- China

- /

- General Merchandise and Department Stores

- /

- SHSE:601086

Gansu Guofang Industry & Trade (Group) Co., Ltd.'s (SHSE:601086) 42% Price Boost Is Out Of Tune With Earnings

Gansu Guofang Industry & Trade (Group) Co., Ltd. (SHSE:601086) shareholders have had their patience rewarded with a 42% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.4% over the last year.

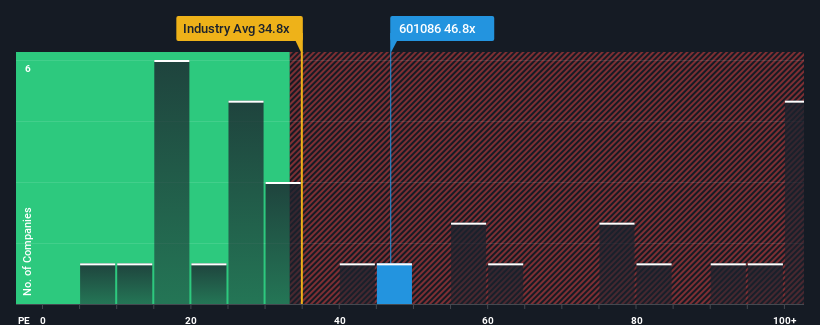

Since its price has surged higher, Gansu Guofang Industry & Trade (Group)'s price-to-earnings (or "P/E") ratio of 46.8x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 32x and even P/E's below 19x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For example, consider that Gansu Guofang Industry & Trade (Group)'s financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Gansu Guofang Industry & Trade (Group)

How Is Gansu Guofang Industry & Trade (Group)'s Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Gansu Guofang Industry & Trade (Group)'s is when the company's growth is on track to outshine the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 64%. The last three years don't look nice either as the company has shrunk EPS by 45% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 37% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Gansu Guofang Industry & Trade (Group)'s P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

The large bounce in Gansu Guofang Industry & Trade (Group)'s shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Gansu Guofang Industry & Trade (Group) currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 3 warning signs for Gansu Guofang Industry & Trade (Group) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601086

Gansu Guofang Industry & Trade (Group)

Gansu Guofang Industry & Trade (Group) Co., Ltd.

Flawless balance sheet slight.