- China

- /

- Consumer Services

- /

- SZSE:003032

3 Stocks Estimated To Be Undervalued By Up To 50%

Reviewed by Simply Wall St

As global markets navigate a period of uncertainty marked by inflation concerns and fluctuating interest rates, investors are keenly observing the performance of various indices. Despite these challenges, opportunities may arise for discerning investors who focus on identifying stocks that appear undervalued relative to their intrinsic worth. In this context, understanding the potential value hidden within certain stocks can be crucial for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Turkcell Iletisim Hizmetleri (IBSE:TCELL) | TRY95.20 | TRY190.03 | 49.9% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.18 | TRY78.34 | 50% |

| Bank BTPN Syariah (IDX:BTPS) | IDR860.00 | IDR1715.86 | 49.9% |

| German American Bancorp (NasdaqGS:GABC) | US$39.26 | US$78.06 | 49.7% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥25.98 | 49.7% |

| Shinko Electric Industries (TSE:6967) | ¥5865.00 | ¥11696.09 | 49.9% |

| AK Medical Holdings (SEHK:1789) | HK$4.28 | HK$8.52 | 49.8% |

| TSE (KOSDAQ:A131290) | ₩43400.00 | ₩86241.99 | 49.7% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥9.20 | CN¥18.40 | 50% |

| Coeur Mining (NYSE:CDE) | US$6.35 | US$12.63 | 49.7% |

Let's uncover some gems from our specialized screener.

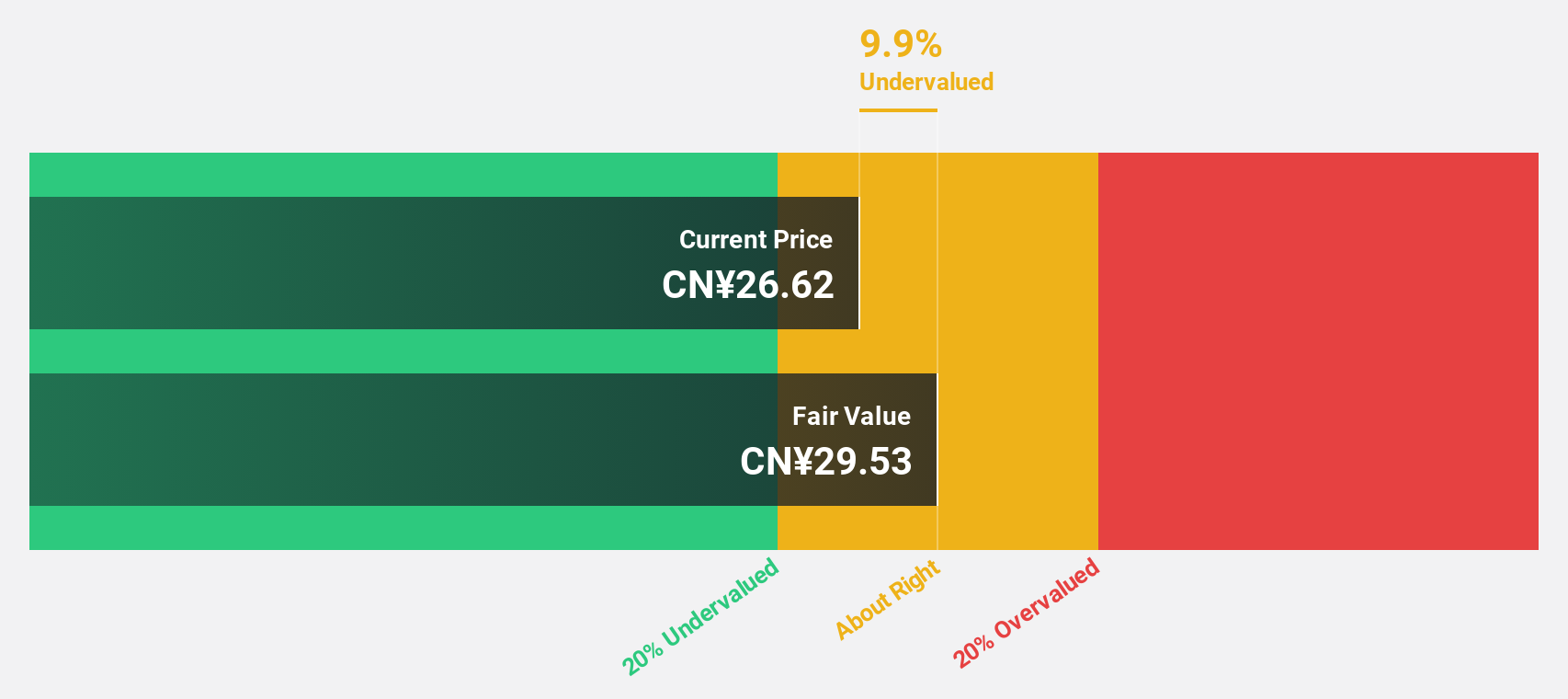

Shandong Weigao Orthopaedic Device (SHSE:688161)

Overview: Shandong Weigao Orthopaedic Device Co., Ltd. operates in the medical device industry, focusing on the development and manufacturing of orthopaedic products, with a market cap of approximately CN¥9.69 billion.

Operations: The company's revenue is primarily derived from its medical products segment, amounting to CN¥1.28 billion.

Estimated Discount To Fair Value: 49%

Shandong Weigao Orthopaedic Device is trading at CN¥24.39, significantly below its estimated fair value of CN¥47.79, indicating potential undervaluation based on cash flows. Despite being removed from a key index, the company's earnings and revenue are forecast to grow faster than the Chinese market at 30.4% and 19.3% per year respectively. However, its return on equity is projected to remain low at 7.7%, which may temper investor enthusiasm.

- Our growth report here indicates Shandong Weigao Orthopaedic Device may be poised for an improving outlook.

- Dive into the specifics of Shandong Weigao Orthopaedic Device here with our thorough financial health report.

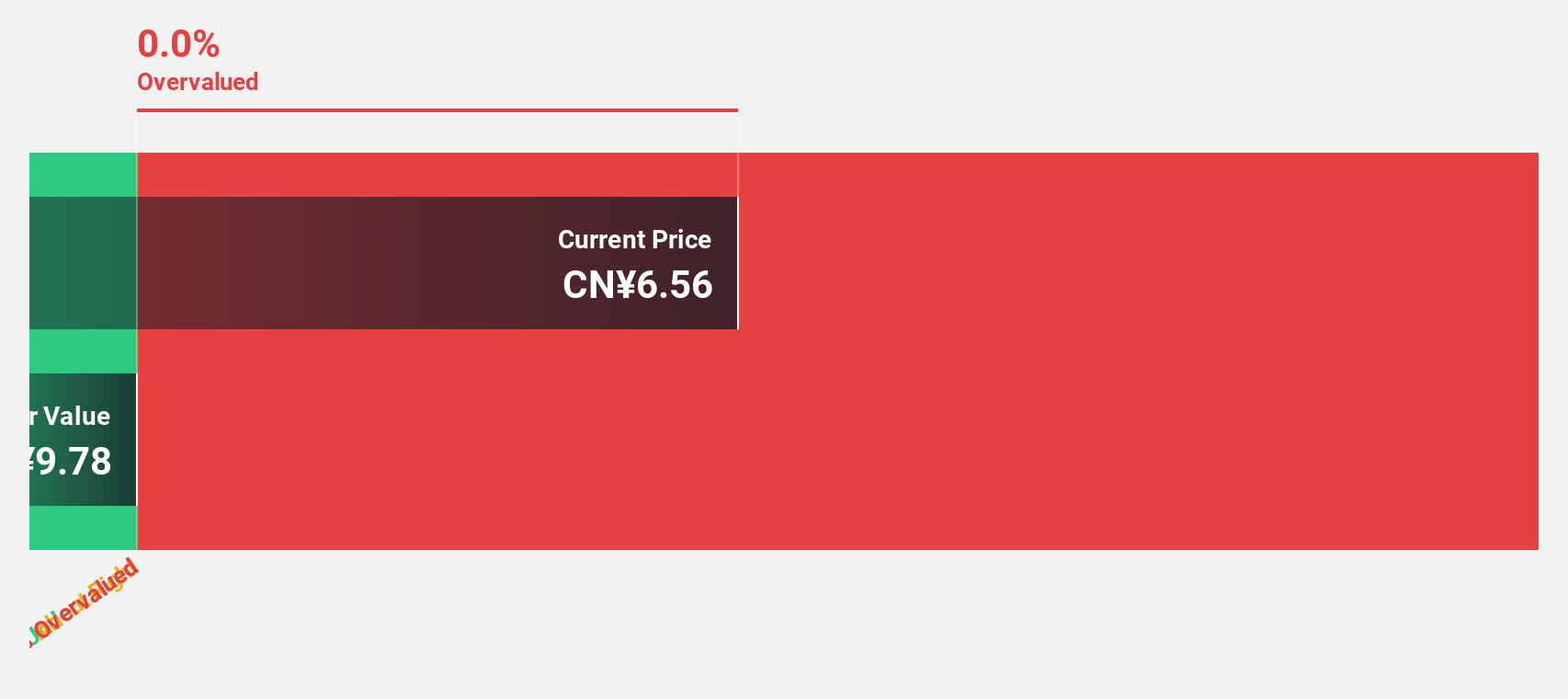

Jiangsu Chuanzhiboke Education Technology (SZSE:003032)

Overview: Jiangsu Chuanzhiboke Education Technology Co., Ltd. operates in the education technology sector and has a market cap of CN¥3.70 billion.

Operations: The company's revenue segment primarily comprises Training Services, generating CN¥269.45 million.

Estimated Discount To Fair Value: 50%

Jiangsu Chuanzhiboke Education Technology is trading at CN¥9.2, well below its fair value estimate of CN¥18.4, highlighting potential undervaluation based on cash flows. Despite a significant revenue drop to CN¥180.75 million and a net loss of CN¥41.22 million for the recent nine months, forecasts suggest robust revenue growth of 27.6% annually and earnings expected to grow by 121% per year, surpassing market averages and indicating future profitability within three years.

- According our earnings growth report, there's an indication that Jiangsu Chuanzhiboke Education Technology might be ready to expand.

- Unlock comprehensive insights into our analysis of Jiangsu Chuanzhiboke Education Technology stock in this financial health report.

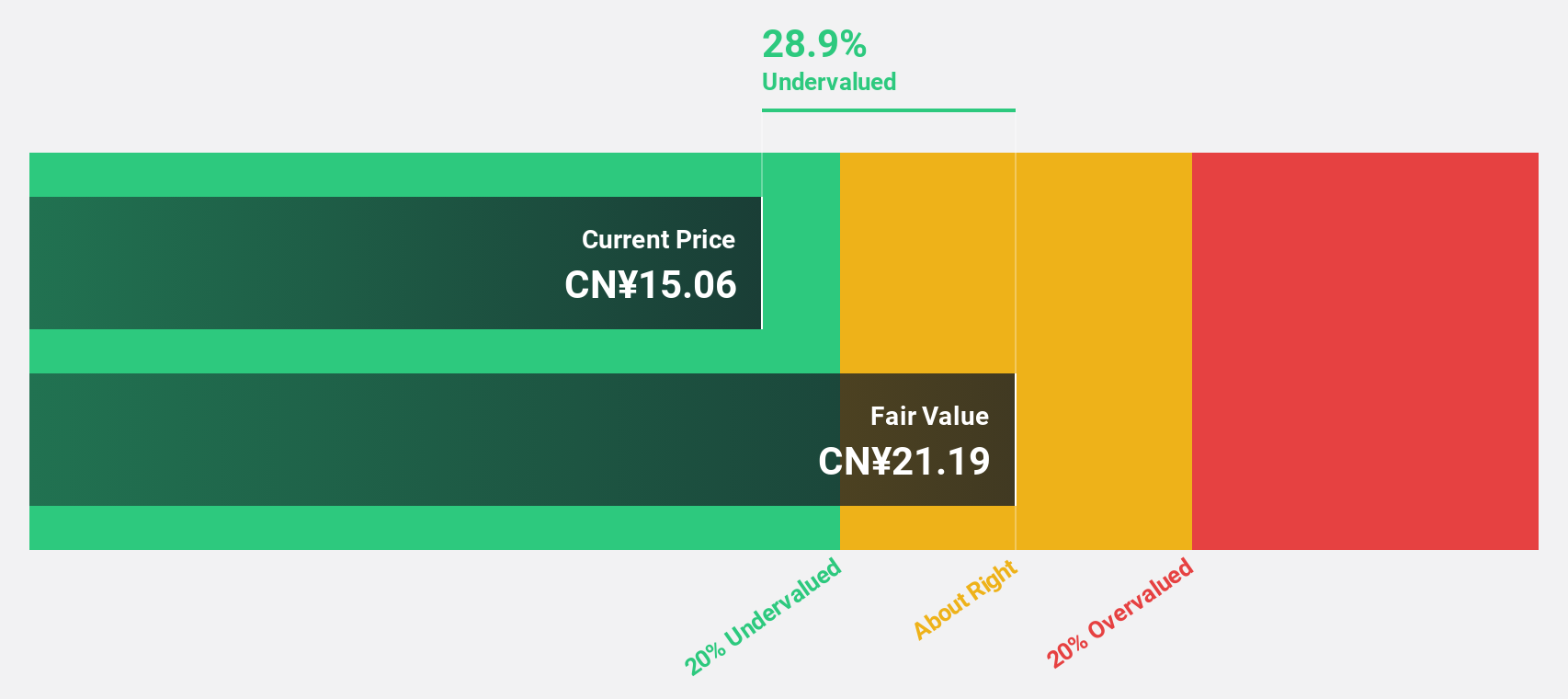

Anhui Anli Material Technology (SZSE:300218)

Overview: Anhui Anli Material Technology Co., Ltd. focuses on the R&D, production, sale, and servicing of ecological functional polyurethane synthetic leather products and polymer composite materials in China, with a market cap of CN¥3.46 billion.

Operations: The company generates revenue from its artificial leather synthetic leather industry segment, amounting to CN¥2.37 billion.

Estimated Discount To Fair Value: 28.3%

Anhui Anli Material Technology's recent earnings report shows a substantial net income growth to CNY 150.26 million, up from CNY 41.63 million the previous year, with basic earnings per share rising to CNY 0.7027. The stock trades at approximately CN¥16.16, significantly below its estimated fair value of CN¥22.52, indicating potential undervaluation based on cash flows despite an unstable dividend history and low forecasted return on equity of 17.3% in three years.

- Insights from our recent growth report point to a promising forecast for Anhui Anli Material Technology's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Anhui Anli Material Technology.

Make It Happen

- Navigate through the entire inventory of 874 Undervalued Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003032

Jiangsu Chuanzhiboke Education Technology

Jiangsu Chuanzhiboke Education Technology Co., LTD.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives