Asian Growth Stocks With Strong Insider Confidence For April 2025

Reviewed by Simply Wall St

As Asian markets navigate the complexities of escalating trade tensions and fluctuating consumer sentiment, investors are increasingly seeking stability in companies where insider ownership signals strong confidence. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate that those closest to the company believe in its long-term growth potential despite external uncertainties.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 27% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.3% |

| Sineng ElectricLtd (SZSE:300827) | 35.9% | 42.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Synspective (TSE:290A) | 12.8% | 44.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Let's explore several standout options from the results in the screener.

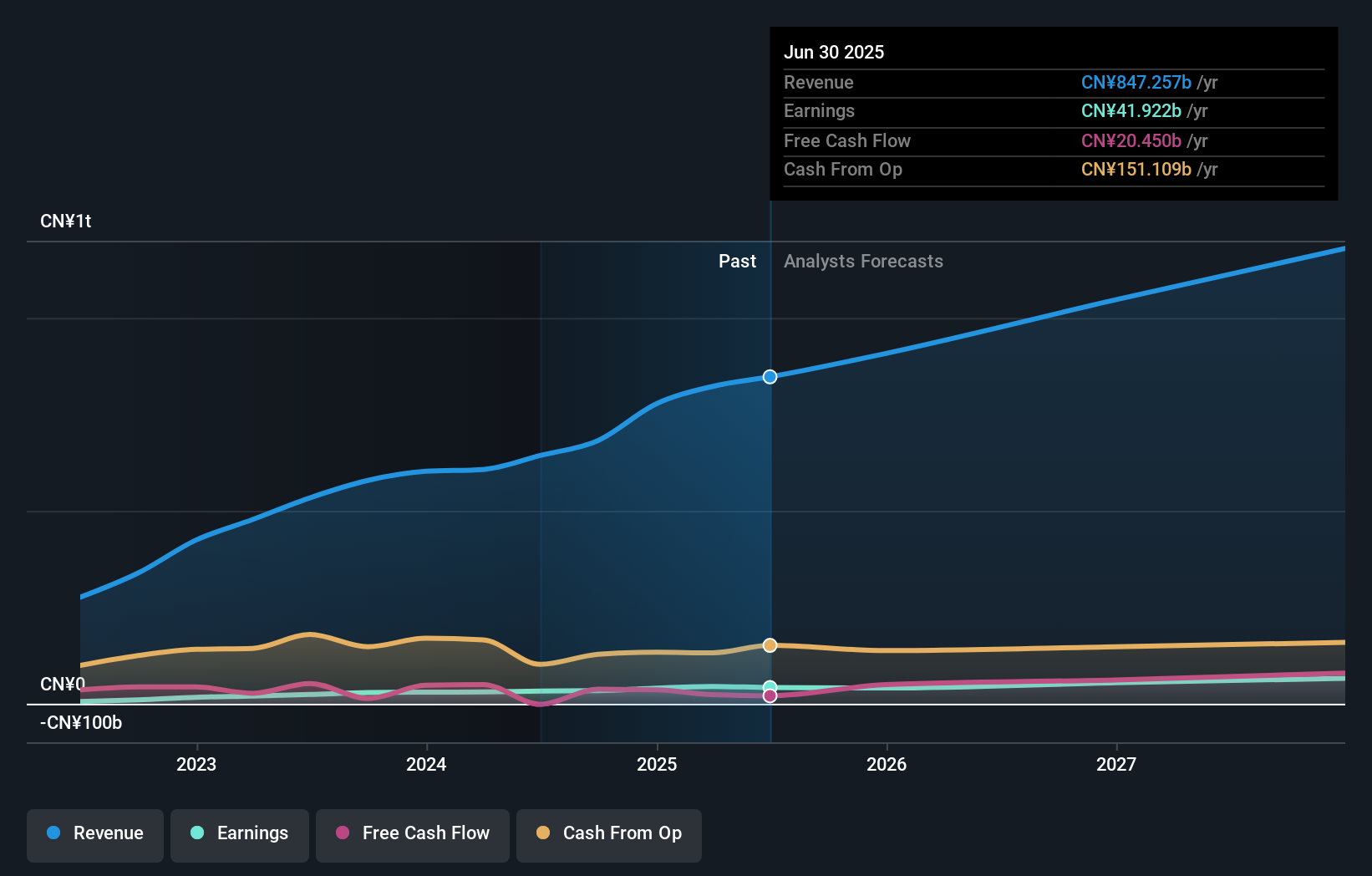

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally with a market cap of approximately HK$1151.27 billion.

Operations: The company generates revenue from two primary segments: Automobiles and Related Products at CN¥620.73 billion and Mobile Handset Components, Assembly Service, and Other Products at CN¥179.13 billion.

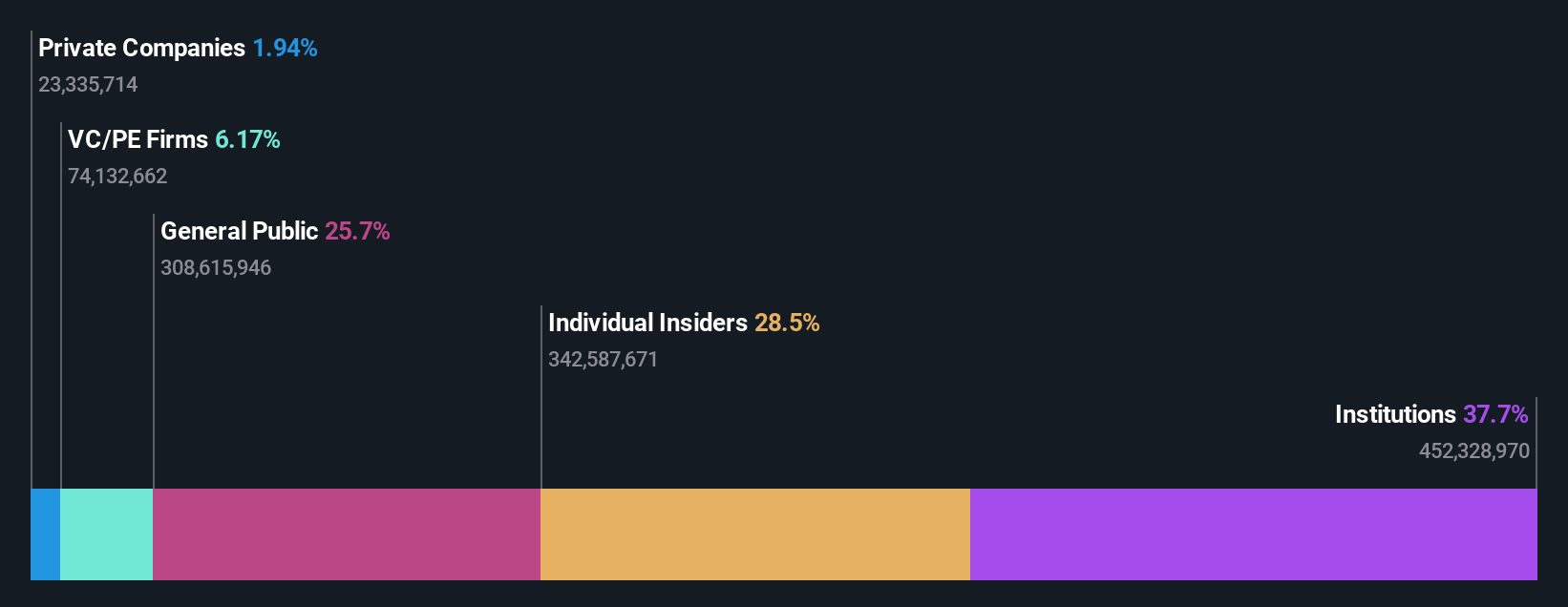

Insider Ownership: 28.6%

Revenue Growth Forecast: 13.4% p.a.

BYD demonstrates strong growth potential with significant insider ownership, trading at 29.2% below its estimated fair value. The company forecasts earnings growth of 16.06% annually, outpacing the Hong Kong market's average. Recent guidance highlights a substantial increase in net profit for Q1 2025, driven by record sales in the new energy vehicle (NEV) sector and international expansion. BYD's strategic vertical integration enhances profitability, while its innovative energy storage solutions bolster market leadership.

- Navigate through the intricacies of BYD with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, BYD's share price might be too optimistic.

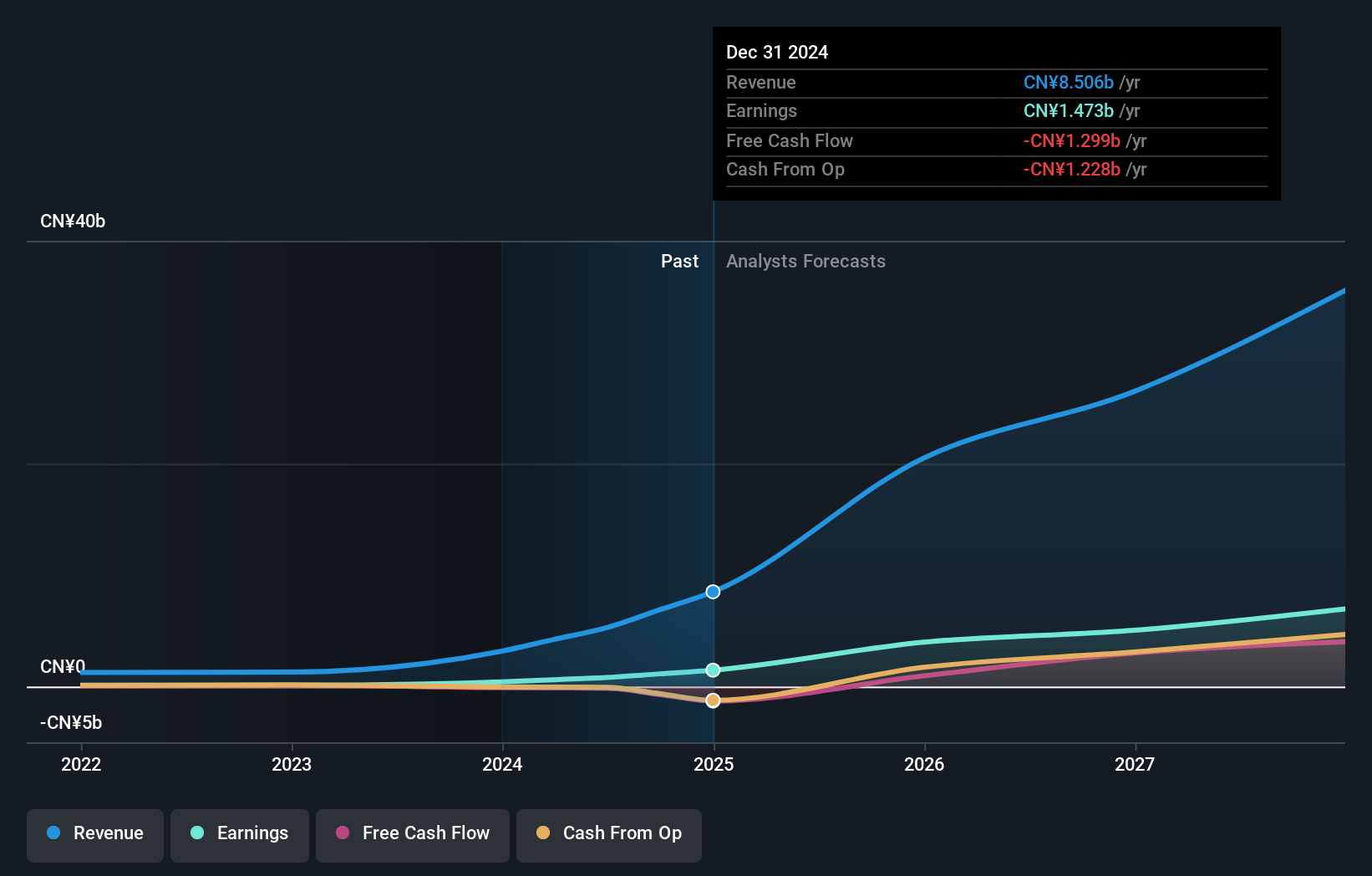

Laopu Gold (SEHK:6181)

Simply Wall St Growth Rating: ★★★★★★

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of HK$134.10 billion.

Operations: The company's revenue is primarily derived from its Jewelry & Watches segment, amounting to CN¥8.51 billion.

Insider Ownership: 36.4%

Revenue Growth Forecast: 37.5% p.a.

Laopu Gold exhibits robust growth prospects with high insider ownership, as evidenced by its substantial revenue increase to RMB 8.51 billion in 2024. Earnings surged by over 250% year-on-year, driven by brand expansion and new boutique openings. The company's earnings are projected to grow at a significant annual rate of nearly 40%, surpassing market averages. Despite recent share price volatility, Laopu Gold's strategic initiatives and strong financial performance position it well for future growth.

- Take a closer look at Laopu Gold's potential here in our earnings growth report.

- Our expertly prepared valuation report Laopu Gold implies its share price may be too high.

Will Semiconductor (SHSE:603501)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Will Semiconductor Co., Ltd. is a semiconductor design company offering sensor, analog, and touch screen and display solutions, with a market cap of approximately CN¥151.80 billion.

Operations: Revenue segments for the company include sensor solutions, analog solutions, and touch screen and display solutions.

Insider Ownership: 28.6%

Revenue Growth Forecast: 13.9% p.a.

Will Semiconductor demonstrates promising growth potential with high insider ownership. Earnings are forecast to grow significantly at 29.3% annually, outpacing the Chinese market average of 23.8%. While revenue growth is slower than 20%, it still exceeds the market's 12.6%. The Price-To-Earnings ratio of 59.2x is below the industry average, indicating reasonable valuation within its sector. Recently becoming profitable, Will Semiconductor's strategic focus remains on enhancing shareholder value amidst upcoming shareholder meetings in Shanghai.

- Dive into the specifics of Will Semiconductor here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Will Semiconductor's current price could be inflated.

Taking Advantage

- Click this link to deep-dive into the 637 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade BYD, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives