- China

- /

- Real Estate

- /

- SHSE:600266

Investors Still Aren't Entirely Convinced By Beijing Urban Construction Investment & Development Co., Ltd.'s (SHSE:600266) Revenues Despite 43% Price Jump

Beijing Urban Construction Investment & Development Co., Ltd. (SHSE:600266) shares have had a really impressive month, gaining 43% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 4.6% isn't as impressive.

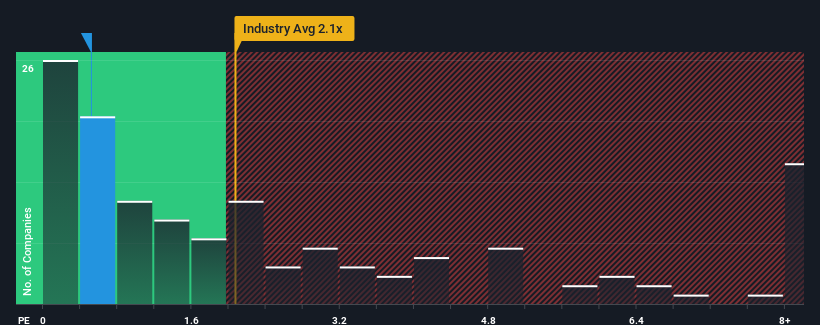

Although its price has surged higher, Beijing Urban Construction Investment & Development may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Real Estate industry in China have P/S ratios greater than 2.1x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Beijing Urban Construction Investment & Development

How Beijing Urban Construction Investment & Development Has Been Performing

Beijing Urban Construction Investment & Development hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Beijing Urban Construction Investment & Development will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Beijing Urban Construction Investment & Development?

In order to justify its P/S ratio, Beijing Urban Construction Investment & Development would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 29% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 29% during the coming year according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 5.5%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Beijing Urban Construction Investment & Development's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Beijing Urban Construction Investment & Development's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Beijing Urban Construction Investment & Development currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Beijing Urban Construction Investment & Development you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Beijing Urban Construction Investment & Development, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Urban Construction Investment & Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600266

Beijing Urban Construction Investment & Development

Beijing Urban Construction Investment & Development Co., Ltd.

Very undervalued with moderate growth potential.

Market Insights

Community Narratives