- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600729

Benign Growth For Chongqing Department Store Co.,Ltd. (SHSE:600729) Underpins Its Share Price

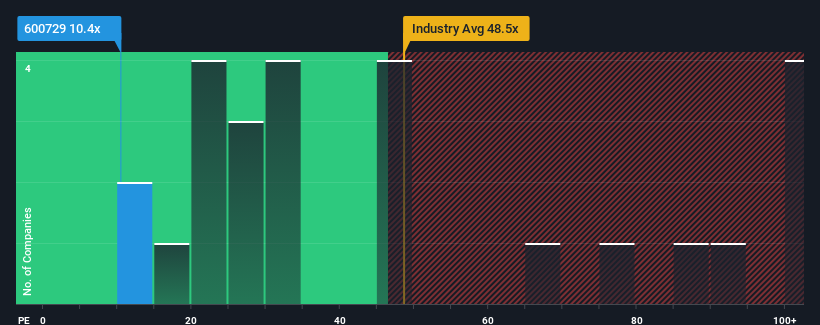

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 38x, you may consider Chongqing Department Store Co.,Ltd. (SHSE:600729) as a highly attractive investment with its 10.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings that are retreating more than the market's of late, Chongqing Department StoreLtd has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Chongqing Department StoreLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Chongqing Department StoreLtd's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 9.6%. Regardless, EPS has managed to lift by a handy 25% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 1.3% during the coming year according to the five analysts following the company. That's shaping up to be materially lower than the 37% growth forecast for the broader market.

In light of this, it's understandable that Chongqing Department StoreLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Chongqing Department StoreLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Chongqing Department StoreLtd.

If these risks are making you reconsider your opinion on Chongqing Department StoreLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600729

Chongqing Department StoreLtd

Operates department stores, supermarkets, and electrical appliances stores in the People's Republic of China.

Undervalued established dividend payer.

Market Insights

Community Narratives