- China

- /

- Real Estate

- /

- SHSE:600657

Improved Revenues Required Before Cinda Real Estate Co., Ltd. (SHSE:600657) Shares Find Their Feet

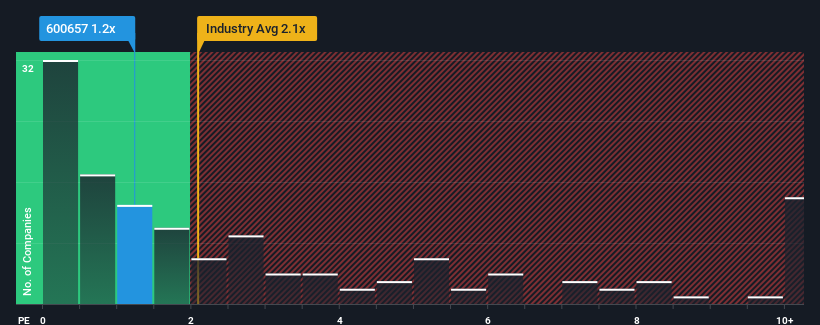

With a price-to-sales (or "P/S") ratio of 1.2x Cinda Real Estate Co., Ltd. (SHSE:600657) may be sending bullish signals at the moment, given that almost half of all the Real Estate companies in China have P/S ratios greater than 2.1x and even P/S higher than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Cinda Real Estate

What Does Cinda Real Estate's Recent Performance Look Like?

The recent revenue growth at Cinda Real Estate would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Cinda Real Estate will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Cinda Real Estate?

The only time you'd be truly comfortable seeing a P/S as low as Cinda Real Estate's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 6.9% gain to the company's revenues. Still, lamentably revenue has fallen 49% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Cinda Real Estate's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Cinda Real Estate maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Having said that, be aware Cinda Real Estate is showing 4 warning signs in our investment analysis, and 2 of those are concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600657

Cinda Real Estate

Engages in the real estate development business in China.

Slight with mediocre balance sheet.

Market Insights

Community Narratives