- China

- /

- Semiconductors

- /

- SZSE:300236

3 Growth Stocks With High Insider Ownership And Up To 58% Earnings Growth

Reviewed by Simply Wall St

As global markets experience volatility driven by inflation concerns and economic policy shifts, investors are increasingly focused on identifying resilient growth opportunities. In such an environment, companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 35.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China, with a market cap of CN¥7.67 billion.

Operations: The company generates revenue primarily from its Computer, Communication and Other Electronic Equipment Manufacturing segment, totaling CN¥1.15 billion.

Insider Ownership: 32.1%

Earnings Growth Forecast: 33.9% p.a.

EmbedWay Technologies (Shanghai) has demonstrated strong financial performance, with a notable increase in sales to CNY 880.94 million for the first nine months of 2024, up from CNY 498.37 million the previous year. Earnings grew by 96.7% over the past year and are forecasted to grow at an annual rate of 33.9%, outpacing the Chinese market's average growth rate of 24.8%. Despite low future return on equity expectations, insider ownership remains substantial without recent trading activity.

- Get an in-depth perspective on EmbedWay Technologies (Shanghai)'s performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, EmbedWay Technologies (Shanghai)'s share price might be too optimistic.

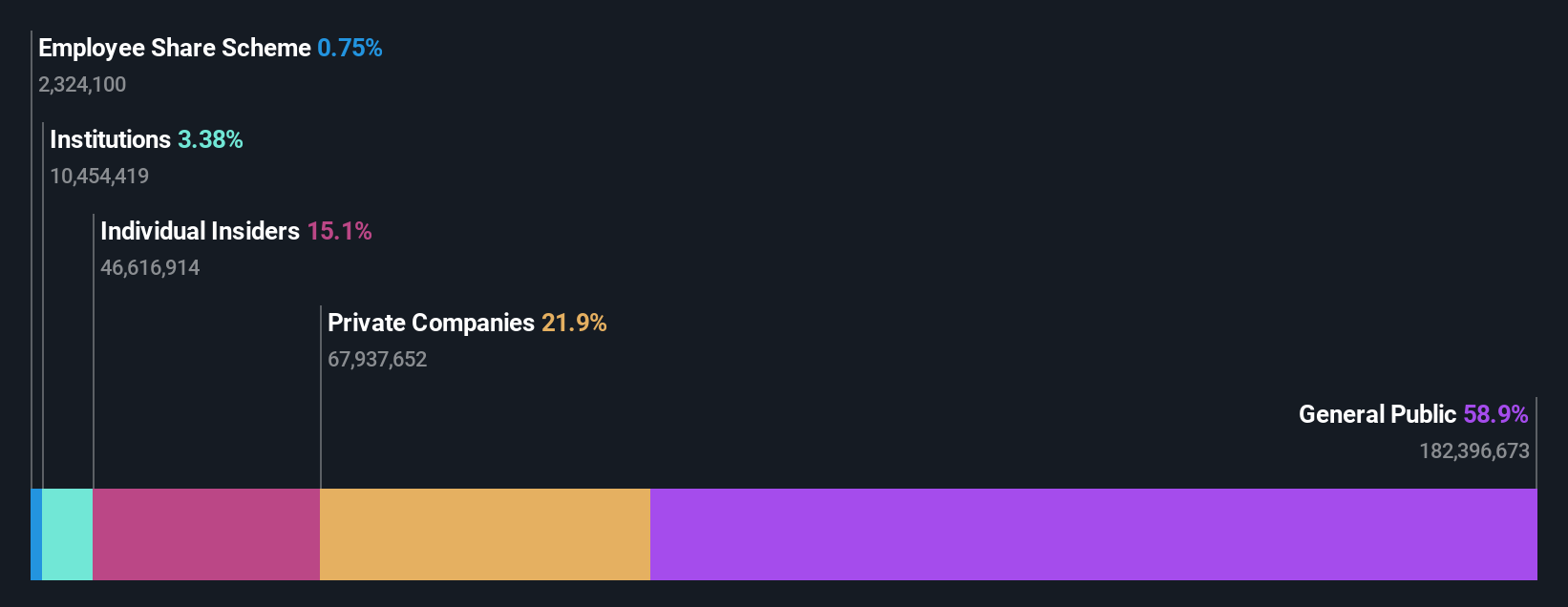

China Transinfo Technology (SZSE:002373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Transinfo Technology Co., Ltd. operates in the transportation and IoT sectors with a market capitalization of approximately CN¥14.49 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 17.2%

Earnings Growth Forecast: 58.1% p.a.

China Transinfo Technology is experiencing substantial earnings growth, expected to rise 58.1% annually, surpassing the Chinese market's 24.8% average. Despite a high Price-to-Earnings ratio of 61.7x, slightly below the IT industry average, its revenue growth forecast of 14.7% lags behind the ideal threshold for high-growth companies but exceeds the CN market's rate. Recent earnings announcements showed a decline in net income to CNY 15.76 million from CNY 323.54 million year-over-year with no significant insider trading activity reported recently.

- Unlock comprehensive insights into our analysis of China Transinfo Technology stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of China Transinfo Technology shares in the market.

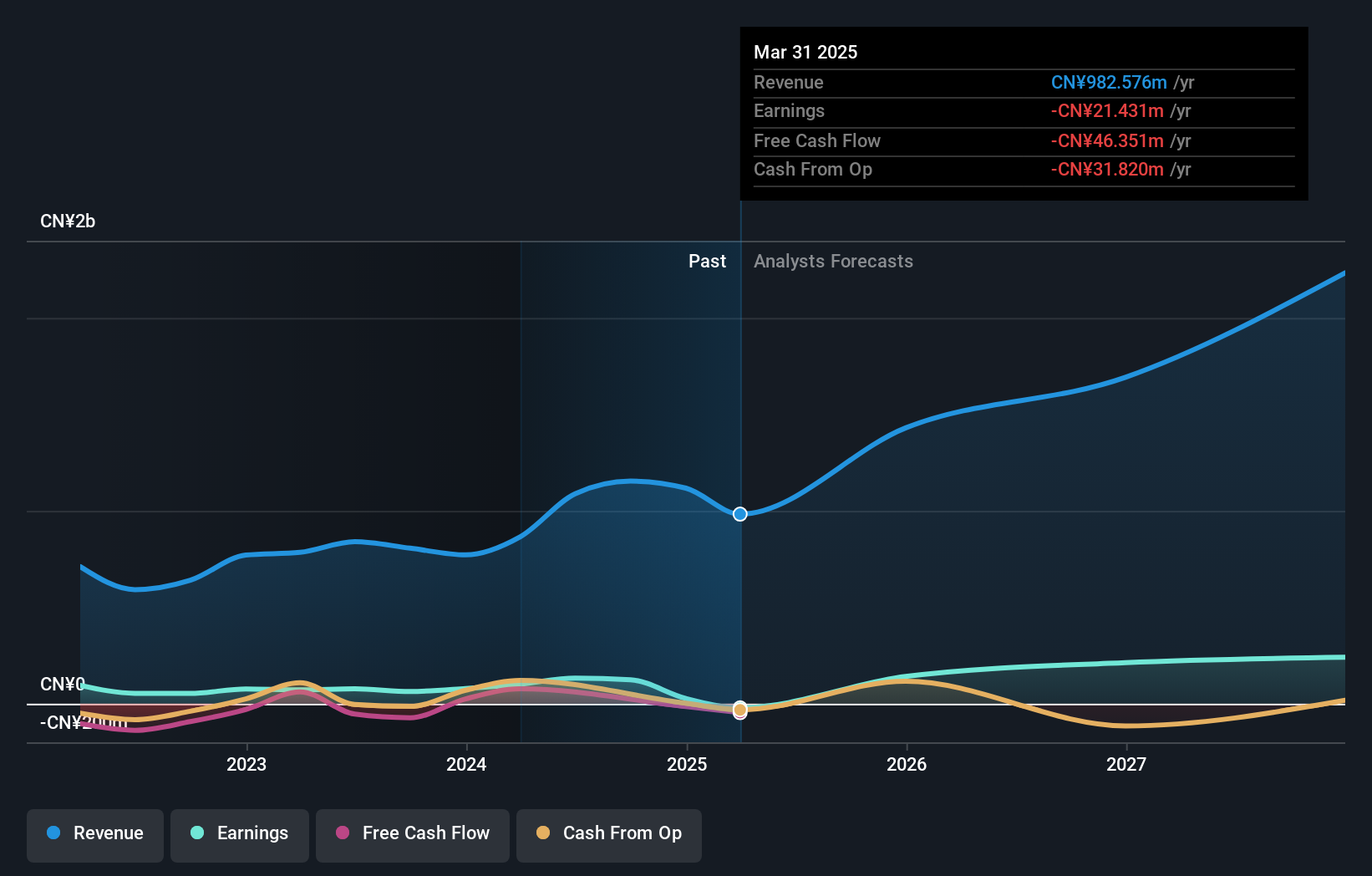

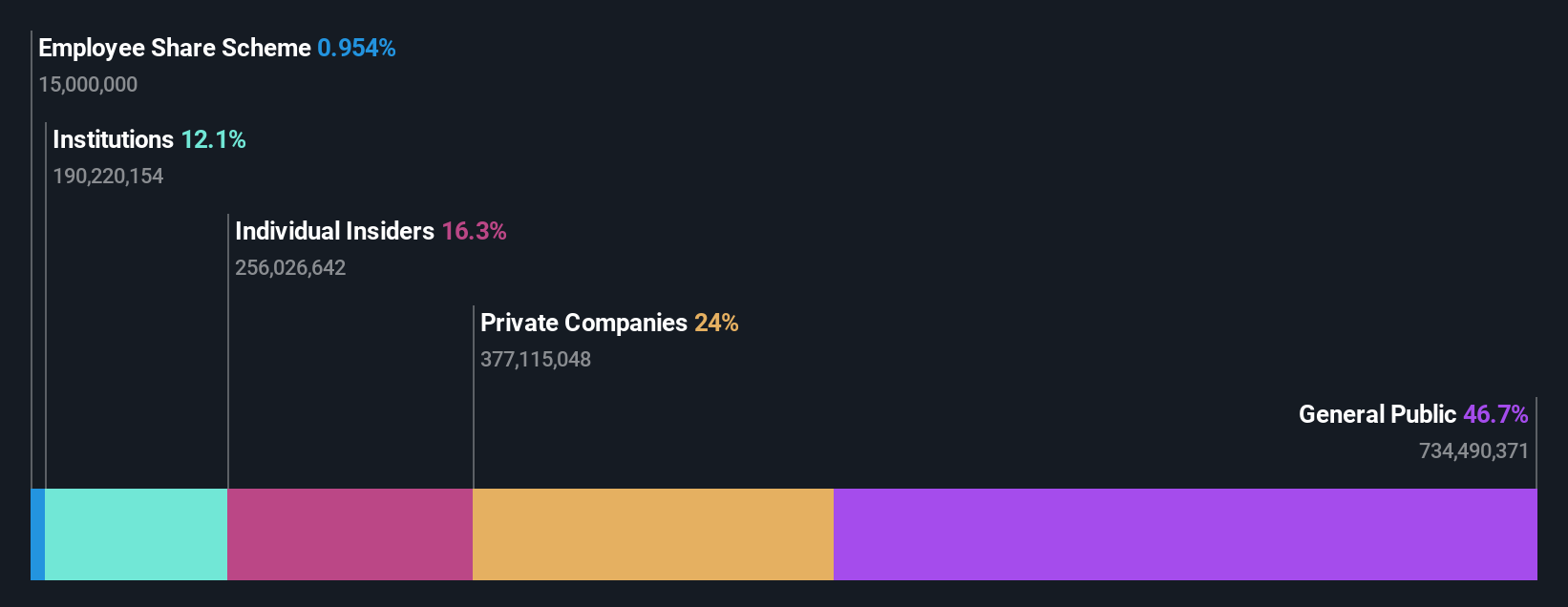

Shanghai Sinyang Semiconductor Materials (SZSE:300236)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Sinyang Semiconductor Materials Co., Ltd. operates in the semiconductor industry, focusing on the production of materials for semiconductor manufacturing, with a market cap of CN¥11.31 billion.

Operations: I'm sorry, but it seems the revenue segment information is missing from the provided text. If you can provide those details, I would be happy to help summarize them for you.

Insider Ownership: 15.1%

Earnings Growth Forecast: 31.3% p.a.

Shanghai Sinyang Semiconductor Materials is poised for robust growth, with revenue expected to increase by 26.9% annually, outpacing the Chinese market's average. Recent earnings reported a rise in net income to CNY 129.76 million from CNY 113.83 million year-over-year, reflecting strong performance despite low forecasted return on equity of 7.4%. There have been no significant insider trading activities recently, and amendments to company bylaws were approved in October 2024.

- Take a closer look at Shanghai Sinyang Semiconductor Materials' potential here in our earnings growth report.

- Our valuation report unveils the possibility Shanghai Sinyang Semiconductor Materials' shares may be trading at a premium.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1444 companies within our Fast Growing Companies With High Insider Ownership screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300236

Shanghai Sinyang Semiconductor Materials

Shanghai Sinyang Semiconductor Materials Co., Ltd.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success