- China

- /

- Real Estate

- /

- SHSE:600568

3 Penny Stocks With Market Caps Under US$400M To Consider

Reviewed by Simply Wall St

As global markets continue to experience shifts, with U.S. stocks reaching new highs amid optimism over trade policies and AI developments, investors are exploring diverse opportunities. Penny stocks, though often seen as a niche segment of the market, remain relevant for those looking beyond large-cap names for potential growth. These smaller or newer companies can offer unique prospects when supported by strong financial health, and this article will explore three such penny stocks that may present compelling opportunities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.25B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.01 | HK$641.14M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.07 | £780M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

Click here to see the full list of 5,707 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

CapAllianz Holdings (Catalist:594)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CapAllianz Holdings Limited is an investment holding company involved in oil and gas exploration, development, production, and drilling activities in Singapore and Thailand, with a market cap of SGD18.41 million.

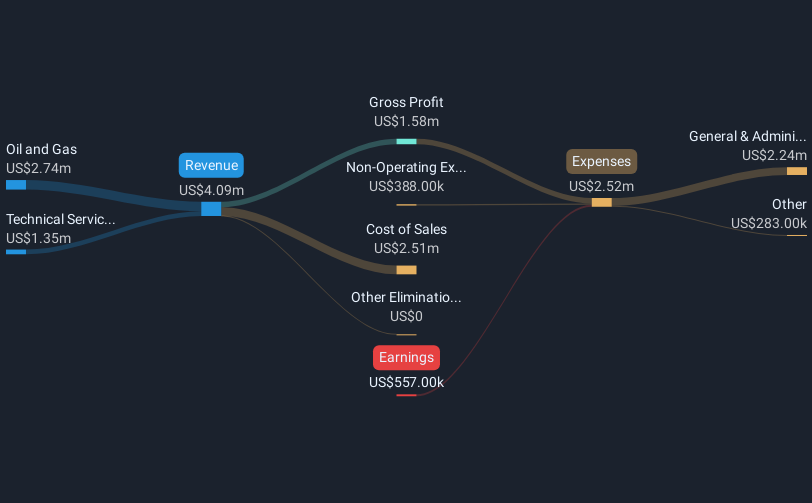

Operations: The company generates revenue from two primary segments: Oil and Gas, contributing $2.74 million, and Technical Services, accounting for $1.35 million.

Market Cap: SGD18.41M

CapAllianz Holdings, with a market cap of SGD18.41 million, operates in oil and gas exploration and technical services. Despite being unprofitable, the company has reduced its losses by 39.4% annually over the past five years. It remains debt-free and has sufficient cash runway for more than a year based on current free cash flow, although it faces challenges with long-term liabilities exceeding short-term assets by $32.3 million. The stock's volatility has increased recently, indicating potential risks for investors seeking stability in penny stocks. The board is relatively new with an average tenure of 2.7 years.

- Dive into the specifics of CapAllianz Holdings here with our thorough balance sheet health report.

- Understand CapAllianz Holdings' track record by examining our performance history report.

Raisio (HLSE:RAIVV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raisio plc, with a market cap of €347.58 million, operates in the production and sale of food and food ingredients across Finland, the Netherlands, Belgium, and other parts of Europe.

Operations: The company's revenue is primarily derived from its Healthy Food segment, generating €149.7 million, and its Healthy Ingredients segment, contributing €112 million.

Market Cap: €347.58M

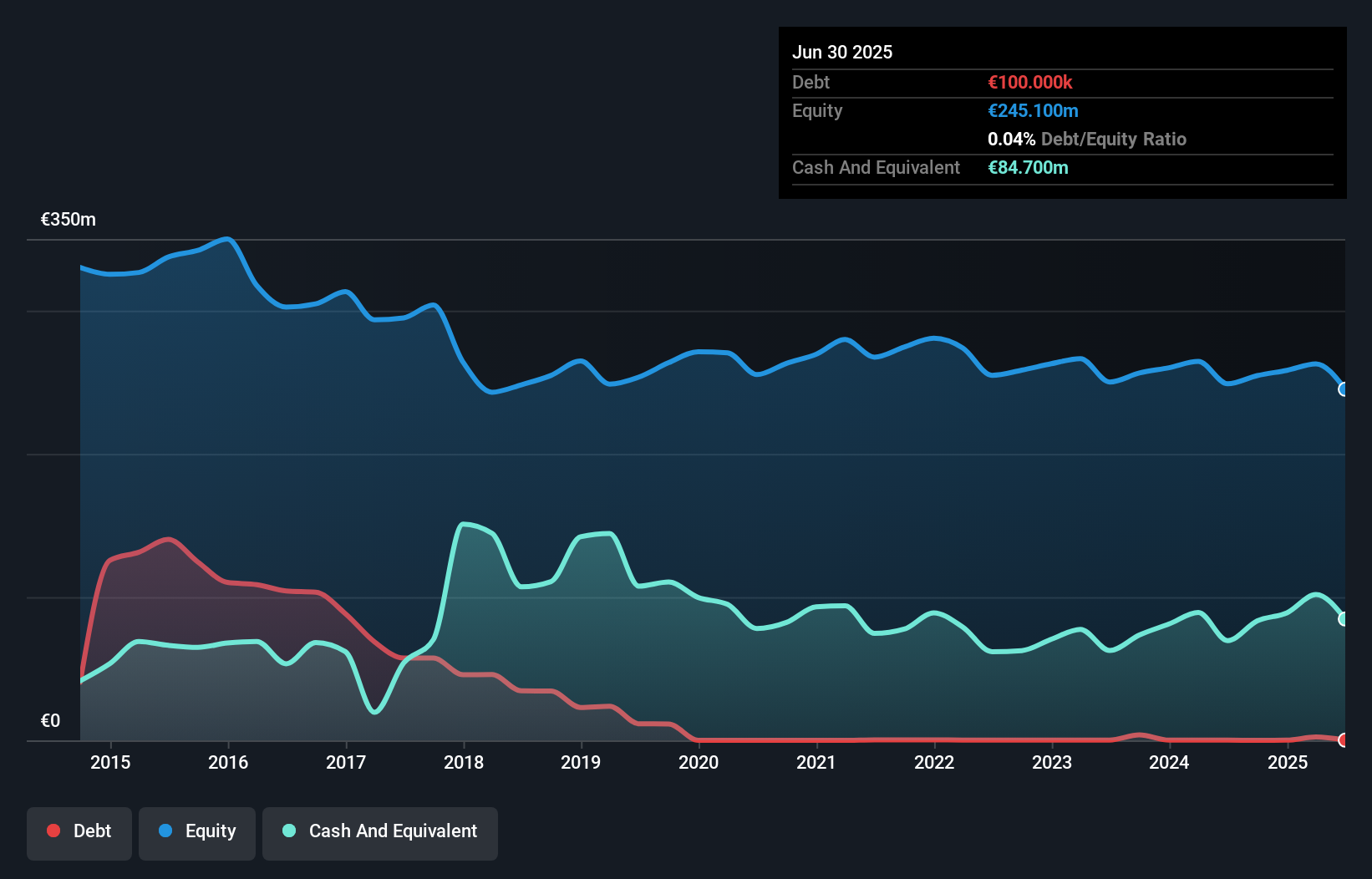

Raisio plc, with a market cap of €347.58 million, operates in the food industry across Europe. Despite being debt-free and having stable weekly volatility, Raisio faces challenges with declining earnings over the past five years and a low return on equity of 7%. Recent earnings reports show mixed results; while sales increased to €172 million for the nine months ending September 2024, net income slightly improved to €14 million compared to the previous year. The company's dividend yield of 6.36% is not well covered by earnings, indicating potential sustainability issues for investors considering penny stocks.

- Get an in-depth perspective on Raisio's performance by reading our balance sheet health report here.

- Assess Raisio's future earnings estimates with our detailed growth reports.

Zhongzhu Healthcare HoldingLtd (SHSE:600568)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhongzhu Healthcare Holding Co., Ltd is involved in the research, development, production, and sales of pharmaceutical drugs in China with a market capitalization of CN¥2.51 billion.

Operations: The company's revenue is primarily derived from its operations in China, amounting to CN¥641.61 million.

Market Cap: CN¥2.51B

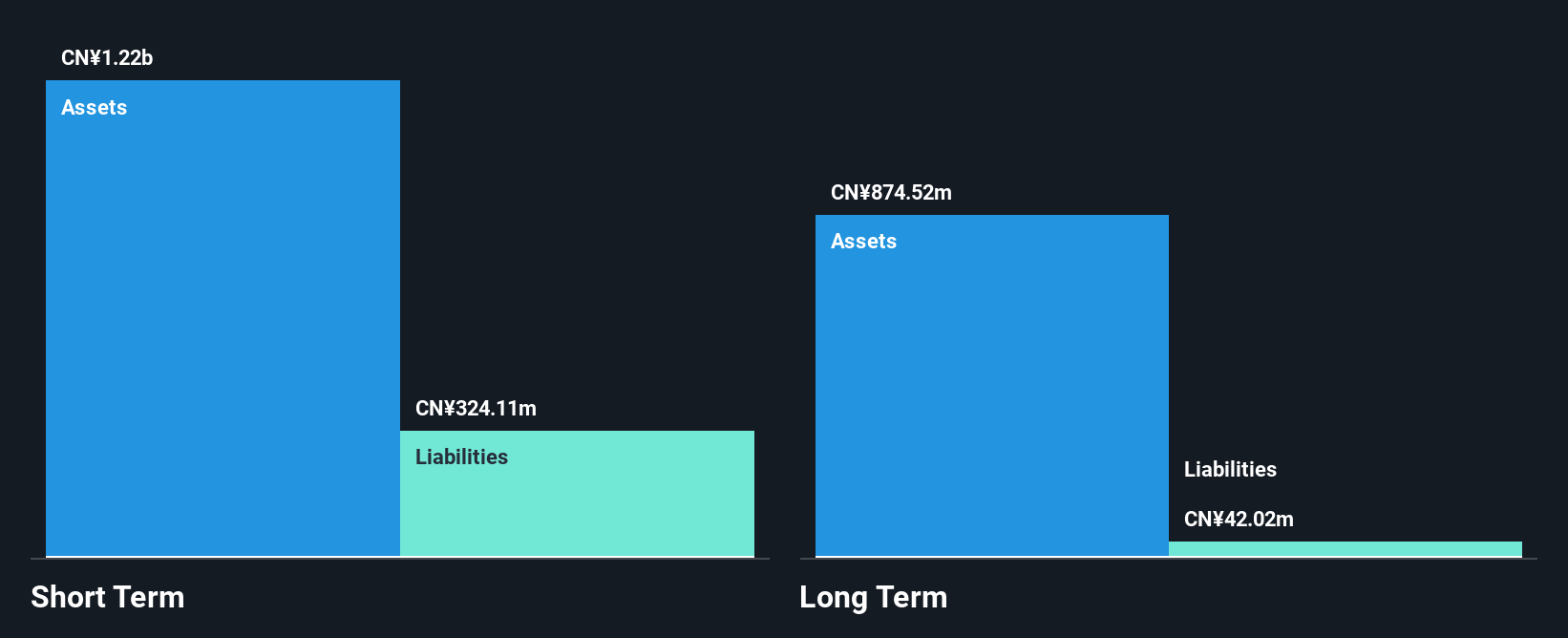

Zhongzhu Healthcare Holding Co., Ltd, with a market capitalization of CN¥2.51 billion, operates in the pharmaceutical sector in China. Despite being unprofitable with a negative return on equity of -7.68%, the company has reduced its net loss to CN¥92.42 million for the nine months ending September 2024, compared to a larger loss last year. Its short-term assets of CN¥1.4 billion comfortably cover both short and long-term liabilities, and it maintains positive free cash flow with no debt burden. Recent shareholder activism led to changes in board composition, potentially impacting future strategic direction.

- Navigate through the intricacies of Zhongzhu Healthcare HoldingLtd with our comprehensive balance sheet health report here.

- Assess Zhongzhu Healthcare HoldingLtd's previous results with our detailed historical performance reports.

Summing It All Up

- Gain an insight into the universe of 5,707 Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongzhu Healthcare HoldingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600568

Zhongzhu Healthcare HoldingLtd

Engages in the research, development, production, and sales of pharmaceuticals drugs in China.

Flawless balance sheet with weak fundamentals.

Market Insights

Community Narratives