- China

- /

- Semiconductors

- /

- SHSE:603986

What Giga Device Semiconductor Inc.'s (SHSE:603986) 26% Share Price Gain Is Not Telling You

Those holding Giga Device Semiconductor Inc. (SHSE:603986) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

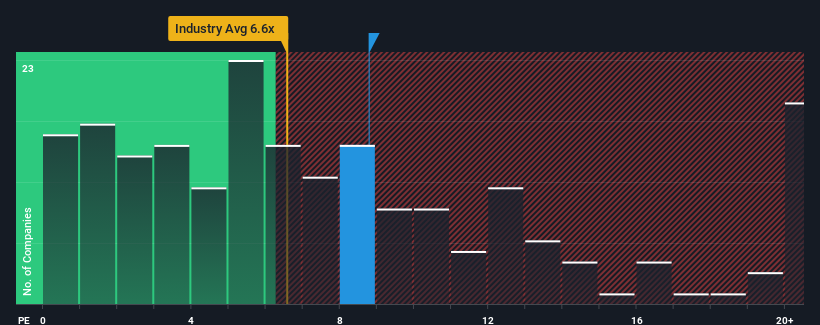

Since its price has surged higher, Giga Device Semiconductor may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 8.8x, since almost half of all companies in the Semiconductor in China have P/S ratios under 6.6x and even P/S lower than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Giga Device Semiconductor

What Does Giga Device Semiconductor's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Giga Device Semiconductor's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Giga Device Semiconductor's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Giga Device Semiconductor?

In order to justify its P/S ratio, Giga Device Semiconductor would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's top line. Still, the latest three year period has seen an excellent 38% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 20% per annum as estimated by the analysts watching the company. With the industry predicted to deliver 31% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Giga Device Semiconductor's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Giga Device Semiconductor's P/S

The large bounce in Giga Device Semiconductor's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Giga Device Semiconductor trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about these 3 warning signs we've spotted with Giga Device Semiconductor.

If these risks are making you reconsider your opinion on Giga Device Semiconductor, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603986

Giga Device Semiconductor

A fabless company, provides engages in the research and development, technical support, and sales of memories, microcontrollers, and sensors.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives