Jiangxi Salt Industry Group And 2 Hidden Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

As Chinese stocks navigate a complex economic landscape marked by mixed inflation signals and uneven growth, investors are increasingly on the lookout for hidden opportunities within the small-cap sector. In this article, we explore Jiangxi Salt Industry Group and two other lesser-known small-cap stocks that could enhance your portfolio, particularly in a market where identifying resilient companies is crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pan Asian Microvent Tech (Jiangsu) | 15.79% | 12.88% | 6.43% | ★★★★★★ |

| Center International GroupLtd | 35.04% | 4.82% | -39.58% | ★★★★★★ |

| Founder Technology GroupLtd | 7.56% | -8.80% | 15.53% | ★★★★★★ |

| Jiangsu Eazytec | 24.12% | 15.75% | 4.26% | ★★★★★☆ |

| Xinjiang Torch Gas | 4.71% | 16.54% | 9.37% | ★★★★★☆ |

| BGT Group | 6.98% | 1.62% | -21.98% | ★★★★★☆ |

| Sublime China Information | 0.60% | 6.24% | 1.49% | ★★★★★☆ |

| Guangdong Kingstrong Technology | 0.24% | 20.62% | 48.81% | ★★★★★☆ |

| Haimo Technologies Group | 48.58% | 0.60% | 12.57% | ★★★★☆☆ |

| Chongqing Gas Group | 23.23% | 9.54% | 1.00% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Jiangxi Salt Industry Group (SHSE:601065)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Salt Industry Group Co., Ltd focuses on the research, development, production, and sale of salt products in China and has a market cap of CN¥5.61 billion.

Operations: Jiangxi Salt Industry Group generates revenue primarily from the sale of salt products in China. The company's market cap stands at CN¥5.61 billion.

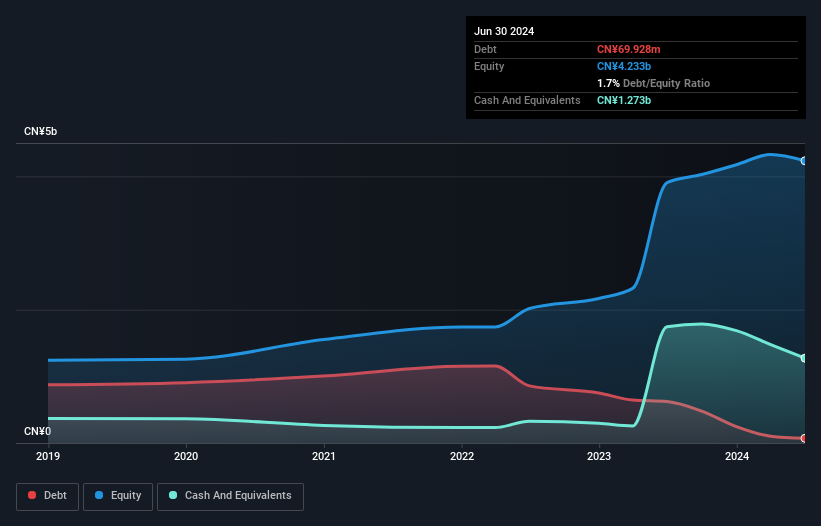

Jiangxi Salt Industry Group has shown promising financial health, with earnings growing by 3.5% over the past year, outperforming the Chemicals industry average of -14.6%. The company's debt to equity ratio improved significantly from 70.8% to 2.4% in five years, indicating better financial management. Additionally, it's trading at 78.8% below its estimated fair value and boasts high-quality earnings, making it an intriguing prospect for investors seeking undervalued opportunities in China’s market.

Ping An Guangzhou Comm Invest Guanghe Expressway (SZSE:180201)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ping An Guangzhou Comm Invest Guanghe Expressway Close-end Infrastructure Fund operates as an infrastructure fund with a market cap of CN¥6.85 billion.

Operations: Ping An Guangzhou Comm Invest Guanghe Expressway generates revenue primarily from its transportation infrastructure segment, totaling CN¥798.91 million.

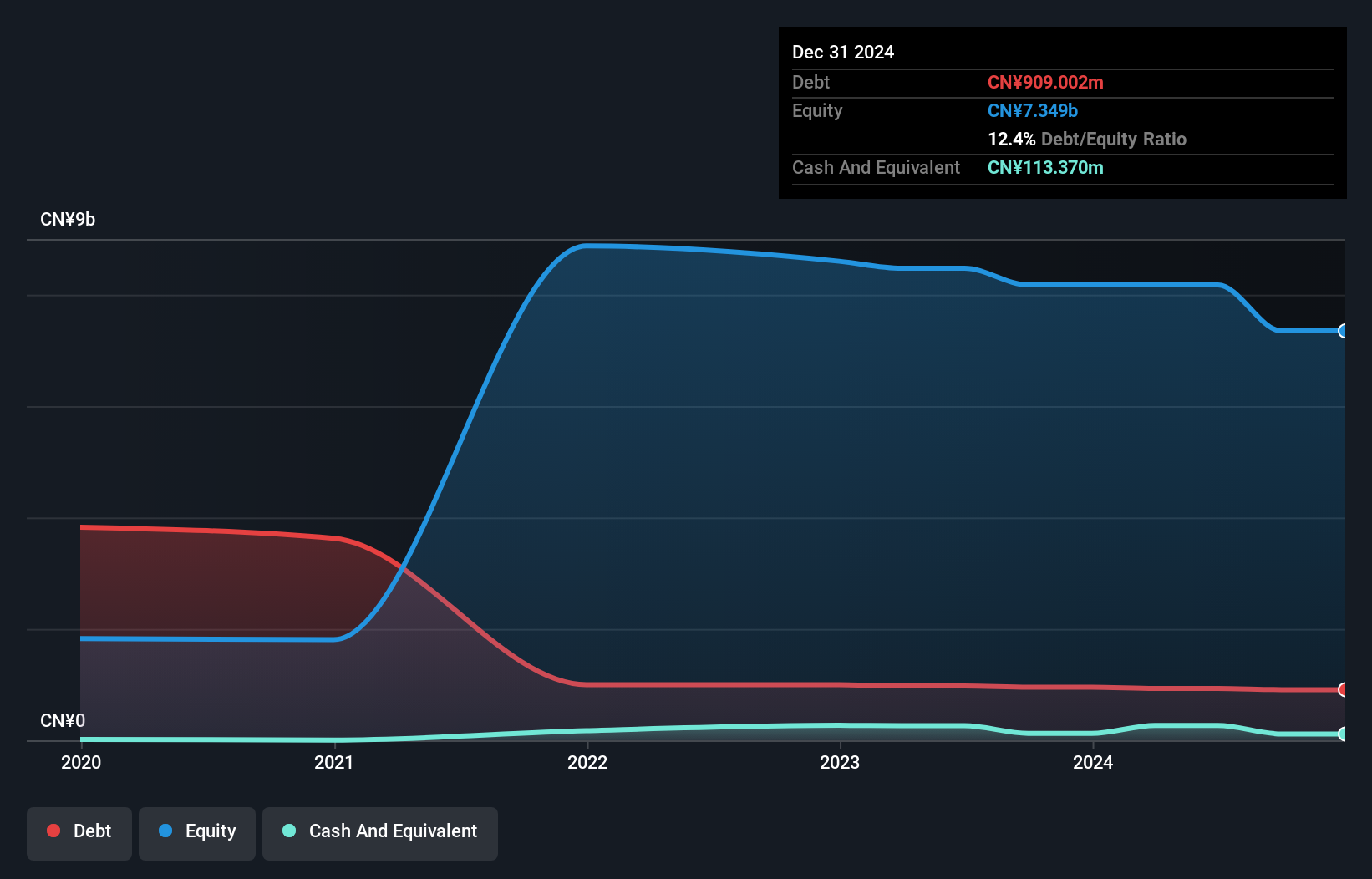

Ping An Guangzhou Comm Invest Guanghe Expressway has shown remarkable earnings growth of 149.6% over the past year, significantly outpacing the Specialized REITs industry at 12.5%. Trading at 51.6% below its estimated fair value, it presents a compelling investment case. The company's interest payments are well covered by EBIT with an 8.6x coverage ratio, and it maintains a satisfactory net debt to equity ratio of 10.1%. Additionally, its recent dividend payout of CNY0.2158 per share underscores solid financial health and shareholder returns.

Shenzhen Jdd Tech New Material (SZSE:301538)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Jdd Tech New Material Co., Ltd specializes in the research, design, development, production, and sale of modified polymer protective materials in China and has a market cap of CN¥4.76 billion.

Operations: Shenzhen Jdd Tech New Material Co., Ltd generates revenue primarily from the sale of modified polymer protective materials. The company's market cap stands at CN¥4.76 billion.

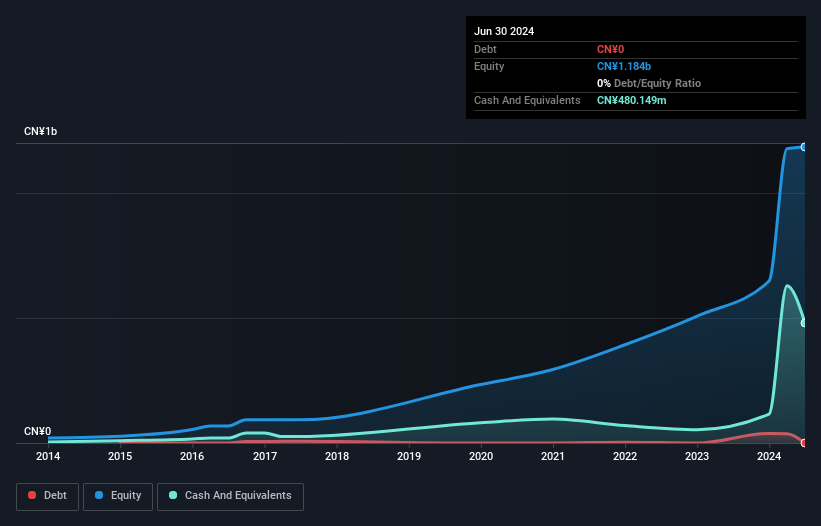

Shenzhen Jdd Tech New Material has shown robust performance with earnings growing by 35.9% in the past year, outpacing the Chemicals industry’s -14.8%. The company repurchased shares recently, signaling confidence in its future prospects. Additionally, it approved a cash dividend of CNY 7 per 10 shares for 2023. Despite a volatile share price over the last three months, its debt to equity ratio rose from 1.1 to 3.2 over five years while maintaining more cash than total debt.

Taking Advantage

- Navigate through the entire inventory of 1000 Chinese Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301538

Shenzhen Jdd Tech New Material

Engages in the research, design, development, production and sale of modified polymer protective materials in China.

Flawless balance sheet with acceptable track record.