- China

- /

- Auto Components

- /

- SHSE:603040

Discovering Hidden Opportunities Wuxi Taiji Industry Limited Among 2 Other Small Cap Gems

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced significant challenges, with the Russell 2000 Index dipping into correction territory and underperforming compared to large-cap peers. Despite these headwinds, resilient economic indicators such as a stronger-than-expected U.S. labor market and ongoing inflation concerns present unique opportunities for discerning investors seeking hidden gems among small-cap companies. In this context, identifying stocks like Wuxi Taiji Industry Limited requires a keen eye for potential growth drivers that can thrive amid economic fluctuations and broader market sentiment shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ha Giang Mineral Mechanics | NA | 23.21% | 43.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Wuxi Taiji Industry Limited (SHSE:600667)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Taiji Industry Limited Corporation primarily operates in the semiconductor packaging and testing sector, with a market cap of CN¥14.17 billion.

Operations: The company generates revenue primarily from its semiconductor packaging and testing services. It has a market capitalization of CN¥14.17 billion, reflecting its position in the industry.

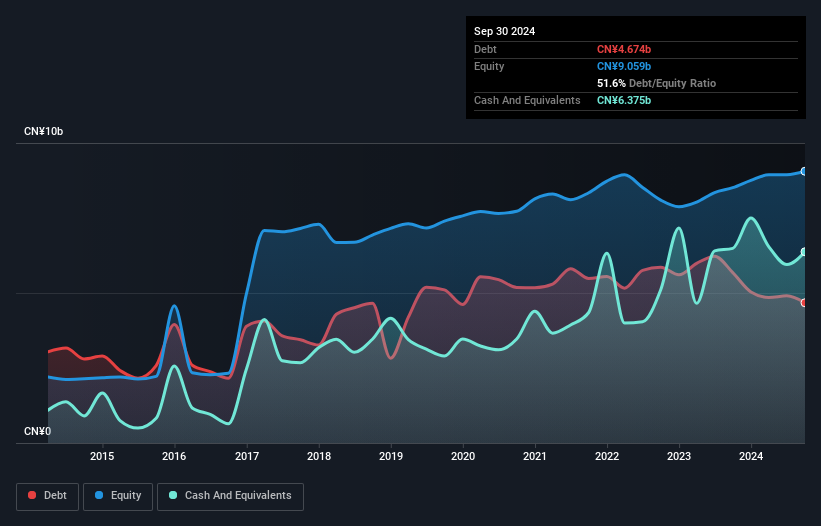

Wuxi Taiji, a nimble player in the semiconductor space, has demonstrated robust growth with earnings surging by 140.7% over the past year, far outpacing the industry's 16.5%. The company seems to be managing its finances well, with a debt-to-equity ratio reduced from 69% to 51.6% over five years and more cash than total debt. Despite recent challenges reflected in sales dropping to CNY 24.58 billion from CNY 26.41 billion and net income slipping to CNY 513 million from CNY 577 million year-on-year, its price-to-earnings ratio of 21.3x suggests it trades at good value compared to peers in China (31.8x).

Hangzhou XZB Tech (SHSE:603040)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hangzhou XZB Tech Co., Ltd focuses on the research, development, production, and sale of precision parts both in China and internationally, with a market cap of CN¥3.16 billion.

Operations: XZB Tech generates revenue primarily through the sale of precision parts, with a focus on both domestic and international markets. The company's financial performance is influenced by its cost structure and market presence.

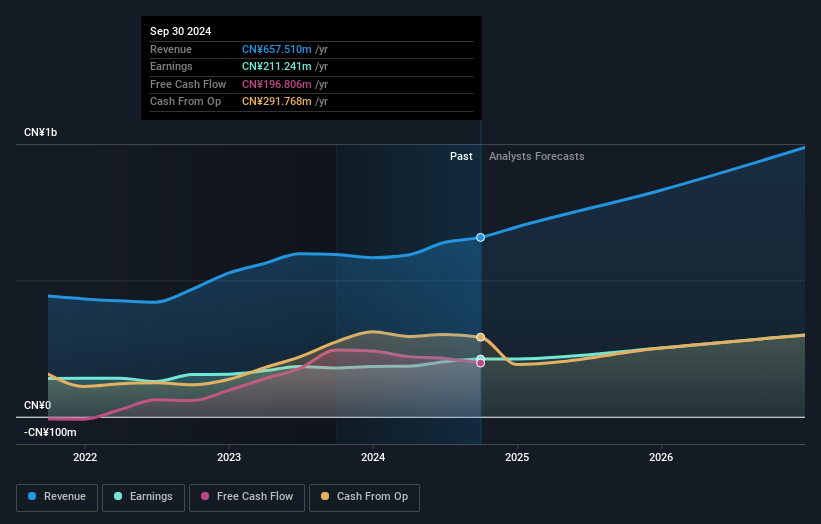

Hangzhou XZB Tech, a smaller player in the auto components sector, has been making waves with its impressive financial performance. Over the past year, earnings growth of 18.4% outpaced the industry average of 10.1%, showcasing robust momentum. The company reported sales of CNY 496.63 million for the first nine months of 2024, up from CNY 422.43 million in the previous year, while net income rose to CNY 161.71 million from CNY 134.85 million a year earlier. Trading at an estimated value below its fair price by about one-third suggests potential undervaluation relative to peers and industry standards.

- Take a closer look at Hangzhou XZB Tech's potential here in our health report.

Evaluate Hangzhou XZB Tech's historical performance by accessing our past performance report.

Shenzhen SDG ServiceLtd (SZSE:300917)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen SDG Service Co., Ltd. offers property management services in China and has a market cap of CN¥7.92 billion.

Operations: Shenzhen SDG Service Co., Ltd. generates revenue primarily through property management services in China. The company reported a gross profit margin of 30% in the most recent financial period, reflecting its efficiency in managing costs relative to its revenue.

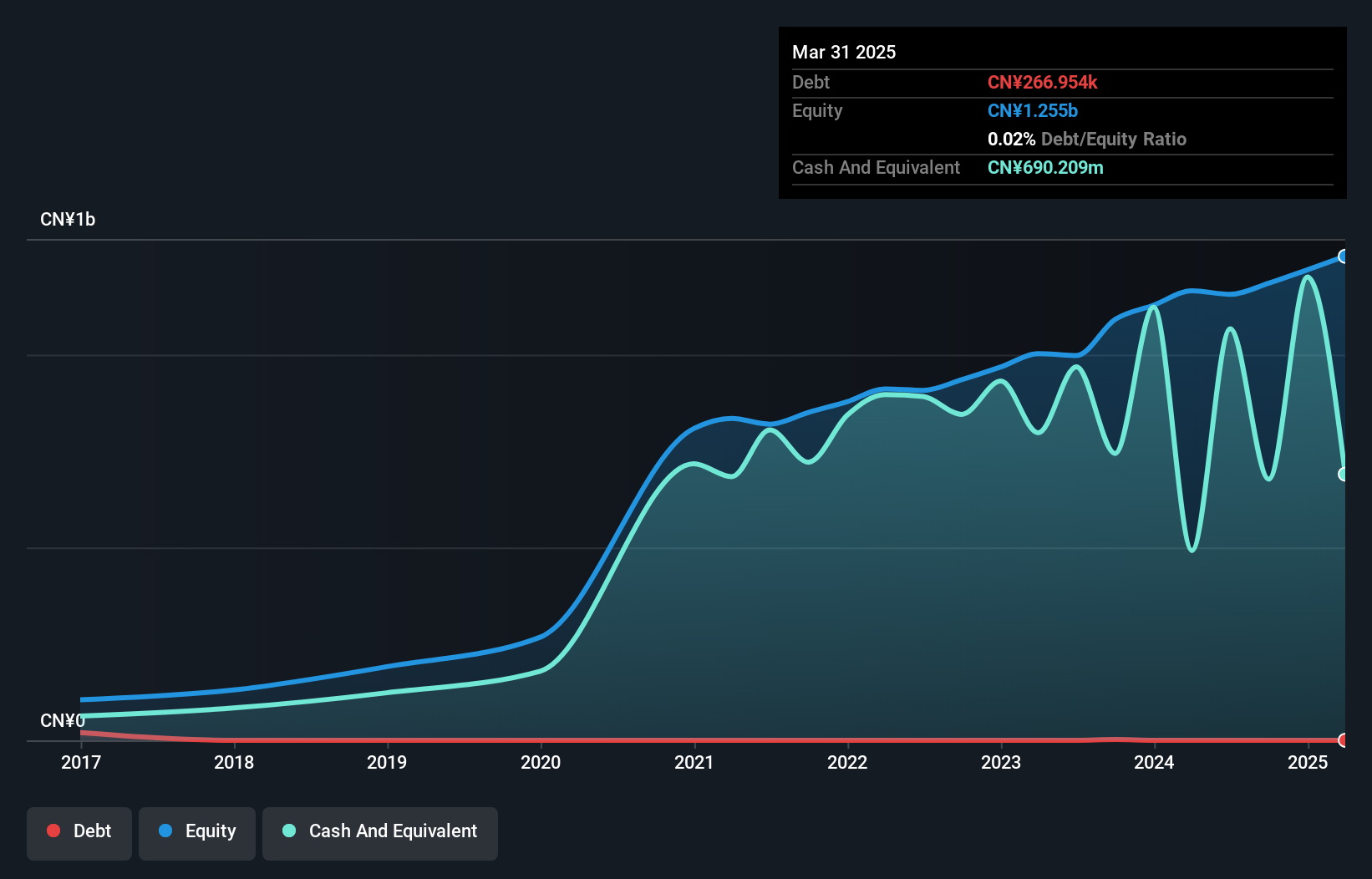

Shenzhen SDG Service, a smaller player in its field, has demonstrated resilience with earnings growth of 3.3% over the past year, outpacing the real estate industry's -38.4%. Despite a slight dip in net income to CNY 81.9 million from CNY 83.9 million last year, the company's revenue increased to CNY 2.08 billion from CNY 1.82 billion, suggesting strong operational performance. The firm remains debt-free and boasts high-quality earnings with positive free cash flow of CNY 130.69 million as of September 2024, although recent board changes might introduce some uncertainty in governance stability going forward.

Taking Advantage

- Embark on your investment journey to our 4510 Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hangzhou XZB Tech, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hangzhou XZB Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603040

Hangzhou XZB Tech

Engages in the research and development, production, and sale of precision parts in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives