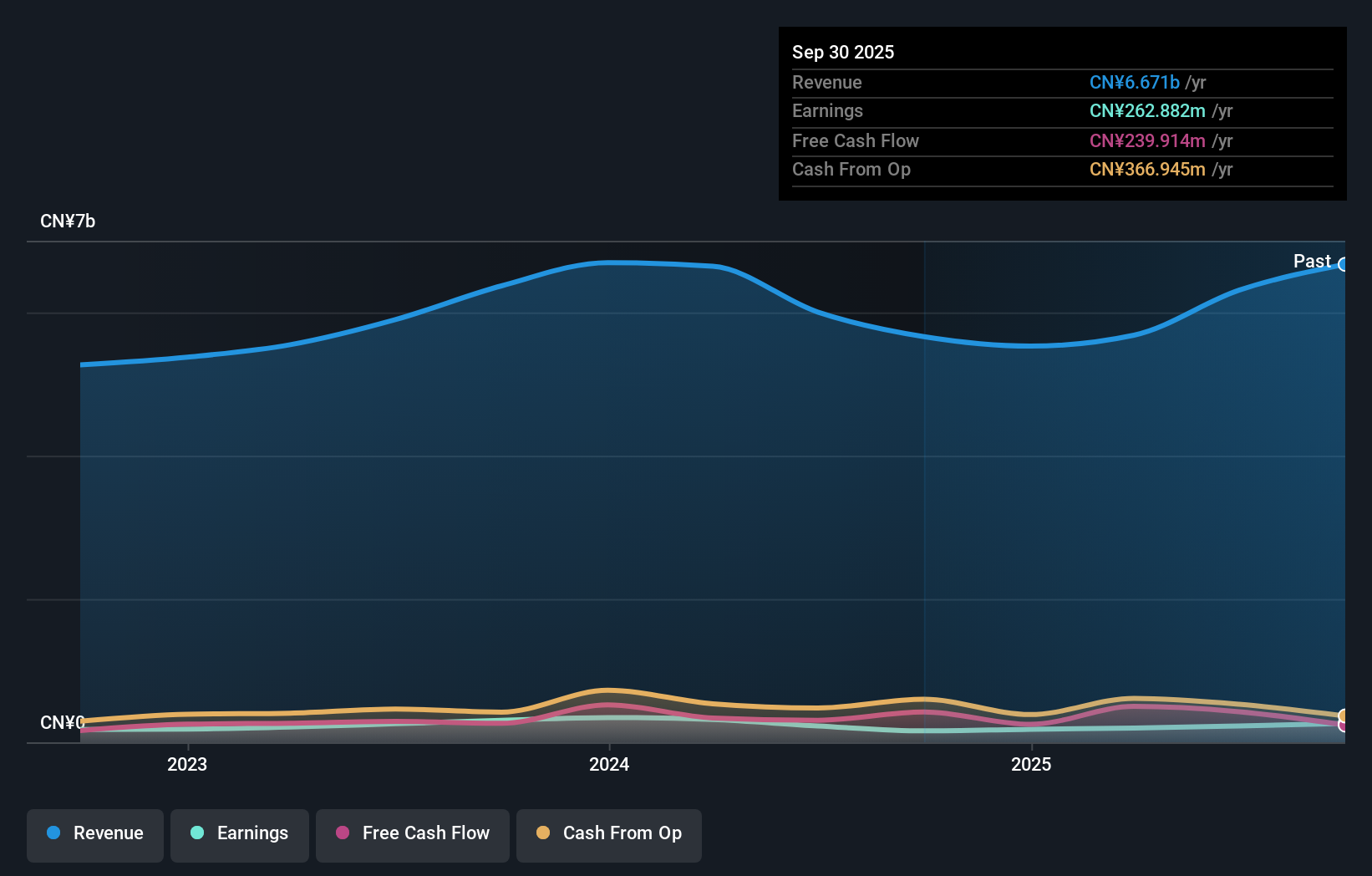

Jiangsu Lopal Tech (SHSE:603906)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Lopal Tech Co., Ltd. focuses on the R&D, production, and sale of lithium iron phosphate cathode materials and environmental protection fine chemicals for vehicles both in China and internationally, with a market cap of CN¥6.17 billion.

Operations: The company generates revenue through its activities in the development, manufacturing, and distribution of lithium iron phosphate cathode materials and vehicle-related environmental protection fine chemicals.

Insider Ownership: 35.8%

Earnings Growth Forecast: 125.9% p.a.

Jiangsu Lopal Tech is forecast to achieve significant revenue growth of 25.7% annually, outpacing the broader Chinese market. Despite this, the company faces challenges with low return on equity projections and recent asset impairment issues that could reduce net profit by up to RMB 164.86 million. Trading at a substantial discount compared to its fair value and peers, it remains an attractive prospect for growth-focused investors despite past shareholder dilution concerns.

- Click to explore a detailed breakdown of our findings in Jiangsu Lopal Tech's earnings growth report.

- Our valuation report unveils the possibility Jiangsu Lopal Tech's shares may be trading at a discount.

Macmic Science&TechnologyLtd (SHSE:688711)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Macmic Science&Technology Co., Ltd. designs, develops, produces, and sells power semiconductor chips, single tubes, and modules in Taiwan and internationally with a market cap of CN¥3.62 billion.

Operations: The company's revenue primarily comes from its semiconductors segment, which generated CN¥1.35 billion.

Insider Ownership: 26.4%

Earnings Growth Forecast: 84% p.a.

Macmic Science & Technology Ltd. is poised for substantial earnings growth at 84% per year, surpassing the broader Chinese market's 25.3% rate, despite slower revenue growth of 19.1%. The company recently completed a share buyback worth CNY 9.62 million and plans further repurchases up to CNY 50 million, potentially boosting shareholder value. However, challenges include low return on equity forecasts and declining profit margins from last year's figures.

- Take a closer look at Macmic Science&TechnologyLtd's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Macmic Science&TechnologyLtd is trading beyond its estimated value.

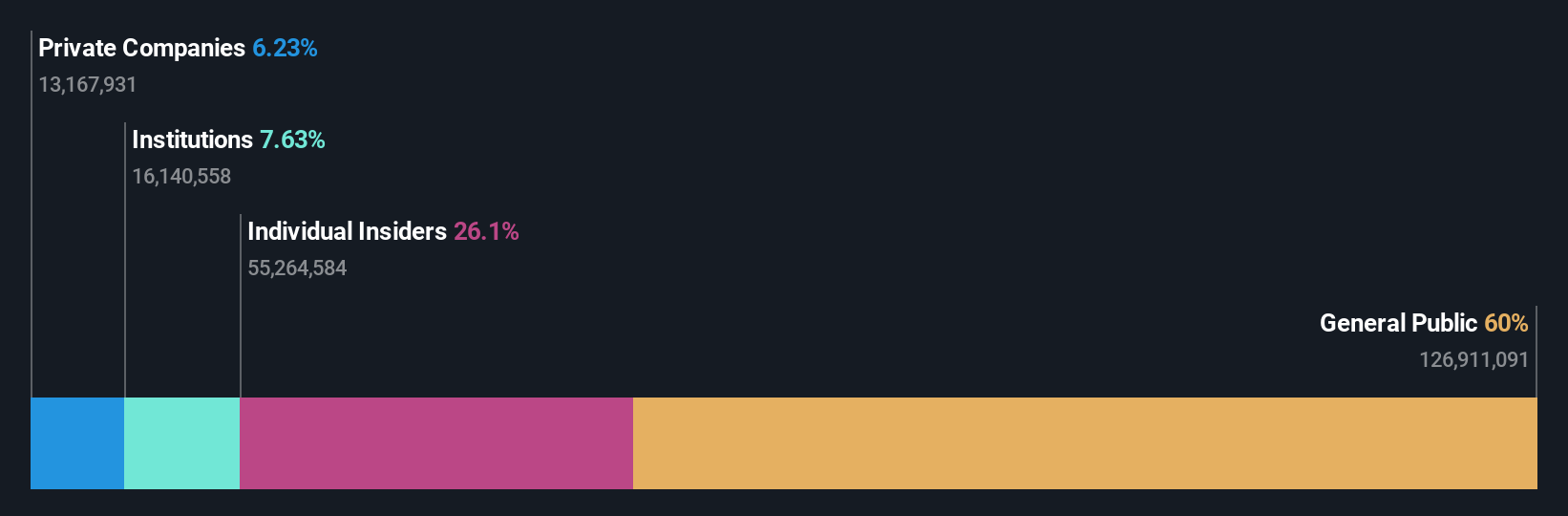

Xiamen Jihong Technology (SZSE:002803)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xiamen Jihong Technology Co., Ltd. operates in the cross-border social e-commerce sector in China and has a market cap of CN¥5.21 billion.

Operations: Revenue Segments (in millions of CN¥): [No specific revenue segment details provided in the text.]

Insider Ownership: 35%

Earnings Growth Forecast: 38.1% p.a.

Xiamen Jihong Technology is positioned for strong growth, with earnings expected to increase by 38.1% annually, outpacing the Chinese market's 25.3%. Revenue is also forecasted to grow at a robust 22.2% per year. Despite trading at a significant discount to its fair value and showing good relative value compared to peers, profit margins have decreased from last year, and dividends are not well covered by earnings. Recent buyback activity has been inactive.

- Navigate through the intricacies of Xiamen Jihong Technology with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Xiamen Jihong Technology's current price could be quite moderate.

Seize The Opportunity

- Click this link to deep-dive into the 1462 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603906

Jiangsu Lopal Tech. Group

Engages in the research and development, production, and sale of lithium iron phosphate cathode materials and environmental protection fine chemicals for vehicles in China and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives