- Hong Kong

- /

- Diversified Financial

- /

- SEHK:2598

3 Asian Growth Companies With High Insider Ownership Expecting 16% Revenue Growth

Reviewed by Simply Wall St

In the current global market landscape, Asian markets have shown resilience amid ongoing trade uncertainties and economic policy shifts. As investors navigate these conditions, companies with strong insider ownership and robust growth prospects stand out as attractive opportunities, particularly those expecting significant revenue increases.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 34.3% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.2% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 45.7% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| UTour Group (SZSE:002707) | 24.1% | 32.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

We'll examine a selection from our screener results.

Lianlian DigiTech (SEHK:2598)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lianlian DigiTech Co., Ltd. offers digital payment and value-added services to small and midsized merchants and enterprises in China, with a market cap of HK$12.06 billion.

Operations: Lianlian DigiTech's revenue segments include Global Payment services generating CN¥807.77 million, Domestic Payment services with CN¥342.86 million, and Value-Added Services contributing CN¥146.19 million.

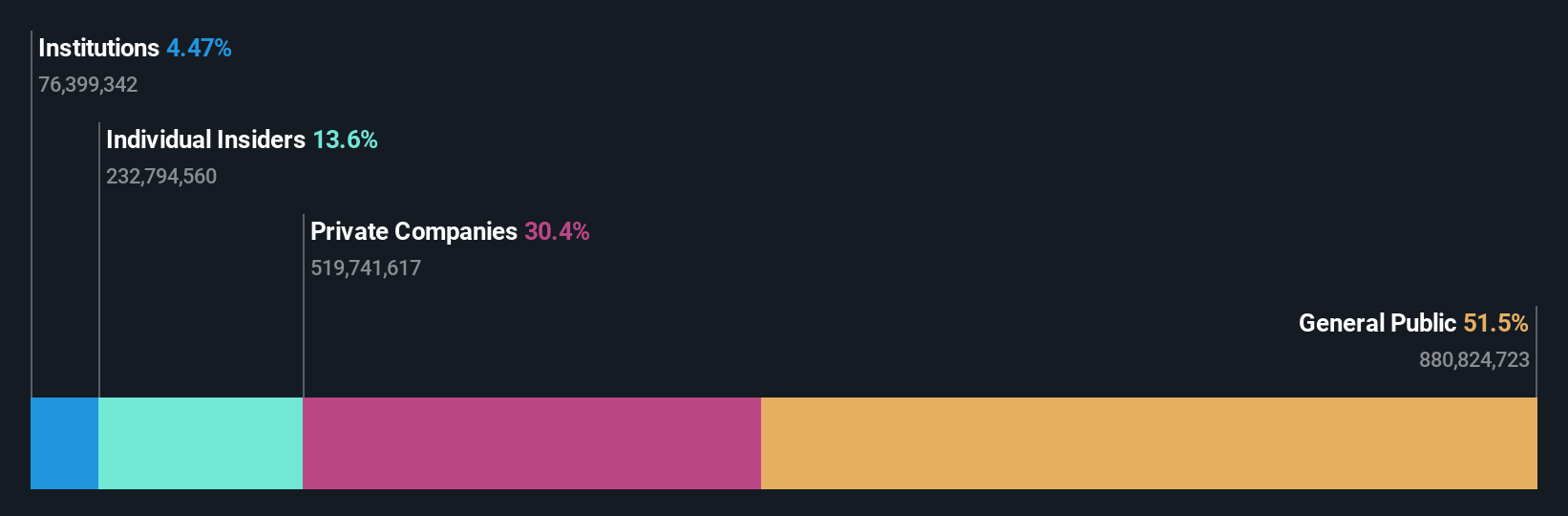

Insider Ownership: 19.7%

Revenue Growth Forecast: 16.7% p.a.

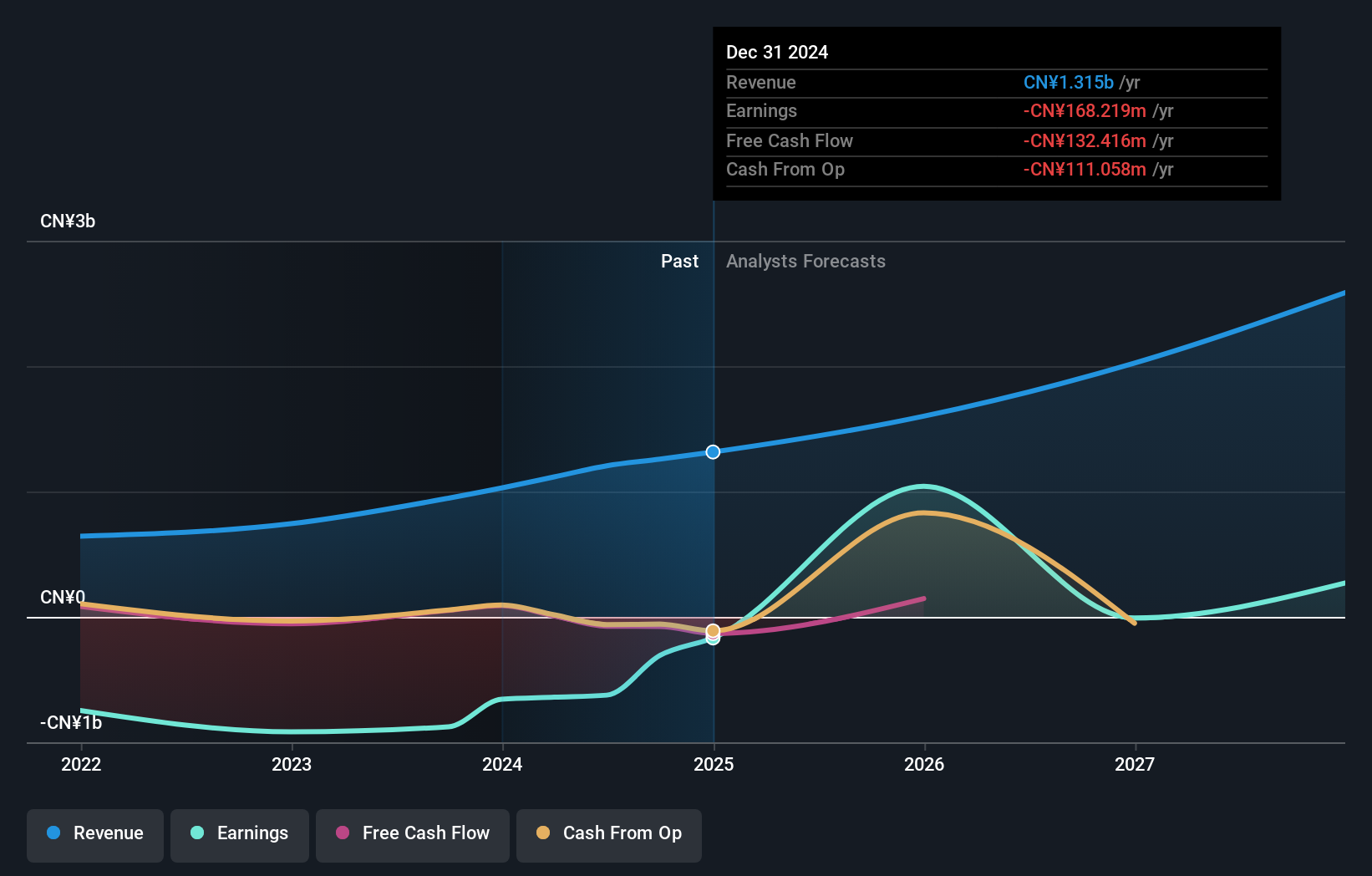

Lianlian DigiTech demonstrates strong growth potential with revenue forecasted to increase at 16.7% annually, outpacing the Hong Kong market average. Despite a net loss of CNY 168.22 million in 2024, it marks a significant improvement from the previous year. The company is anticipated to achieve profitability within three years, reflecting above-average market growth expectations. Recent board changes include Ms. Chan Yuen Mui's appointment as Joint Company Secretary, enhancing governance with her extensive experience in corporate administration.

- Click to explore a detailed breakdown of our findings in Lianlian DigiTech's earnings growth report.

- Our comprehensive valuation report raises the possibility that Lianlian DigiTech is priced higher than what may be justified by its financials.

Bestechnic (Shanghai) (SHSE:688608)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bestechnic (Shanghai) Co., Ltd. focuses on the research, design, development, manufacture, and sale of smart audio and video SoC chips in China with a market cap of CN¥44.46 billion.

Operations: The company's revenue is primarily derived from its Integrated Circuit segment, amounting to CN¥3.26 billion.

Insider Ownership: 25.7%

Revenue Growth Forecast: 23.8% p.a.

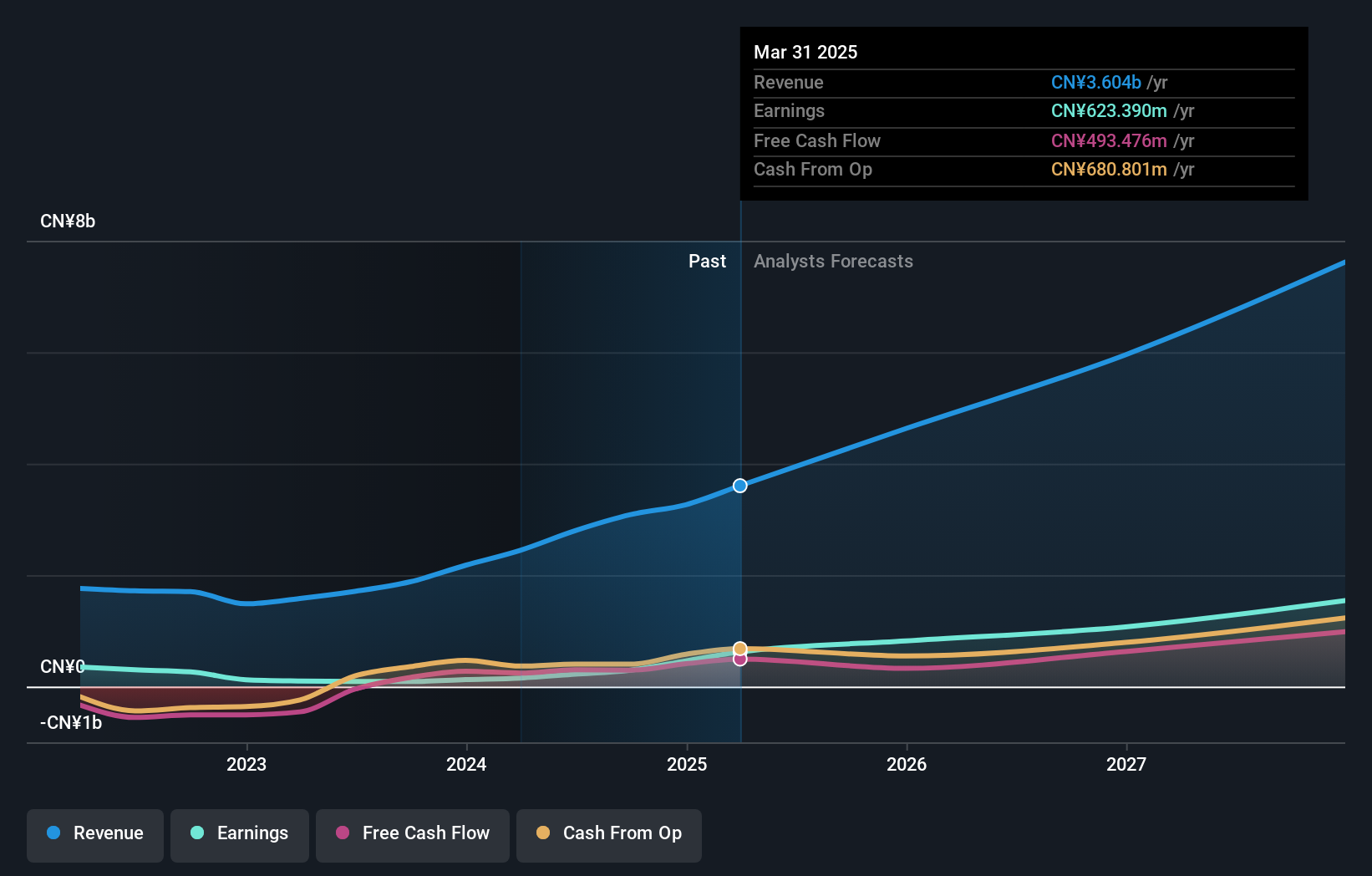

Bestechnic (Shanghai) shows robust growth potential, with earnings surging by 271.7% last year and revenue forecasted to grow at 23.8% annually, surpassing the Chinese market average. The company reported sales of CNY 3.26 billion for 2024, up from CNY 2.18 billion in the previous year, alongside net income growth to CNY 459.52 million from CNY 123.63 million, despite a highly volatile share price recently and low future Return on Equity expectations at around 10%.

- Get an in-depth perspective on Bestechnic (Shanghai)'s performance by reading our analyst estimates report here.

- The analysis detailed in our Bestechnic (Shanghai) valuation report hints at an inflated share price compared to its estimated value.

Fulin Precision (SZSE:300432)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fulin Precision Co., Ltd. focuses on the research, development, manufacture, and sale of automotive engine parts in China and has a market cap of CN¥28.76 billion.

Operations: Fulin Precision's revenue segments include the research, development, manufacture, and sale of automotive engine parts in China.

Insider Ownership: 13.6%

Revenue Growth Forecast: 45.6% p.a.

Fulin Precision exhibits strong growth prospects, with earnings expected to grow significantly at 78.6% annually, outpacing the Chinese market average of 25%. Revenue is also projected to increase by 45.6% per year, surpassing the market's 13% rate. The company has recently turned profitable and maintains a high forecasted Return on Equity of 24.9%. However, its share price has been highly volatile in recent months without substantial insider trading activity reported recently.

- Delve into the full analysis future growth report here for a deeper understanding of Fulin Precision.

- Insights from our recent valuation report point to the potential overvaluation of Fulin Precision shares in the market.

Taking Advantage

- Reveal the 644 hidden gems among our Fast Growing Asian Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2598

Lianlian DigiTech

Provides digital payment services and value-added services to small and midsized merchants and enterprises in China and internationally.

Fair value with acceptable track record.

Market Insights

Community Narratives