- China

- /

- Semiconductors

- /

- SHSE:688702

Revenues Not Telling The Story For Suzhou Centec Communications Co., Ltd. (SHSE:688702) After Shares Rise 36%

Despite an already strong run, Suzhou Centec Communications Co., Ltd. (SHSE:688702) shares have been powering on, with a gain of 36% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 75% in the last year.

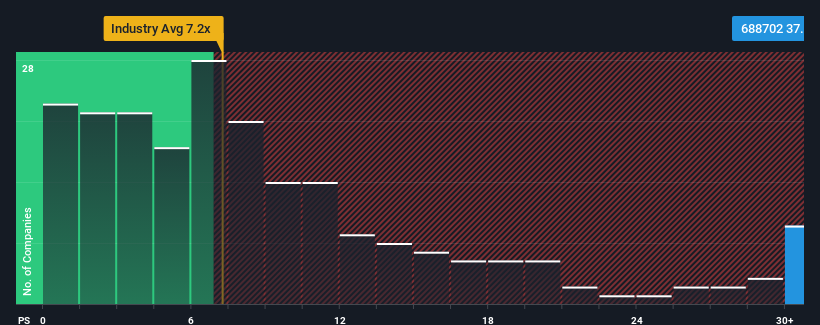

Since its price has surged higher, Suzhou Centec Communications may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 37.7x, since almost half of all companies in the Semiconductor industry in China have P/S ratios under 7.2x and even P/S lower than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Suzhou Centec Communications

What Does Suzhou Centec Communications' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Suzhou Centec Communications' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Suzhou Centec Communications' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Suzhou Centec Communications' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 111% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 49% as estimated by the only analyst watching the company. That's shaping up to be similar to the 49% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Suzhou Centec Communications' P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

The strong share price surge has lead to Suzhou Centec Communications' P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Suzhou Centec Communications currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Suzhou Centec Communications that you need to be mindful of.

If these risks are making you reconsider your opinion on Suzhou Centec Communications, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688702

Suzhou Centec Communications

Provides ethernet switch silicon products and network solutions for 5G, cloud computing, machine learning and industrial markets.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives