- China

- /

- Semiconductors

- /

- SHSE:688256

Global Growth Companies With High Insider Ownership In April 2025

Reviewed by Simply Wall St

As global markets navigate heightened volatility due to escalating trade tensions and shifting economic policies, investors are keenly observing the impact on consumer sentiment and stock indices. Amidst this uncertainty, growth companies with high insider ownership often attract attention for their potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 24.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.3% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 60.7% |

Here we highlight a subset of our preferred stocks from the screener.

Smoore International Holdings (SEHK:6969)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Smoore International Holdings Limited is an investment holding company that provides vaping technology solutions, with a market cap of HK$73.81 billion.

Operations: The company generates revenue primarily from the sale of APV and vaping devices and components, amounting to CN¥11.80 billion.

Insider Ownership: 39.4%

Smoore International Holdings exhibits promising growth potential with earnings forecasted to grow significantly at 23.4% annually, surpassing the Hong Kong market's average growth rate. Despite trading at 15.5% below its estimated fair value, recent financial results show a decline in net income from CNY 1,645.09 million to CNY 1,303.26 million year-over-year. No substantial insider trading activity was reported over the past three months, maintaining investor confidence in its long-term prospects.

- Dive into the specifics of Smoore International Holdings here with our thorough growth forecast report.

- Our valuation report unveils the possibility Smoore International Holdings' shares may be trading at a premium.

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cambricon Technologies Corporation Limited focuses on researching, developing, designing, and selling core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of CN¥256.58 billion.

Operations: Cambricon Technologies generates revenue from core chips used in cloud servers, edge computing, and terminal equipment within China.

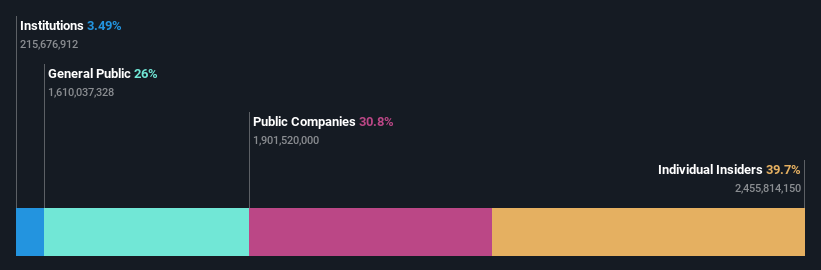

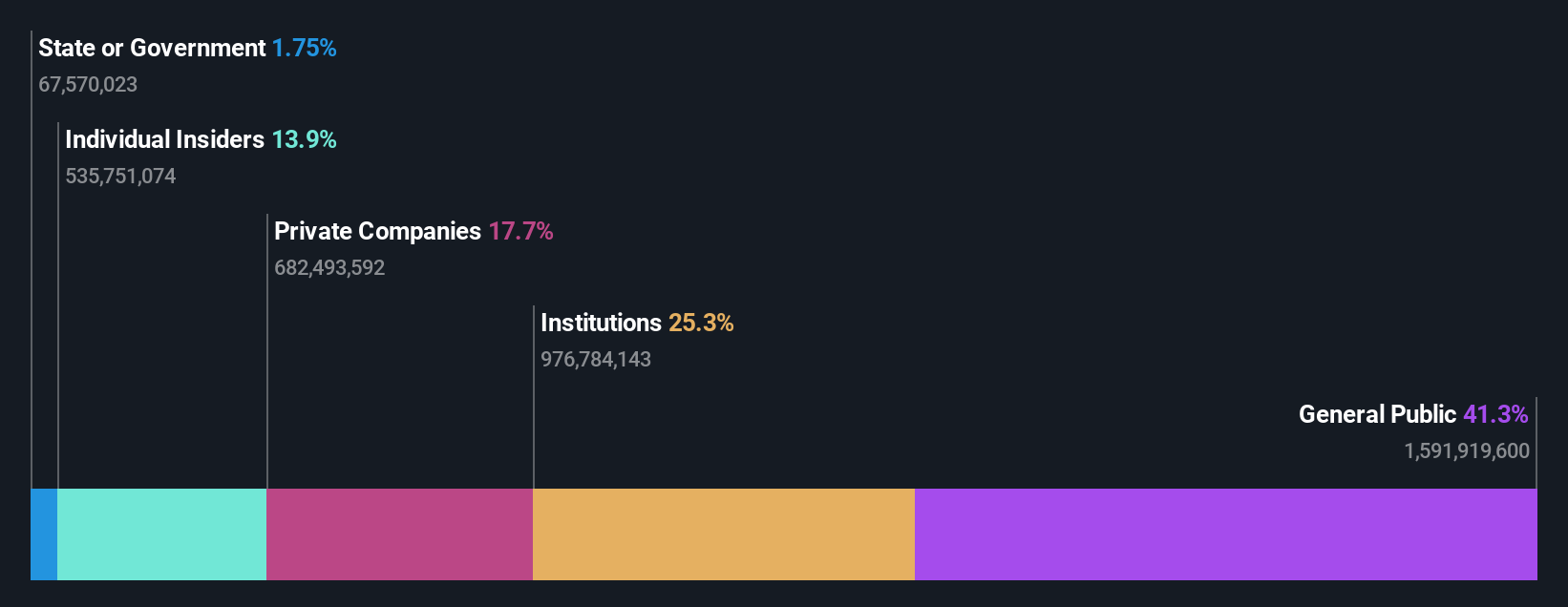

Insider Ownership: 28.7%

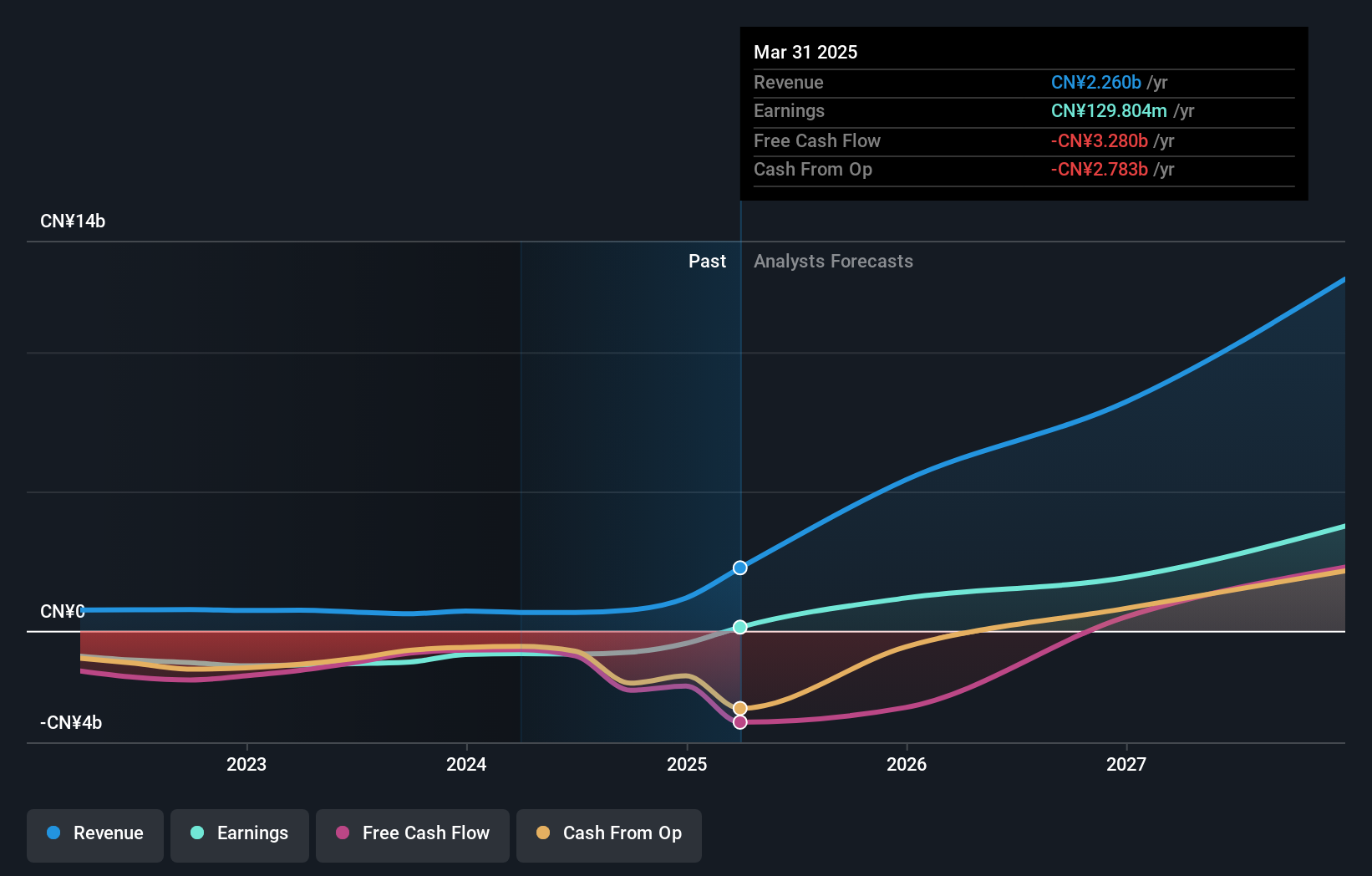

Cambricon Technologies demonstrates strong growth potential with forecasted revenue growth of 41.5% annually, outpacing the Chinese market's average. The company reported a significant reduction in net loss from CNY 848.44 million to CNY 443.2 million year-over-year, indicating improved financial health. Despite high share price volatility and low expected return on equity (8.5%), its projected profitability within three years suggests a promising trajectory for investors focused on growth companies with substantial insider ownership influences.

- Click here to discover the nuances of Cambricon Technologies with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Cambricon Technologies shares in the market.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with operations spanning Asia, the Americas, Europe, and other international markets, and has a market cap of approximately NT$830.65 billion.

Operations: The Electronics Sector generates NT$3.05 billion in revenue for the company.

Insider Ownership: 13.7%

Quanta Computer's recent earnings report highlights robust growth, with sales reaching TWD 1.41 trillion and net income increasing to TWD 59.7 billion for 2024. The company's revenue is projected to grow at 27.7% annually, surpassing the market average, while its earnings are expected to rise by 17%, outpacing the Taiwanese market's rate. Despite a dividend yield of 5.71% not fully covered by free cash flows, Quanta trades at a favorable P/E ratio of 14.7x compared to peers.

- Unlock comprehensive insights into our analysis of Quanta Computer stock in this growth report.

- Upon reviewing our latest valuation report, Quanta Computer's share price might be too pessimistic.

Turning Ideas Into Actions

- Reveal the 863 hidden gems among our Fast Growing Global Companies With High Insider Ownership screener with a single click here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688256

Cambricon Technologies

Research, develops, design, and sells core chips in cloud server, edge computing, and terminal equipment in China.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives