- China

- /

- Semiconductors

- /

- SHSE:688123

Undiscovered Gems And 2 Other Small Caps Backed By Strong Fundamentals

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating indices and economic uncertainties, small-cap stocks are experiencing mixed performance, with the S&P 600 reflecting these broader trends. Amidst this backdrop of volatility and competitive pressures, particularly in the tech sector due to emerging AI developments, investors are increasingly seeking companies with robust fundamentals that can weather such market dynamics. Identifying promising small-cap stocks involves looking for those with strong financial health and growth potential that align well with current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.78% | 27.31% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Giantec Semiconductor (SHSE:688123)

Simply Wall St Value Rating: ★★★★★★

Overview: Giantec Semiconductor Corporation is engaged in the manufacturing and sale of integrated circuits both within China and internationally, with a market capitalization of CN¥11.90 billion.

Operations: Giantec Semiconductor generates revenue primarily from the integrated circuit design industry, amounting to CN¥970.87 million.

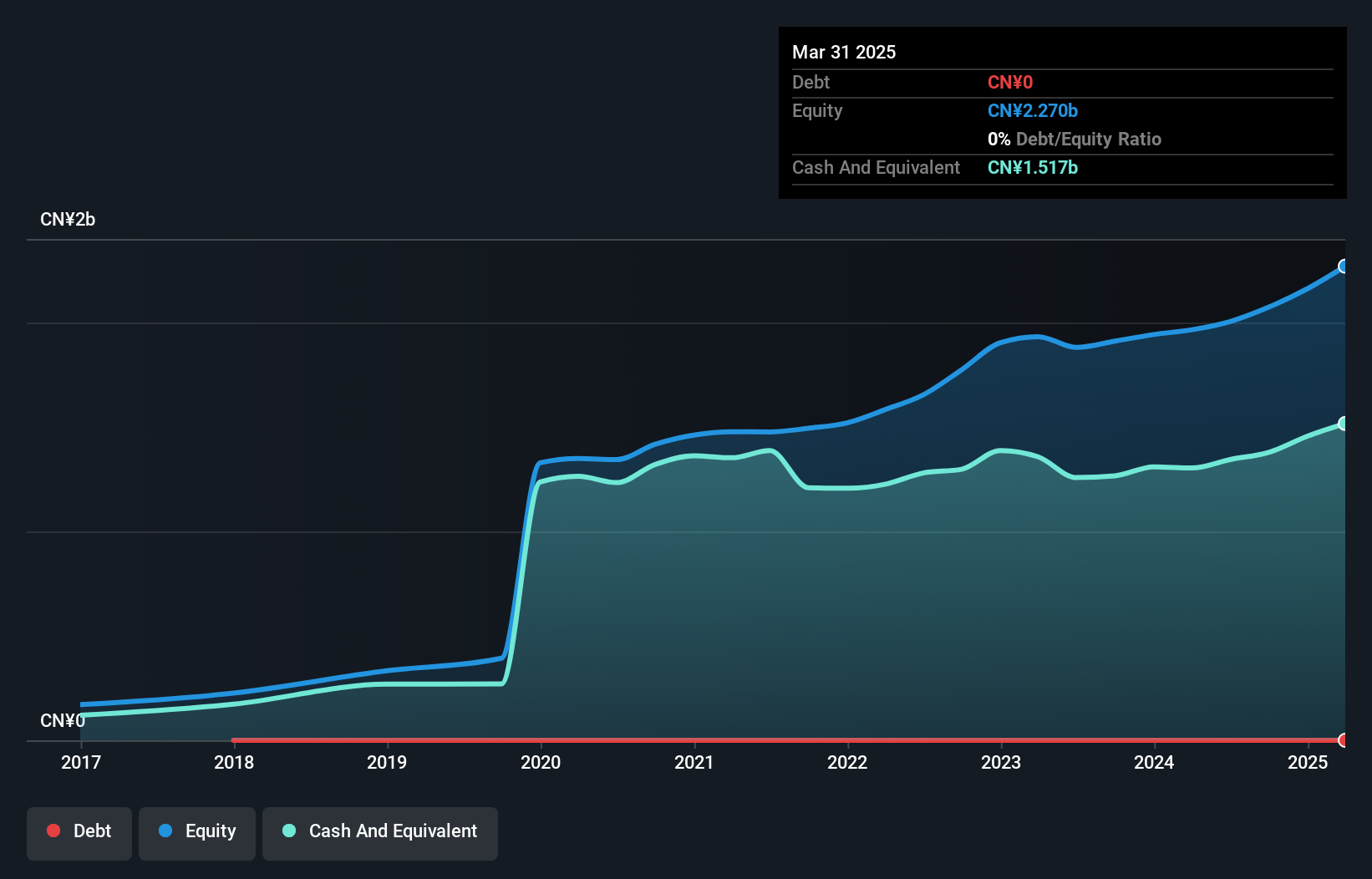

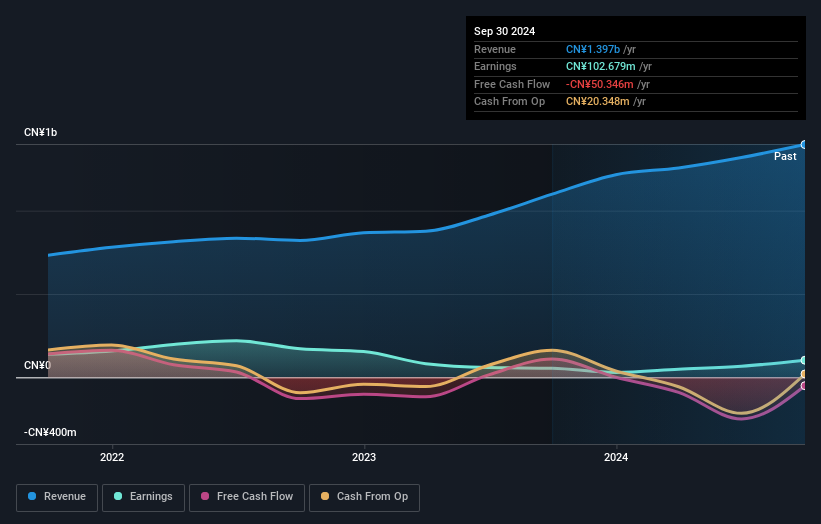

Giantec Semiconductor, a nimble player in the semiconductor sector, has shown remarkable earnings growth of 29% over the past year, outpacing the industry average of 12.9%. With no debt for five years and a price-to-earnings ratio of 51.9x that sits comfortably below the industry norm of 62.9x, it offers appealing value compared to its peers. The company seems to benefit from high-quality earnings and positive free cash flow, with recent figures at US$227 million as of September 2024. Looking ahead, projected annual earnings growth is pegged at an impressive 42%, suggesting robust potential for future expansion.

- Dive into the specifics of Giantec Semiconductor here with our thorough health report.

Evaluate Giantec Semiconductor's historical performance by accessing our past performance report.

Shenzhen Injoinic TechnologyLtd (SHSE:688209)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Injoinic Technology Co.,Ltd. is an IC design company that specializes in designing, developing, manufacturing, and selling digital-analog hybrid chips with a market cap of CN¥8.31 billion.

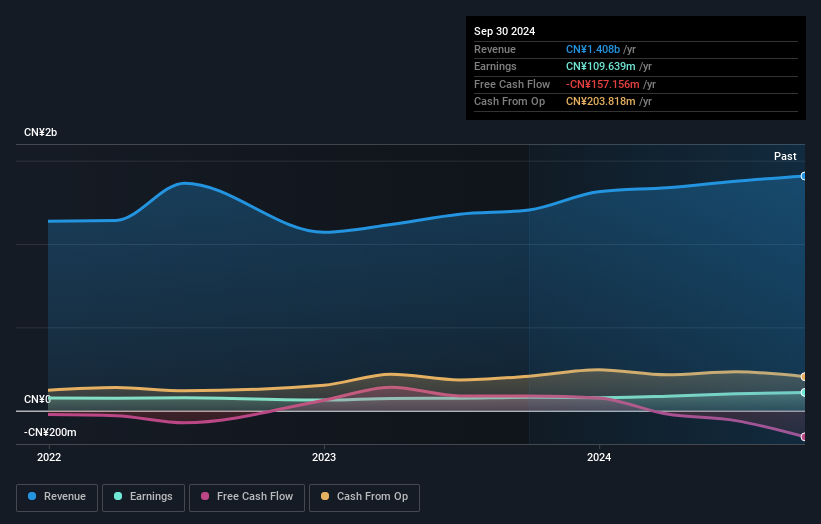

Operations: Injoinic generates revenue primarily from the sale of integrated circuits, amounting to CN¥1.40 billion.

Shenzhen Injoinic Technology, a player in the semiconductor sector, has shown impressive earnings growth of 88% over the past year, significantly outpacing the industry's 13%. Despite this recent surge, its earnings have decreased by an average of 6% annually over five years. The company operates without debt, which simplifies financial management and eliminates interest payment concerns. Recent corporate activities include a notable acquisition where Shanghai Wuyuefeng Phase III Private Investment Fund acquired an 8.87% stake for CNY 650 million (approximately US$102 million), indicating strategic interest in its potential growth trajectory.

Sanbo Hospital Management Group (SZSE:301293)

Simply Wall St Value Rating: ★★★★★★

Overview: Sanbo Hospital Management Group Limited operates a network of hospitals providing medical services, with a market capitalization of CN¥9.54 billion.

Operations: Sanbo Hospital Management Group generates revenue primarily from its healthcare facilities and services, amounting to CN¥1.41 billion.

Sanbo Hospital Management Group, a relatively smaller player in the healthcare sector, has shown impressive earnings growth of 36.9% over the past year, outpacing the industry average of -5.7%. The company is debt-free, having reduced its debt to equity ratio from 3% five years ago to zero today. Despite not being free cash flow positive recently, Sanbo's profitability ensures that cash runway isn't a concern. Notably, it completed a share buyback of nearly 3 million shares for CNY 104.19 million in late 2024, reflecting confidence in its valuation and future potential within the healthcare market.

Summing It All Up

- Navigate through the entire inventory of 4721 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688123

Giantec Semiconductor

Manufactures and sells integrated circuits in China and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives