- Hong Kong

- /

- Industrials

- /

- SEHK:2722

Discovering Three Hidden Small Cap Gems with Solid Potential

Reviewed by Simply Wall St

In a global market environment where major U.S. stock indexes are nearing record highs and inflation concerns are prompting cautious monetary policies, small-cap stocks have been lagging behind the broader indices. As investors navigate these dynamics, identifying promising small-cap companies with strong fundamentals and growth potential can be an effective strategy to capitalize on undervalued opportunities in this segment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Wema Bank | 45.02% | 36.14% | 60.04% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

| Konya Kagit Sanayi ve Ticaret | 0.67% | 24.97% | 7.82% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Chongqing Machinery & Electric (SEHK:2722)

Simply Wall St Value Rating: ★★★★☆☆

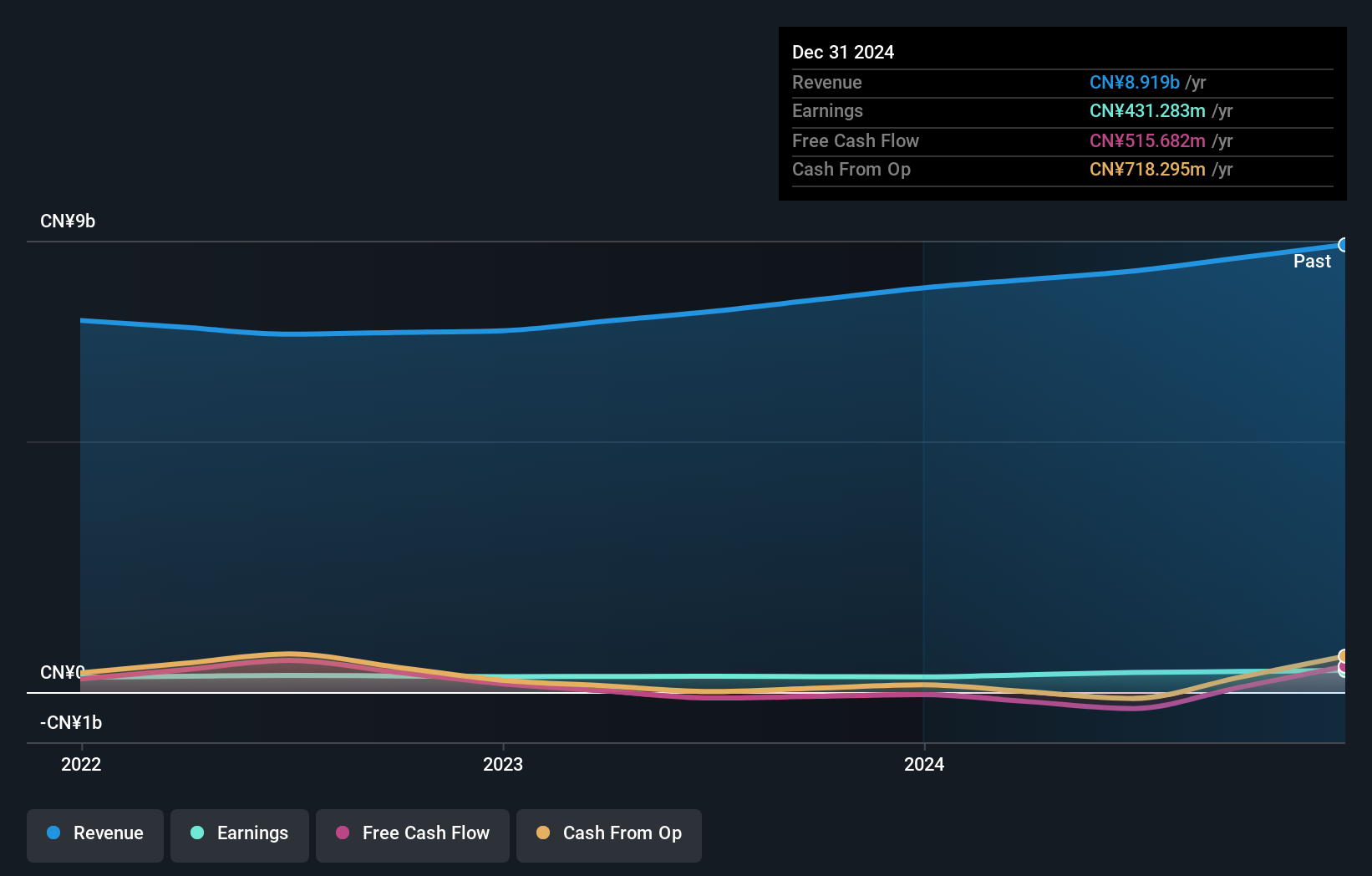

Overview: Chongqing Machinery & Electric Co., Ltd. operates in the design, manufacturing, and sale of clean energy and high-end smart manufacturing equipment across China and Europe, with a market cap of HK$2.69 billion.

Operations: The company's primary revenue streams include hydroelectric generation equipment (CN¥2.32 billion), general machinery (CN¥2.23 billion), and wire and cable (CN¥1.89 billion). Other significant contributions come from numerically controlled machine tools (CN¥805.25 million) and intelligent manufacturing (CN¥550.04 million).

Chongqing Machinery & Electric, a notable player in the industrial sector, has been making waves with its strategic moves and solid performance. Over the past year, earnings grew by 24%, outpacing the industrials industry average of 4.5%. The company boasts a favorable price-to-earnings ratio of 7.4x compared to the Hong Kong market's 10.2x, suggesting it might be undervalued. Additionally, its debt-to-equity ratio improved significantly from 45% to 27.8% over five years, indicating better financial health. Recent executive changes include Mr. Qin Shaobo's appointment as an executive director and temporary CFO leadership by Mr. Yue Xiangjun after Ms. Liu Zhongtang's retirement.

- Unlock comprehensive insights into our analysis of Chongqing Machinery & Electric stock in this health report.

Learn about Chongqing Machinery & Electric's historical performance.

Suzhou Shihua New Material Technology (SHSE:688093)

Simply Wall St Value Rating: ★★★★★★

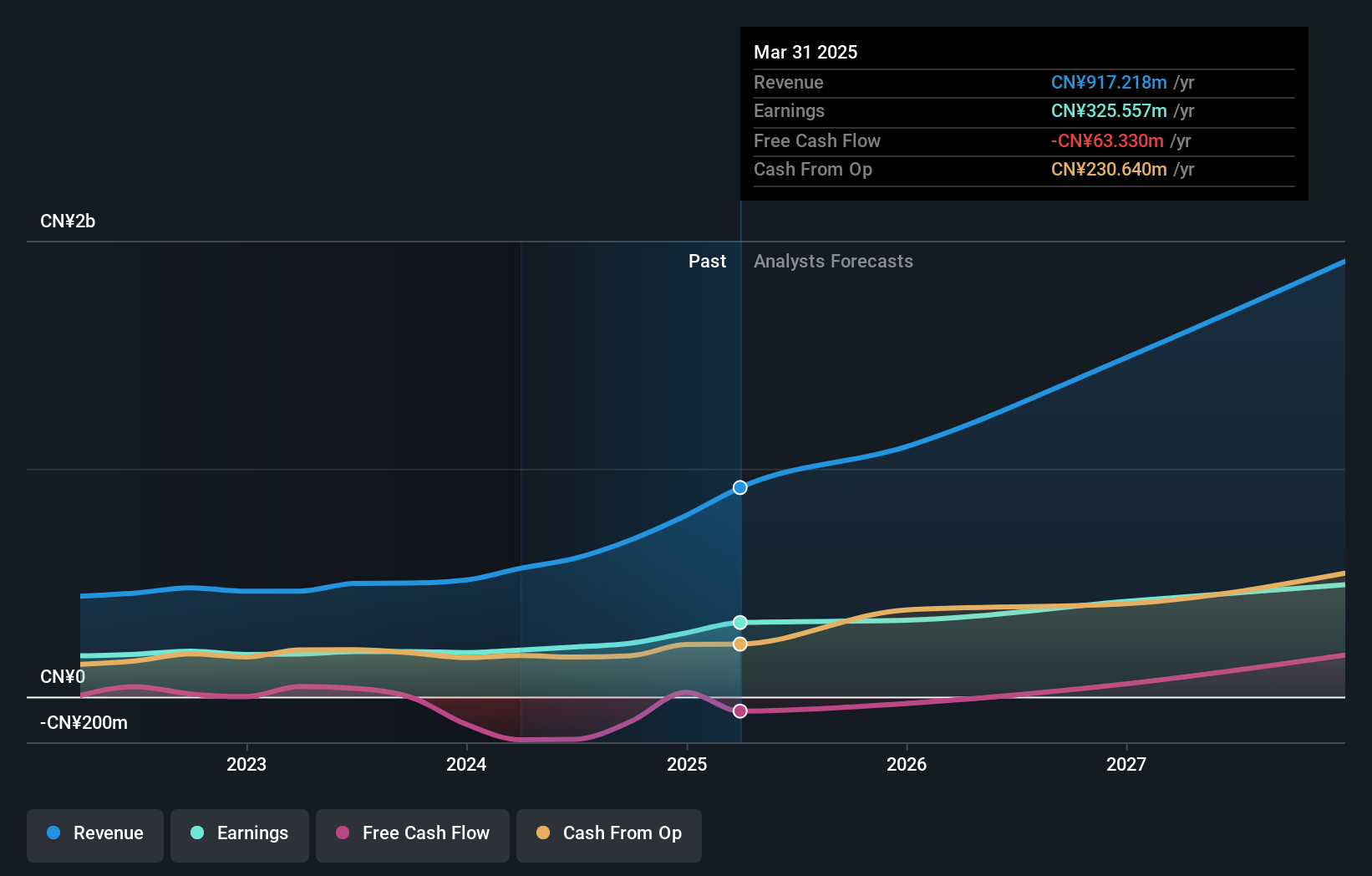

Overview: Suzhou Shihua New Material Technology Co., Ltd. is a company focused on the development and production of advanced materials, with a market cap of CN¥5.61 billion.

Operations: Suzhou Shihua New Material Technology generates revenue primarily from its advanced materials segment, contributing significantly to its financial performance. The company has a market capitalization of CN¥5.61 billion.

Suzhou Shihua New Material Technology stands out with its debt-free status, a significant shift from a debt to equity ratio of 11.9% five years ago. The company has shown impressive earnings growth of 18.4% over the past year, outpacing the broader chemicals industry, which saw a -5.4%. Despite not being free cash flow positive recently, it trades at an attractive 21.4% below estimated fair value and is expected to grow earnings by 25.3% annually. A recent private placement aims to raise CNY 600 million, reflecting strategic moves for future expansion in its niche market segment.

Shanghai Prisemi ElectronicsLtd (SHSE:688230)

Simply Wall St Value Rating: ★★★★★☆

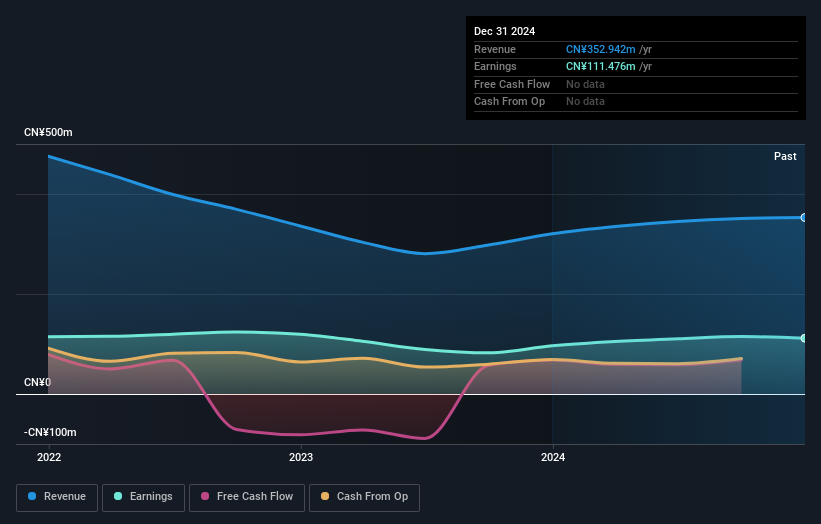

Overview: Shanghai Prisemi Electronics Co., Ltd. is a high-tech company focused on the research, development, production, and sale of power integrated circuits (ICs) and power devices in China with a market capitalization of CN¥5.57 billion.

Operations: Prisemi generates revenue primarily from its integrated circuit segment, which accounts for CN¥352.94 million. The company's market capitalization stands at CN¥5.57 billion.

Shanghai Prisemi Electronics, a smaller player in the semiconductor space, has shown promising financial health. Its price-to-earnings ratio of 52.2x is attractive compared to the industry average of 67.4x, suggesting potential value for investors. The company's earnings grew by 15% over the past year, outpacing the industry's growth rate of 13%. Additionally, it reported a net income increase from CNY 96 million to CNY 111 million for the full year ending December 2024. With high-quality earnings and sufficient cash to cover its debt obligations, Prisemi seems well-positioned in its market niche.

Make It Happen

- Click here to access our complete index of 4746 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2722

Chongqing Machinery & Electric

Designs, manufactures, and sells clean energy equipment and high-end smart manufacturing equipment.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)